A quitclaim deed is a legal document that transfers ownership rights in property without guaranteeing the title's validity or clear status.

Is Property In Us

Select 'Yes' if the property is within the United States. Quitclaim Deed requirements may differ for international properties.

Table of Contents

What is a Quitclaim Deed?

A quitclaim deed is a specific type of legal instrument used to transfer interest in real property from one individual, termed the grantor, to another, known as the grantee. Unlike general or special warranty deeds, this document conveys only the interest the grantor currently possesses at the time of the transfer, without providing any warranties, guarantees, or covenants regarding the validity of the title or freedom from liens and encumbrances. Consequently, if the grantor holds no valid ownership interest in the property, the grantee receives nothing, making this instrument most suitable for transactions between trusted parties where the history of the property title is well-known or irrelevant to the transfer.

Legal Nature and Ownership Transfer

The fundamental characteristic of this legal instrument is its lack of warranty. When individuals ask does a quitclaim deed give you ownership, the answer lies in the scope of the grantor's interest. The deed operates on the principle of "as-is" transfer; it passes the grantor's entire interest, whether that interest is a full fee simple estate, a life estate, or merely a cloud on the title. It does not guarantee that the grantor actually owns the property or that the property is free of debt. Regarding the duration of the transfer and how long does a quitclaim deed give you ownership, the transfer is generally permanent and lasts indefinitely unless the deed specifically outlines a lesser estate, such as a life estate, or unless the deed is later successfully challenged in court due to fraud or duress.

Quitclaim Deed vs Warranty Deed

Distinguishing between a quitclaim deed vs warranty deed is essential for understanding property protection. A warranty deed contains legal promises (covenants) that the grantor holds clear title to the property and has the right to sell it. Furthermore, a warranty deed obligates the grantor to defend the grantee against future claims regarding the property's title history. In contrast, a quitclaim deed offers no such protection. If a third party later emerges with a claim to the property, or if an undisclosed lien is discovered, the grantee has no legal recourse against the grantor under a quitclaim deed. For this reason, warranty deeds are the standard in commercial real estate sales, while quitclaim deeds are reserved for low-risk transfers where money is not changing hands.

Common Use Cases and Examples

Because of the lack of buyer protection, these deeds are rarely used in traditional real estate sales between strangers. A common quitclaim deed example involves family matters, such as parents transferring a vacation home to their children or a property owner adding a new spouse to a deed after marriage. Another frequent application is during divorce proceedings; one spouse may sign a quitclaim deed to release their interest in the family home to the other spouse as part of a settlement agreement. Additionally, these documents are frequently used to cure defects in a title, often referred to as a "cloud on the title." For instance, if a previous deed contained a misspelling of a name or a minor error in the legal description, the relevant party may execute a quitclaim deed to clarify the record and resolve the ambiguity.

