A cleaning invoice template is a commercial instrument used by sanitation services to itemize rendered tasks and formally request remuneration from clients.

Invoice Type

Select the type of cleaning service provided. This will help tailor the invoice details.

Table of Contents

What is a Cleaning Invoice Template?

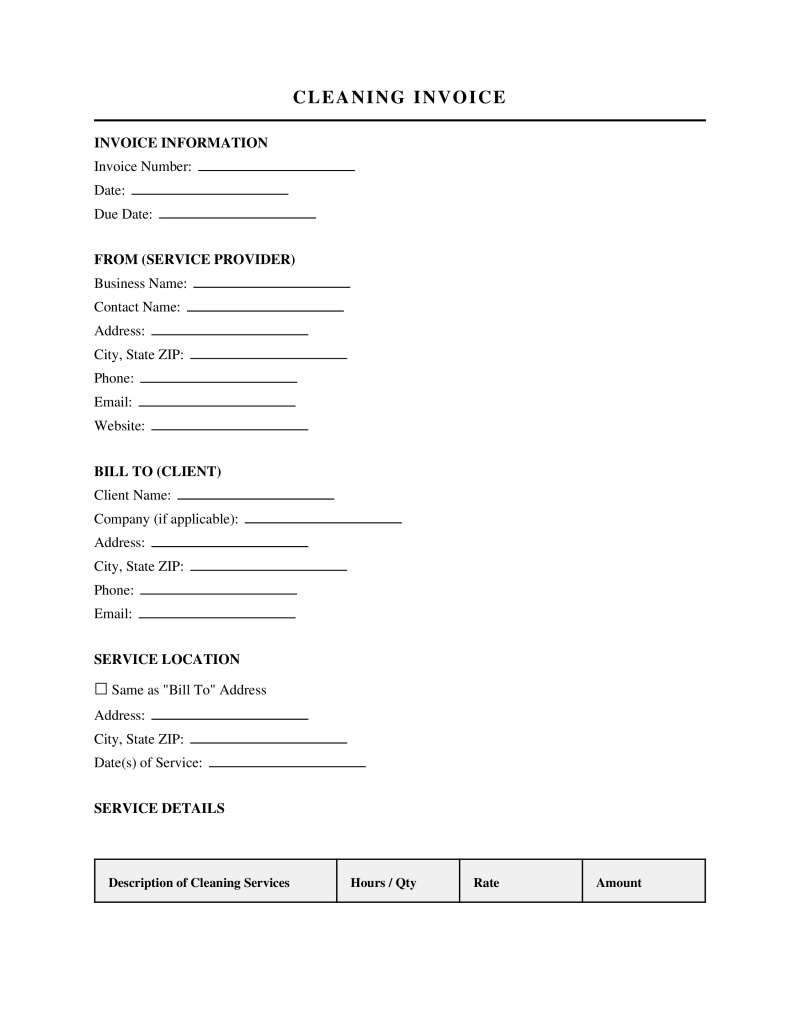

A cleaning invoice template is a standardized billing document utilized by janitorial companies, independent housekeepers, and sanitation service providers to formally request payment from clients. This instrument serves as a detailed record of services rendered, such as carpet cleaning, deep sanitization, or routine maintenance, and outlines the financial obligation of the customer. It is used by a wide spectrum of professionals, ranging from sole proprietorships handling residential properties to large-scale commercial cleaning firms managing corporate facilities. The primary function of this document is to establish a clear audit trail for accounting purposes, ensure tax compliance, and provide a legally recognized demand for payment upon the completion of agreed-upon work.

Core Components of a Valid Billing Document

To function effectively as a financial record and a request for payment, a cleaning invoice template must contain specific data points. These elements ensure that the document is actionable for the client's accounts payable department and valid for the service provider's bookkeeping. Without these critical details, a business may face delays in payment or difficulties during tax audits.

Required Elements Checklist

- Header Information: The word "Invoice" must be clearly visible, along with the cleaning company's legal name, address, and contact information.

- Client Details: The full name and billing address of the customer receiving the services.

- Unique Identifier: A sequential invoice number is essential for tracking and preventing duplicate payments.

- Service Date and Description: A breakdown of when the cleaning occurred and specific tasks performed (e.g., "HVAC dusting," "floor waxing").

- Financial Totals: Line items for labor and materials, applicable taxes, and the final amount due.

- Payment Terms: Clear instructions regarding the due date (e.g., "Net 30") and accepted methods of payment.

Legal Implications and Tax Compliance

While an invoice is primarily a commercial document, it carries significant legal weight under federal and state laws. At the federal level, the Internal Revenue Service (IRS) requires businesses to maintain accurate records of income and expenses. Under the Internal Revenue Code (IRC) Section 6001, businesses are obligated to keep records that are sufficient to establish the amount of gross income, deductions, and credits shown on their tax returns. A properly structured cleaning invoice template serves as primary evidence of income for the service provider and a deductible business expense for commercial clients.

State laws also play a critical role, particularly regarding sales tax. In many jurisdictions, janitorial services are subject to sales and use tax. If a cleaning business fails to itemize and collect these taxes on their invoice where required by state statute, they may be held personally liable for the uncollected tax, plus penalties and interest. Furthermore, in the event of non-payment, the invoice acts as evidence of the debt in small claims court or civil litigation. While not a contract in itself, it evidences the performance of a verbal or written agreement, supporting claims made under the Uniform Commercial Code (UCC) regarding the obligation to pay for accepted services.

Residential vs. Commercial Invoicing

The structure and tone of a cleaning invoice template often differ depending on whether the client is a homeowner or a business entity. Residential invoices are typically simpler and are often treated as "due upon receipt." These documents usually focus on general housekeeping tasks and flat-rate pricing models. The relationship is often governed by implied contracts or simple service agreements.

Conversely, commercial invoicing is more complex and frequently involves "Net 30" or "Net 60" payment terms, meaning the business client has 30 or 60 days to pay. These invoices must often reference specific Purchase Order (PO) numbers to be processed by corporate accounting departments. Commercial templates may also need to account for specialized retainers or contractual periodic billing cycles distinct from the one-off nature of many residential jobs.

How to Process a Cleaning Invoice

Establishing a consistent workflow for billing is crucial for maintaining cash flow and professional standing. The following process outlines the standard procedure for generating and issuing these documents.

Step 1: Verification of Services – Before drafting the document, review the work logs or employee timesheets to confirm that all scheduled tasks were completed to the client's satisfaction.

Step 2: Calculation of Costs – Tally the labor hours if billing hourly, or apply the agreed-upon flat rate. Add any extra costs for specialized supplies or equipment rental if the contract allows for expense reimbursement.

Step 3: Draft Generation – Input the data into the cleaning invoice template, ensuring the date, unique invoice number, and client details are current.

Step 4: Submission – Send the document to the client via their preferred method (email, regular mail, or client portal). Ensure it is directed to the specific person or department responsible for payments.

Step 5: Archiving – Save a copy of the sent invoice in the business's accounting records to monitor aging receivables and for future tax preparation.

Frequently Asked Questions

Do you have a question about a Cleaning Invoice Template?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!