Bill of Sale for Gifted Car

A Bill of Sale for a Gifted Car is a legal document that records the transfer of ownership (for a car) without monetary exchange.

Is Gift To Family Member

Some jurisdictions offer tax exemptions or reduced fees for gifts to family members. Select 'Yes' if the recipient is related to the donor by blood, marriage, or adoption.

Table of Contents

What is a Bill of Sale for Gifted Car?

A Bill of Sale for a gifted car serves as a legal instrument documenting the transfer of vehicle ownership from a donor to a recipient without the exchange of monetary funds. This document acts as primary evidence for the Department of Motor Vehicles (DMV) and taxation authorities to classify the transaction as a gift rather than a retail sale. Parties involved in the transfer utilize this form to establish the zero-dollar value of the transaction, which often allows the recipient to claim an exemption from or a reduction in state sales tax during the registration process. The document also functions to release the donor from liability regarding the vehicle once the transfer concludes.

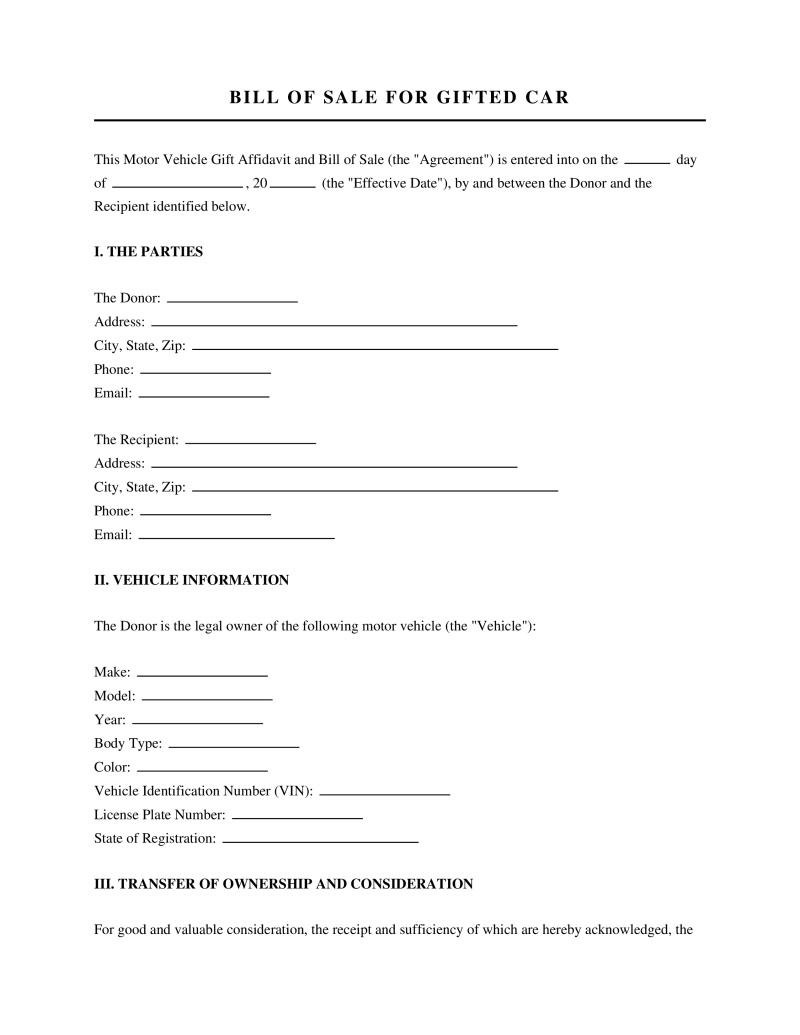

Core Elements of a Gift Bill of Sale

A valid transfer document must contain specific data points to satisfy state titling and registration requirements. Missing information often results in delays or rejection at the DMV office:

- Donor and Recipient Identification - Full legal names and physical addresses of both the party giving the vehicle and the party receiving it.

- Vehicle Description - Comprehensive details including the Vehicle Identification Number (VIN), make, model, year, body type, and color.

- Odometer Disclosure - The current mileage reading at the time of transfer, required by federal law for vehicles under a certain age.

- Consideration Statement - A specific clause stating the purchase price is $0.00 or explicitly labeling the transaction as a "gift."

- Signatures - Dated signatures from both the donor and the recipient to attest to the accuracy of the information.

Federal and State Legal Requirements

The transfer of a motor vehicle as a gift invokes various statutes regarding taxation, truthful disclosure, and liability.

- Federal Odometer Act - Mandates the disclosure of mileage upon transfer of ownership for most vehicles to prevent odometer fraud (49 U.S.C. Chapter 327).

- Federal Gift Tax Exclusion - Allows individuals to give gifts up to a certain value annually per recipient without incurring federal gift tax (26 U.S.C. § 2503).

- State Sales Tax Exemptions - State statutes typically define specific criteria for waiving sales tax on vehicle transfers between family members (varies by state revenue code).

- Truth in Taxation Laws - Prohibits the falsification of vehicle values or purchase prices to evade tax obligations (state penal codes vary).

Tax Implications for Donor and Recipient

The financial implications of gifting a car differ significantly from selling one. For the recipient, the primary concern typically involves state sales tax. Most states impose sales tax on the market value of a vehicle when purchased. A properly executed Bill of Sale for a gifted car provides the necessary proof to waive this tax, provided the state allows for gift exemptions. Some states limit these exemptions strictly to immediate family members, such as parents, spouses, siblings, or children.

The donor faces different considerations, primarily regarding federal gift tax. The Internal Revenue Service (IRS) sets an annual exclusion limit for gifts. If the fair market value of the vehicle exceeds this annual limit, the donor must file a gift tax return (Form 709). This filing does not necessarily result in a tax bill but counts against the donor's lifetime gift tax exemption.

How to Complete a Bill of Sale for Gifted Car

Executing a gift transfer involves a systematic process to ensure legality and successful registration.

Step 1: Verify Ownership and Liens - Ensure the donor possesses a clear title with no outstanding liens or loans on the vehicle.

Step 2: Draft the Bill of Sale - Complete the document with vehicle details, odometer reading, and a clear statement of zero consideration.

Step 3: Execute the Title - The donor must sign the back of the official Certificate of Title in the seller's section, entering "Gift" or "0" in the price field.

Step 4: Notarize Documents - Many states require the Bill of Sale or a separate Affidavit of Gift to be notarized to prevent fraud.

Step 5: Transfer Registration - The recipient takes the signed title, Bill of Sale, and proof of insurance to the DMV to register the vehicle in their name.

Liability and Insurance Considerations

Ownership transfer marks a critical point for liability purposes. Until the title transfer is officially processed by the state agency, the donor may remain legally responsible for the vehicle. A signed Bill of Sale serves as evidence of the date and time ownership changed hands. This document protects the donor if the recipient incurs parking tickets, toll violations, or is involved in an accident immediately after taking possession but before completing the registration. Insurance coverage should be arranged by the recipient prior to taking possession of the vehicle to ensure continuous coverage and compliance with state financial responsibility laws.

FAQs

Not the form you're looking for?

Try our legal document generator to create a custom document

Ask about a Bill of Sale for Gifted Car

Example questions: