A Durable Power of Attorney is a legal form that lets someone (the "principal") choose another person (the "agent") to make decisions for them, even if they can no longer make decisions themselves.

Poa Type

Select the primary scope for your Power of Attorney. Financial/Property covers banking, real estate, and financial matters. Healthcare/Medical covers medical decisions. Combined covers both.

Table of Contents

What is a Durable Power of Attorney?

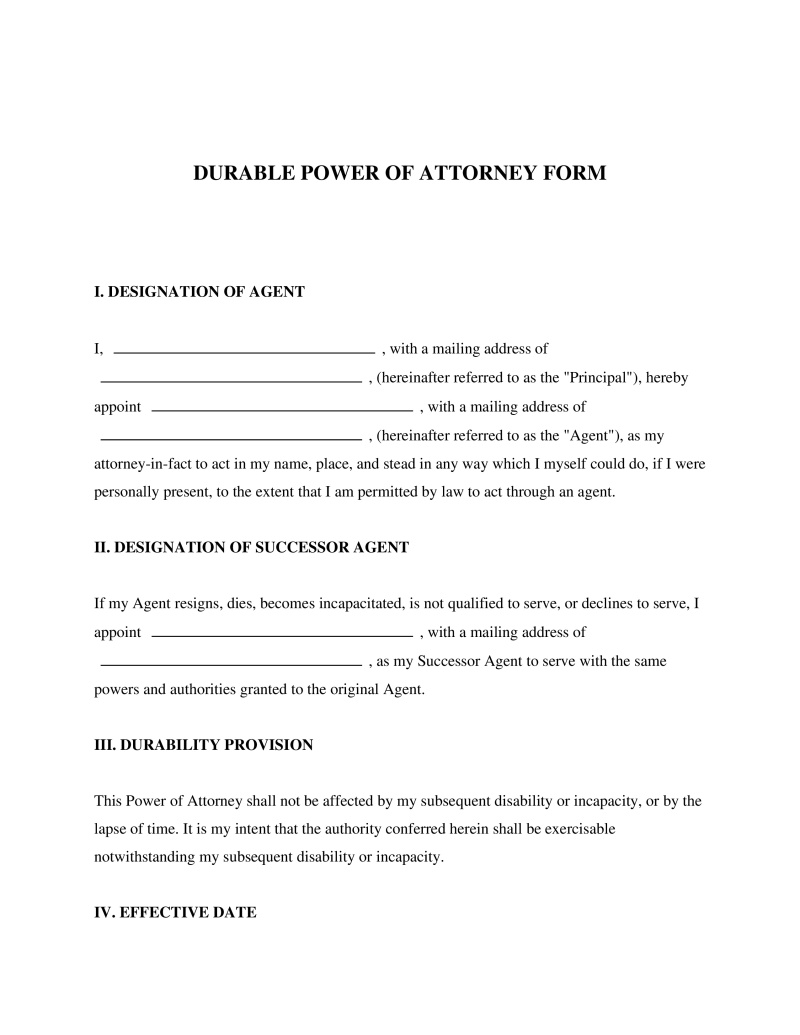

A Durable Power of Attorney is a legal instrument that authorizes a designated agent to act on behalf of a principal regarding financial, legal, or medical matters. This specific type of authorization remains effective even if the principal becomes incapacitated or mentally incompetent, distinguishing it from a standard power of attorney which typically ceases upon incapacitation. Individuals utilize this document as a crucial component of estate planning to ensure their affairs are managed according to their wishes without court intervention.

Legal Requirements for Validity

State laws dictate specific criteria for a Durable Power of Attorney to be legally binding:

- Mental Capacity - The principal must be of sound mind and understand the nature of the document at the time of signing.

- Written Format - Oral agreements are generally insufficient; the appointment must be committed to writing.

- Notarization - Most jurisdictions require the principal's signature to be acknowledged before a notary public to prevent fraud.

- Witness Requirements - Many states mandate the presence of one or two disinterested witnesses during the signing process.

- Durability Clause - The document must explicitly state that the powers survive the principal's subsequent disability or incapacity.

Scope of Agent Authority

The powers granted to an agent under a durable arrangement can be extensive or restricted based on the principal's preferences. A comprehensive document often permits the agent to manage banking transactions, buy or sell real estate, and handle tax matters. Agents may also possess the authority to manage retirement accounts and apply for government benefits such as Social Security or Medicaid. The principal retains the right to exclude specific powers, such as the ability to make gifts or change beneficiary designations on insurance policies.

Fiduciary Duties and Obligations

An agent acts as a fiduciary and stands in a position of special trust regarding the principal. This role demands acting solely in the principal's best interest while avoiding conflicts of interest and self-dealing. The agent must maintain accurate records of all transactions made on behalf of the principal to ensure transparency and accountability. Commingling the principal's funds with the agent's personal assets is strictly prohibited and can lead to legal penalties or removal.

Termination of Authority

A Durable Power of Attorney does not remain in effect indefinitely and terminates upon the death of the principal. The principal may revoke the document at any time provided they retain the mental capacity to do so. Divorce often automatically terminates the authority of a spouse named as an agent in many jurisdictions. A court may also intervene to revoke the power if evidence suggests the agent is abusing their authority or neglecting their duties.

Relevant Laws and Statutes

Various legal frameworks govern the creation and execution of these documents:

- Uniform Power of Attorney Act - Standardizes laws regarding powers of attorney to promote consistency across enacting states (UPOAA § 101 et seq.).

- Health Insurance Portability and Accountability Act - Permits covered entities to disclose protected health information to a designated personal representative (45 CFR § 164.502(g)).

- Social Security Representative Payee Program - Allows the Social Security Administration to appoint a representative to manage benefits distinct from a power of attorney (42 U.S.C. § 405(j)).

- Uniform Health-Care Decisions Act - Provides a comprehensive framework for advance healthcare directives and agent appointments (UHCDA § 1 et seq.).

FAQs

Do you have a question about a Durable Power of Attorney?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!