A Real Estate Purchase Agreement template outlines key terms of a property sale, helps protect both parties’ interests, and serves as a customizable foundation for legal compliance across U.S. states.

Property Type

Select the type of property that is being sold from the options listed: Single-Family Home, Condominium, Duplex, Triplex, or Other. If you choose "Other," briefly describe the property type in the space provided. This information is important for legal clarity in the sale agreement and helps define the property involved in the transaction.

Table of Contents

What is a Real Estate Purchase Agreement?

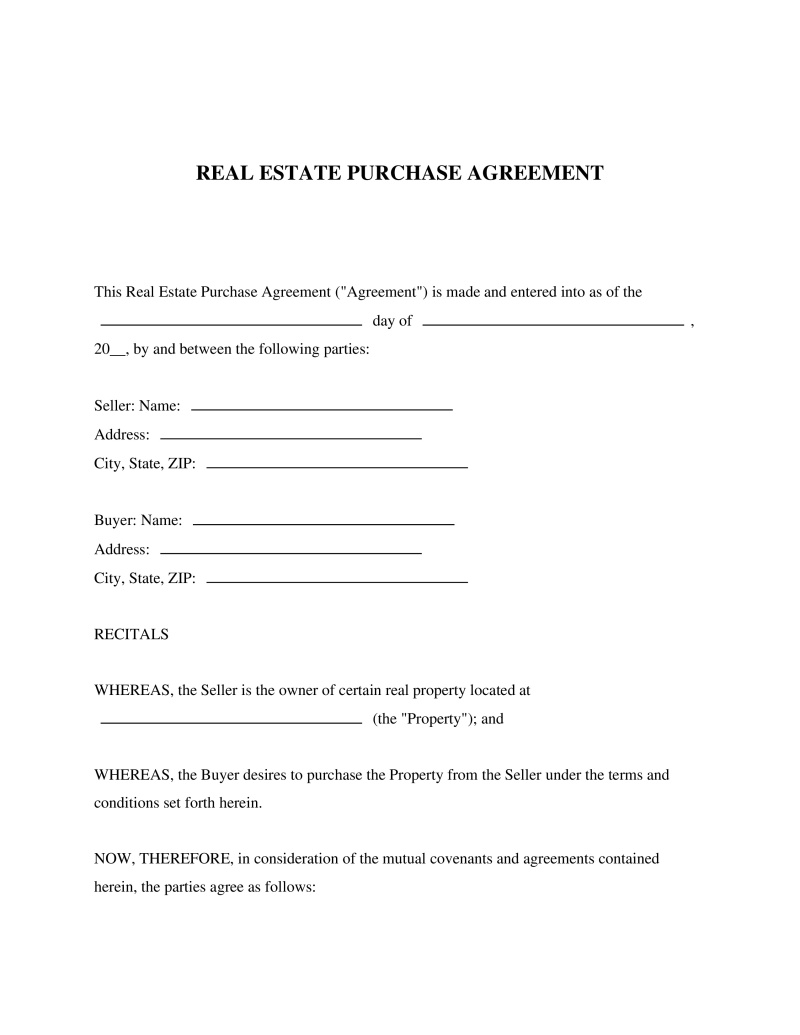

A Real Estate Purchase Agreement functions as a legally binding contract between a buyer and a seller outlining the specific terms of a property transaction. This document details the conditions under which the sale will occur, including the agreed-upon purchase price, financing arrangements, contingencies, and the scheduled closing date. Parties involved in residential or commercial property transfers utilize this instrument to formalize their intent and establish enforceable legal obligations before the final transfer of the deed takes place.

Essential Elements of the Contract

A valid agreement must contain specific components to ensure enforceability and clarity for all parties involved:

- Identification of Parties - Full legal names of all buyers and sellers involved in the transaction.

- Property Description - The legal address and description of the property as recorded in local county records.

- Purchase Price and Financing - The total agreed amount and the method of payment, including down payments and mortgage loan details.

- Earnest Money Deposit - The amount of good faith money the buyer provides to demonstrate serious intent to purchase.

- Closing Date - The specific date when the transfer of ownership and funds will legally occur.

- Disclosures - Mandatory statements regarding the property's condition, such as lead-based paint or environmental hazards.

Common Contingencies

Contingencies function as safety clauses allowing parties to withdraw from the contract without penalty under specific circumstances:

- Inspection Contingency - Permits the buyer to terminate the deal if a professional home inspection reveals significant structural or mechanical defects.

- Appraisal Contingency - Allows the buyer to back out if the property's appraised value falls below the agreed purchase price.

- Financing Contingency - Protects the buyer from losing their earnest money if they cannot secure a mortgage loan within a specified timeframe.

- Title Contingency - Requires the seller to provide a clear title free of liens, encumbrances, or legal disputes before the sale proceeds.

- Home Sale Contingency - Conditions the purchase on the buyer's ability to sell their current home before closing on the new property.

How to Execute a Real Estate Purchase Agreement

The process of finalizing this document typically follows a structured timeline:

- Step 1: Offer Submission - The potential buyer submits a written offer outlining the price and terms to the seller.

- Step 2: Negotiation and Acceptance - The seller reviews the offer and may counter with different terms before both parties sign the final version.

- Step 3: Earnest Money Deposit - The buyer places the agreed-upon deposit into an escrow account to secure the contract.

- Step 4: Due Diligence Period - The buyer conducts inspections, reviews title reports, and secures financing while the contract remains conditional.

- Step 5: Closing - Parties meet to sign transfer documents, exchange funds, and officially transfer the property title.

Federal and State Legal Requirements

Real estate transactions must adhere to various statutory regulations to remain valid:

- Statute of Frauds - Mandates that contracts for the sale of real estate must be in writing and signed by the parties to be legally enforceable (Common Law/State Statutes).

- Real Estate Settlement Procedures Act (RESPA) - Regulates the disclosure of costs and settlement procedures to protect consumers from abusive practices (12 U.S.C. § 2601 et seq.).

- Residential Lead-Based Paint Hazard Reduction Act - Requires sellers of housing built before 1978 to disclose known lead-based paint hazards to buyers (42 U.S.C. § 4852d).

- Fair Housing Act - Prohibits discrimination in the sale of housing based on race, color, religion, sex, familial status, or national origin (42 U.S.C. § 3601 et seq.).

- Truth in Lending Act (TILA) - Compels lenders to disclose exact terms and costs associated with borrowing money for the property purchase (15 U.S.C. § 1601 et seq.).

Do you have a question about a Real Estate Purchase Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!