An RV Bill of Sale is a legal document that records the sale and transfer of ownership of a recreational vehicle from seller to buyer.

Is Sale By Dealer

Select 'Yes' if the Seller is a business or dealership. Select 'No' if the Seller is a private individual.

Table of Contents

What is a RV Bill of Sale Template?

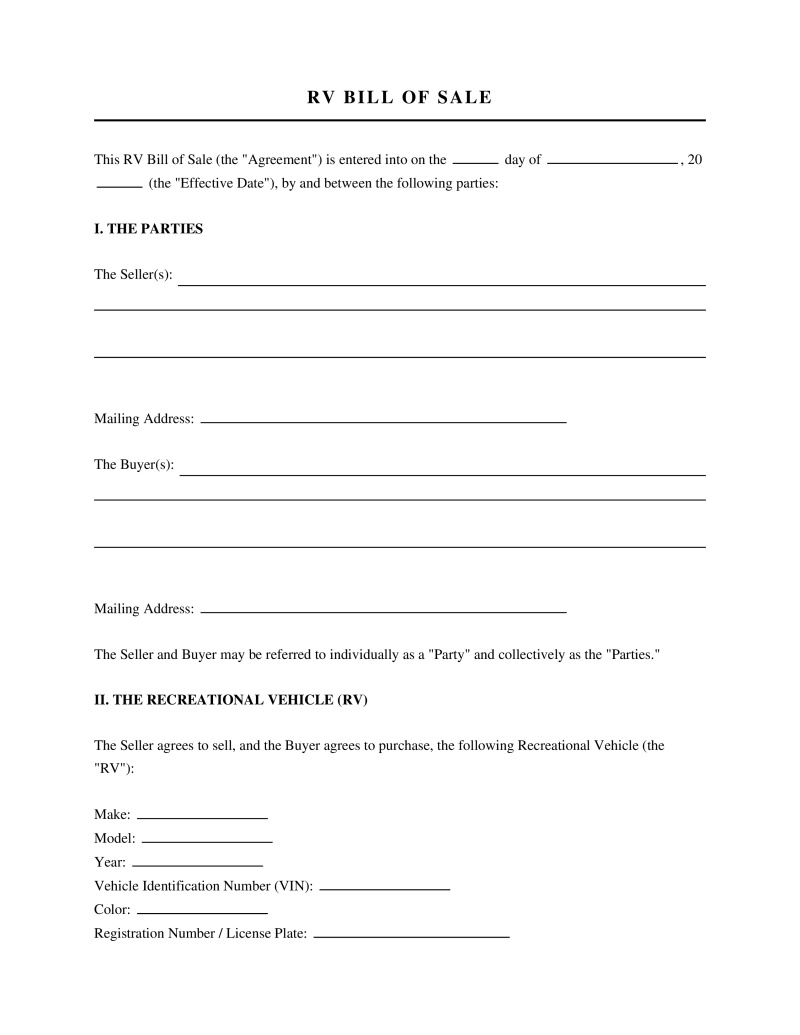

An RV Bill of Sale Template is a legal instrument used to document the transfer of ownership of a recreational vehicle from a seller to a buyer. This written record serves as the primary receipt for the transaction, detailing the specific terms of the sale including the purchase price, vehicle identification number (VIN), and the condition of the camper or motorhome. State motor vehicle departments often require this document to process the registration and titling of the vehicle in the new owner's name. It functions simultaneously as proof of ownership for the buyer and a release of liability for the seller once the transaction concludes.

Required Elements of a Valid RV Bill of Sale

A comprehensive bill of sale must contain specific data points to be considered legally binding and acceptable by local tax collectors or DMV offices. Missing information can lead to delays in registration or legal disputes regarding ownership.

- Parties Involved - Full legal names, physical addresses, and contact information for both the buyer and the seller.

- Vehicle Description - The make, model, year, body style, and unique Vehicle Identification Number (VIN) of the recreational vehicle.

- Purchase Price - The agreed-upon monetary amount paid for the vehicle, often written in both words and numbers to prevent alteration.

- Date of Sale - The specific calendar date when the transaction occurred and ownership officially transferred.

- Odometer Reading - The current mileage displayed on the vehicle's odometer at the time of transfer.

- Signatures - Hand-written or electronic signatures of all parties involved, occasionally requiring notarization depending on state statutes.

Federal and State Legal Considerations

The sale of motor vehicles, including RVs, falls under various federal and state regulations designed to protect consumers and ensure accurate record-keeping. These laws govern how transfers must be documented and reported.

- Federal Odometer Act - Mandates the disclosure of mileage for vehicles under a certain age to prevent odometer fraud (49 U.S.C. § 32705).

- Uniform Commercial Code Article 2 - Governs contracts for the sale of goods, including requirements for written contracts for sales over $500 (UCC § 2-201).

- State Notarization Requirements - Specific states mandate that a notary public witness the signing of the bill of sale for it to be valid for titling (State Statutes Vary).

- Implied Warranty of Merchantability - Automatically guarantees that a vehicle sold by a merchant is fit for its ordinary purpose unless effectively disclaimed (UCC § 2-314).

- Lemon Laws - State-specific statutes that may provide recourse for buyers of defective vehicles, though protections for used RVs vary significantly (Magnuson-Moss Warranty Act).

Registration and Titling Process

Following the execution of the RV Bill of Sale, the new owner must take specific actions to legally register the vehicle. Departments of Motor Vehicles (DMV) or equivalent state agencies enforce strict timelines and documentation standards.

- Proof of Ownership - The signed bill of sale and the previous title signed over by the seller serve as primary evidence of the transfer.

- Tax Payments - Sales tax is typically calculated based on the purchase price listed on the bill of sale and collected at the time of registration.

- Insurance Requirements - Proof of valid insurance coverage is generally required before the state will issue new license plates or tags.

- Inspection Certificates - Some states require safety or emissions inspections before a used vehicle can be registered to a new owner.

Frequently Asked Questions

Do you have a question about a RV Bill of Sale Template?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!