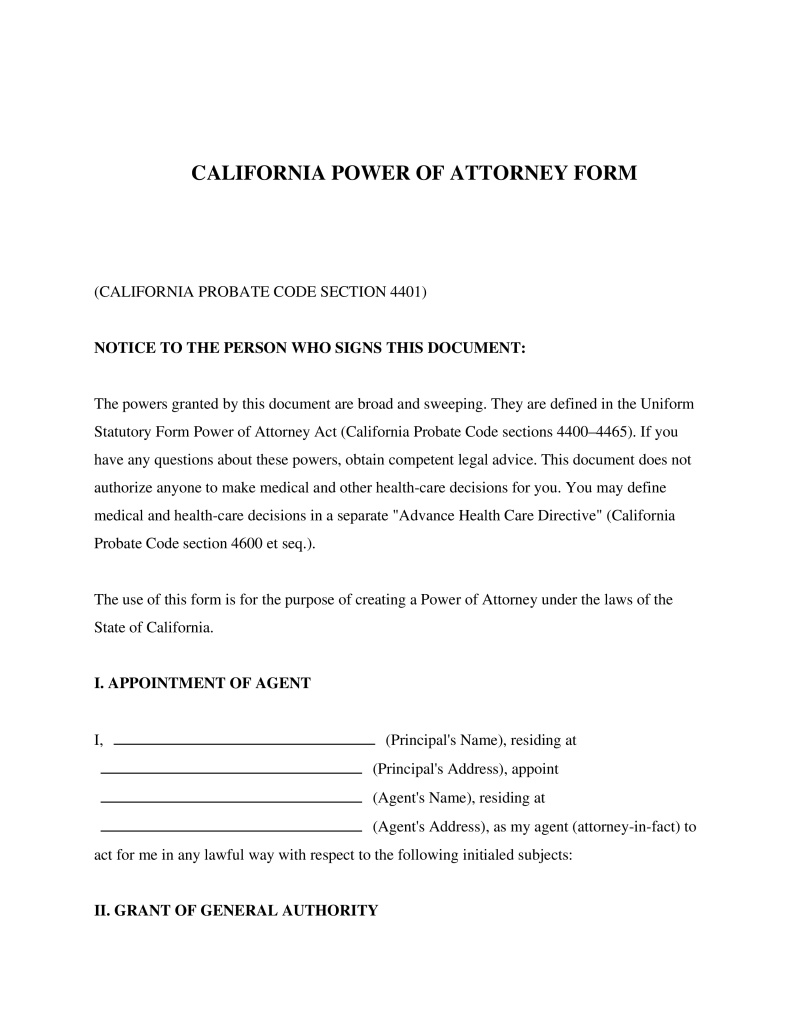

California Power of Attorney Form

A California Power of Attorney Form is a legal instrument that delegates authority from one individual, known as the principal, to another, termed the agent or attorney-in-fact in the state of CA.

Poa Type

Choose the primary purpose for this Power of Attorney. Each type grants different powers to your agent.

Table of Contents

What is a California Power of Attorney Form?

A California Power of Attorney Form is a legal instrument that delegates authority from one individual, known as the principal, to another, termed the agent or attorney-in-fact. This document allows the agent to manage the principal's financial affairs, real estate transactions, or personal matters, depending on the scope defined within the text. It is commonly utilized for estate planning purposes to ensure continuity of management should the principal become incapacitated or unavailable to handle their own obligations. The document operates under strict statutory guidelines to ensure that the designated agent acts in accordance with the principal's wishes and best interests.

Distinction Between Financial and Medical Authority

In California, financial and medical authorities are generally handled through separate documents to respect privacy laws and distinct legal standards. The California Uniform Statutory Form Power of Attorney specifically addresses financial decisions, including banking, taxes, and business operations. Conversely, decisions regarding medical treatment, end-of-life care, and organ donation are governed by an Advance Health Care Directive. While it is possible to draft custom documents, the state legislature has provided statutory forms to standardize these delegations and ensure acceptance by third parties such as banks and hospitals. Mixing these powers into a single document without careful drafting can lead to ambiguity and rejection by institutions.

Requirements for a Valid California Power of Attorney

For a power of attorney to be legally binding in California, it must adhere to specific formalities outlined in the state probate code. Failure to meet these requirements may render the document void or cause third parties to refuse the agent's authority.

- Mental Capacity: The principal must be of sound mind and understand the nature, consequences, and effect of the document at the time of signing.

- Written Format: The designation must be in writing; oral appointments are generally not recognized for these legal powers.

- Notarization: For a power of attorney to be durable and widely accepted, particularly for real estate transactions, it must be acknowledged before a notary public.

- Witnessing: While financial powers generally require notarization, medical directives often require two witnesses or a notary, with specific restrictions on who may serve as a witness (e.g., the agent cannot usually be a witness).

- Signature: The document must be signed by the principal or by another adult in the principal's presence and at their specific direction.

California Probate Code and Legal Framework

The governance of these documents is primarily found within the California Probate Code. Specifically, Division 4.5 creates the Power of Attorney Law. Sections 4400 through 4465 establish the Uniform Statutory Form Power of Attorney, providing the specific language that must be used to create a statutory form that third parties are legally obligated to respect. Section 4124 defines the requirements for a durable power of attorney, mandating that the document explicitly state it shall not be affected by subsequent incapacity of the principal. Furthermore, the California Health Care Decisions Law, found in Probate Code Sections 4600-4806, regulates Advance Health Care Directives. Non-compliance with these statutes can render the document void or result in third parties, such as financial institutions, refusing to honor the agent's authority. Agents who violate their duties under these codes may face civil liability for restoration of assets and potential damages.

Revocation and Termination of Authority

A principal retains the right to revoke a power of attorney at any time, provided they maintain the mental capacity to do so. Revocation is typically achieved by executing a written "Revocation of Power of Attorney" and delivering it to the agent and any third parties, such as banks, that were relying on the previous document. Apart from voluntary revocation, the authority granted terminates automatically upon the death of the principal. In the context of a non-durable power of attorney, the authority also ceases upon the principal's incapacity. Furthermore, if the agent is the principal's spouse, a dissolution of marriage or annulment generally revokes the agent's authority automatically under California law, unless the document expressly states otherwise.

Frequently Asked Questions

Not the form you're looking for?

Try our legal document generator to create a custom document

Ask about a California Power of Attorney Form

Example questions: