A Limited Partnership Agreement details the relationship between general and limited partners, outlining roles, responsibilities, and profit-sharing.

Partnership Name

Type the official name of your partnership as it appears in your partnership agreement. Make sure to include any necessary designations, such as "LLP" or "Inc." if applicable. This name will be used in legal documents, so it must accurately reflect your partnership's registered name.

Table of Contents

What is a Limited Partnership Agreement?

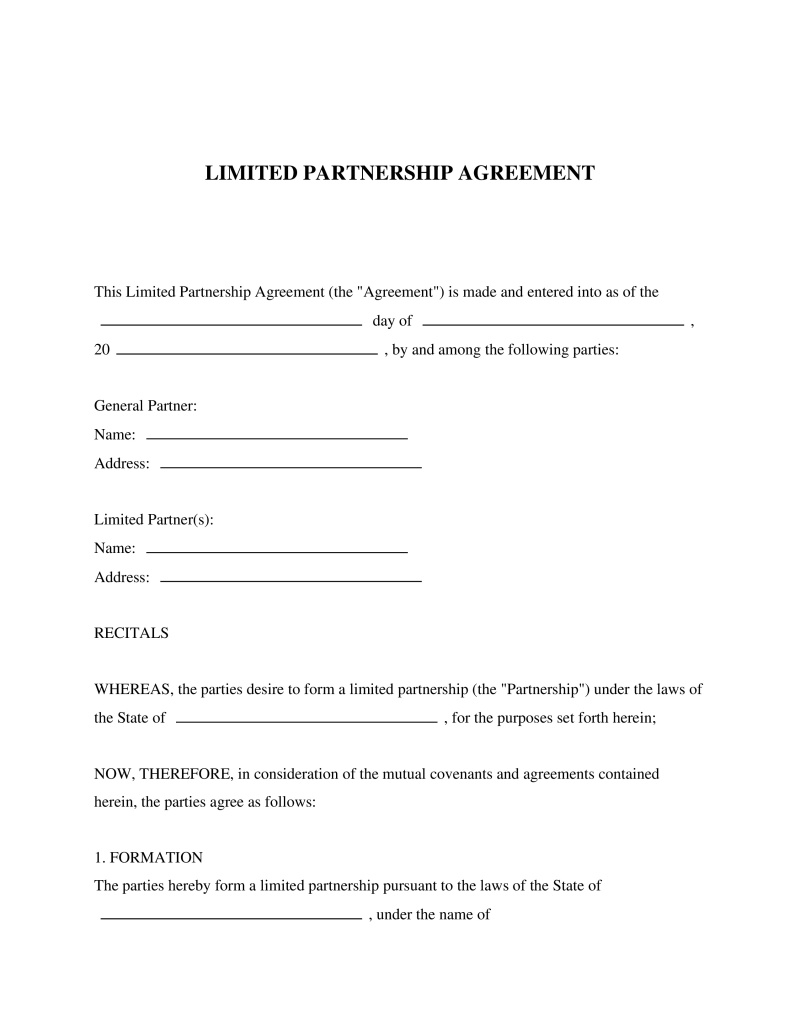

A Limited Partnership Agreement is a formal document that outlines the structure, operations, and governance of a limited partnership. This type of partnership consists of at least one general partner and one or more limited partners. The general partner manages the day-to-day operations and assumes liability for the debts and obligations of the partnership, whereas limited partners contribute capital and receive profits but have limited liability and are not involved in management decisions.

Key Features

Important Provisions

- Capital Contributions: Details on initial investments made by each partner and provisions for future contributions if needed.

- Distribution of Profits and Losses: Clauses specifying how profits and losses are shared among general and limited partners according to agreed-upon percentages.

- Management Duties and Restrictions: A breakdown of the general partner's role in daily operations versus the limited involvement of silent partners.

- Exit Strategy: Terms under which partners can exit the partnership, including buy-out options, notice periods, and valuation methods for selling partnership interests.

- Dispute Resolution: Procedures for handling internal conflicts, potentially including mediation or arbitration before resorting to litigation.

Pros and Cons

Pros

- +Establishes a clear legal structure for managing a partnership with both general and limited partners.

- +Protects the interests of all partners by clearly delineating roles and limiting liability for limited partners.

- +Facilitates smoother operational workflows through predefined rules for decision-making and conflict resolution.

- +Enhances financial transparency and accountability among partners with detailed capital contribution and distribution policies.

- +Potentially reduces legal disputes by providing a comprehensive framework for partnership governance.

Cons

- -May require adjustments or amendments over time as the partnership evolves or circumstances change.

- -Requires careful drafting to ensure compliance with state laws governing partnerships, which can vary significantly.

- -Could be perceived as rigid by some partners, limiting flexibility in how the partnership operates.

Common Uses

- Formation of investment vehicles by individuals seeking to pool resources without engaging in day-to-day management.

- Development projects where investors wish to limit their liability while contributing capital.

- Entrepreneurial ventures that benefit from having a managing partner with industry expertise alongside passive investors.

- Family businesses looking to define roles clearly amongst family members while protecting personal assets.

- Real estate investment groups where members contribute financially but prefer not to be involved in property management.

- Joint ventures between companies where one party provides capital while another manages operations.

Frequently Asked Questions

Do you have a question about a Limited Partnership Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!