How to Complete a Quitclaim Deed

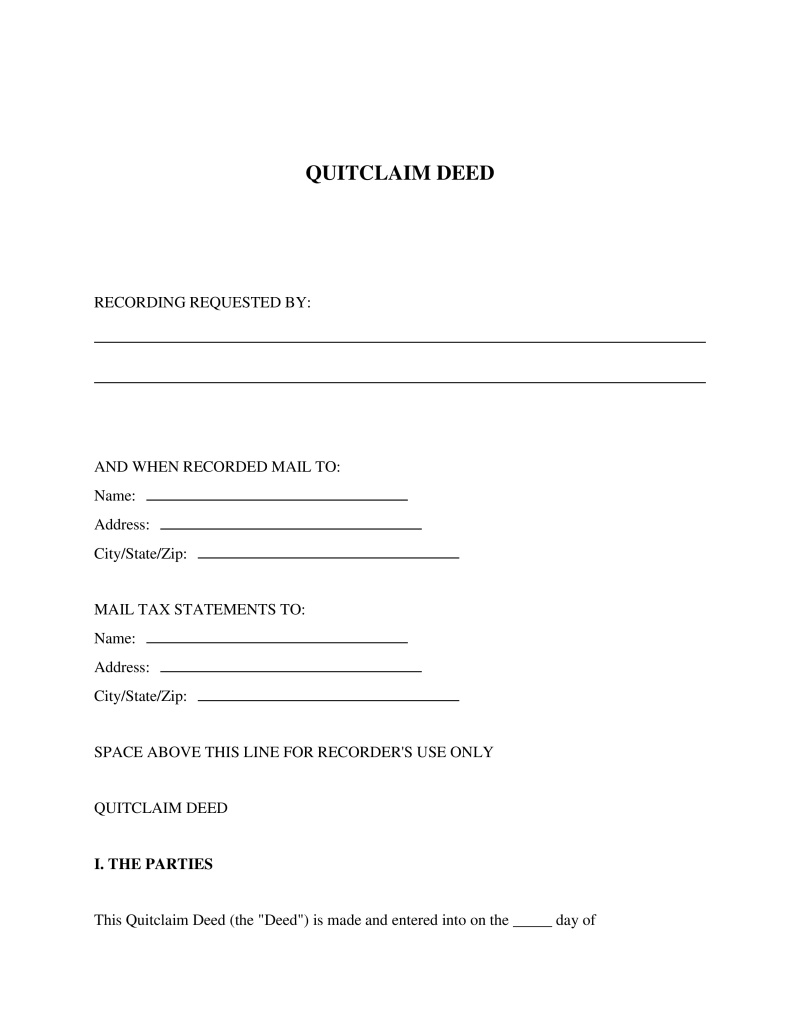

The process of executing this document involves specific procedural steps to ensure validity. While exact requirements vary by jurisdiction, the general workflow remains consistent across most states.

- Step 1: Procurement of Legal Description – The grantor must obtain the full legal description of the property, which can typically be found on the previous deed or at the county recorder's office. This is distinct from the postal address.

- Step 2: Drafting the Instrument – The document must be drafted to include the names of the grantor and grantee, the legal description, and the county in which the property is located. The language must explicitly state that the grantor "quits claim" to the interest.

- Step 3: Execution Before a Notary – The grantor must sign the deed in the presence of a notary public. Some states also require additional witnesses to be present during the signing.

- Step 4: Recording the Deed – Once signed and notarized, the grantee must file the document with the appropriate county office (often the County Clerk or Recorder of Deeds). This step provides public notice of the transfer.

Legal Requirements and Statutory Framework

The validity of property transfers is governed by state statutes and common law principles. A primary federal consideration is the absence of federal land law governing private transfers; thus, state law prevails. Most jurisdictions enforce the Statute of Frauds, which mandates that all real estate transfers must be in writing to be enforceable. For example, under the California Civil Code or Florida Statutes, an oral agreement to transfer property is generally invalid.

Furthermore, state "Recording Acts" dictate priority of ownership. These statutes—categorized as Race, Notice, or Race-Notice—determine who holds valid title if a property is sold to multiple parties. While a quitclaim deed is valid between the parties without recording, failing to file the deed exposes the grantee to significant risk. If the grantor later sells the property to a "bona fide purchaser" who records their warranty deed first, the holder of the unrecorded quitclaim deed may lose their ownership rights. Additionally, specific state laws, such as spousal homestead rights, may prevent a grantor from transferring a primary residence without the spouse's signature, even if the spouse is not named on the title.

Financial and Mortgage Implications

A critical misconception regarding how to do a quitclaim deed involves existing mortgages. Transferring the title does not transfer the mortgage obligation. The grantor remains legally liable for the debt unless the lender agrees to a loan assumption or the grantee refinances the property. Furthermore, many mortgage contracts contain a "due-on-sale" clause. This clause allows the lender to demand immediate repayment of the entire loan balance if the property interest is transferred, even via a quitclaim deed. Therefore, parties must exercise caution and potentially consult with the lender before finalizing the transfer to avoid triggering foreclosure or acceleration of the debt.

Frequently Asked Questions

Do you have a question about a Quitclaim Deed?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!