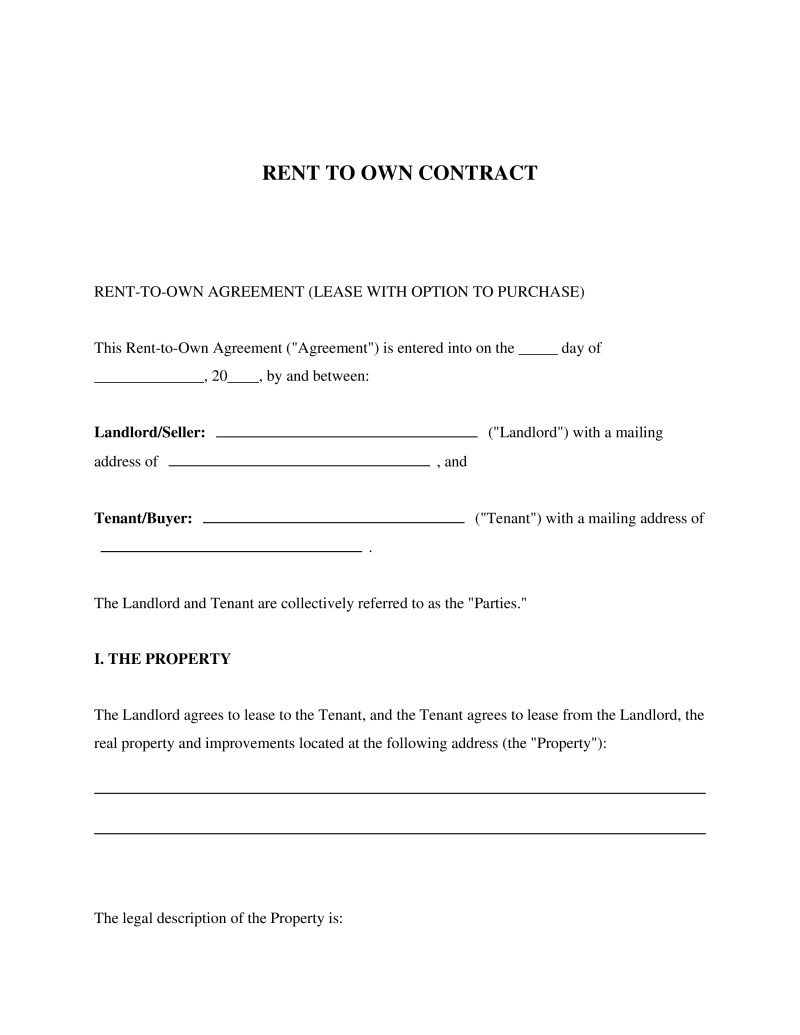

A Rent-to-Own Contract is a legal document that outlines the terms under which property is leased with an option to purchase.

Option Type

Select whether this rent-to-own agreement gives the tenant an "Option to Purchase," meaning they can choose to buy the property, or "Lease to Purchase," where the tenant must buy the property at the end of the lease. This choice affects the tenant's obligations and rights, so choose carefully based on your agreement terms.

Table of Contents

What is a Rent-to-Own Contract Template?

A Rent-to-Own Contract is a legally binding document that outlines the agreement between a homeowner and a tenant, where the tenant has the option or obligation to purchase the home they are renting at a future date. This type of arrangement can be particularly beneficial for individuals or families who are not immediately ready to secure financing due to bad credit or other financial constraints. It serves as a pathway to homeownership, providing tenants with the opportunity to build equity in a home through their rental payments, potentially leading to an eventual purchase. Landlords and tenants alike need this document to ensure clarity on the terms of their agreement, protect their interests, and outline the steps toward transferring ownership of the property.

Key Features

Important Provisions

- Option Fee Clause: Defines any upfront fee paid by the tenant for securing their purchase option rights.

- Rent Credit Provision: Details how much of each rental payment will be credited towards the eventual purchase price of the property.

- Purchase Option Terms: Specifies conditions under which the tenant can exercise their option to buy, including timing and procedures.

- Maintenance and Repairs: Outlines who is responsible for maintaining and repairing the property during the rental period.

Pros and Cons

Pros

- +Facilitates homeownership for individuals with bad credit by providing an alternative path to purchasing a home.

- +Allows tenants to lock in a purchase price upfront, potentially benefiting from property appreciation over time.

- +Gives tenants time to improve their creditworthiness while living in the home they wish to buy.

- +Helps landlords secure committed tenants who have a vested interest in maintaining and improving the property.

- +Provides clear legal recourse for both parties in case of disagreement or default.

Cons

- -Tenants may end up paying above-market rent without necessarily securing financing for purchase.

- -If not carefully negotiated, tenants could lose investment if they decide not to purchase or fail to qualify for financing when required.

- -Requires both parties to commit to future actions based on current forecasts, which may change.

Common Uses

- By individuals or families with bad credit looking to eventually purchase a home.

- For homeowners interested in selling but facing a slow market, offering an alternative sales strategy.

- When a buyer is interested in purchasing a specific property but needs time to secure financing or save for a down payment.

- As an investment strategy for renters who wish to test out a neighborhood or property before committing to a mortgage.

- By real estate investors as part of lease-option investments aimed at generating rental income while planning for future sale.

Frequently Asked Questions

Do you have a question about a Rent-to-Own Contract Template?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!