An invoice is a document from a seller to a buyer that details goods or services provided, costs, and payment terms, serving as both a payment request and a transaction record.

Invoice Type

Choose the invoice type to tailor fields for your needs. Proforma invoices are for quotes/estimates; Recurring invoices are for ongoing services.

Table of Contents

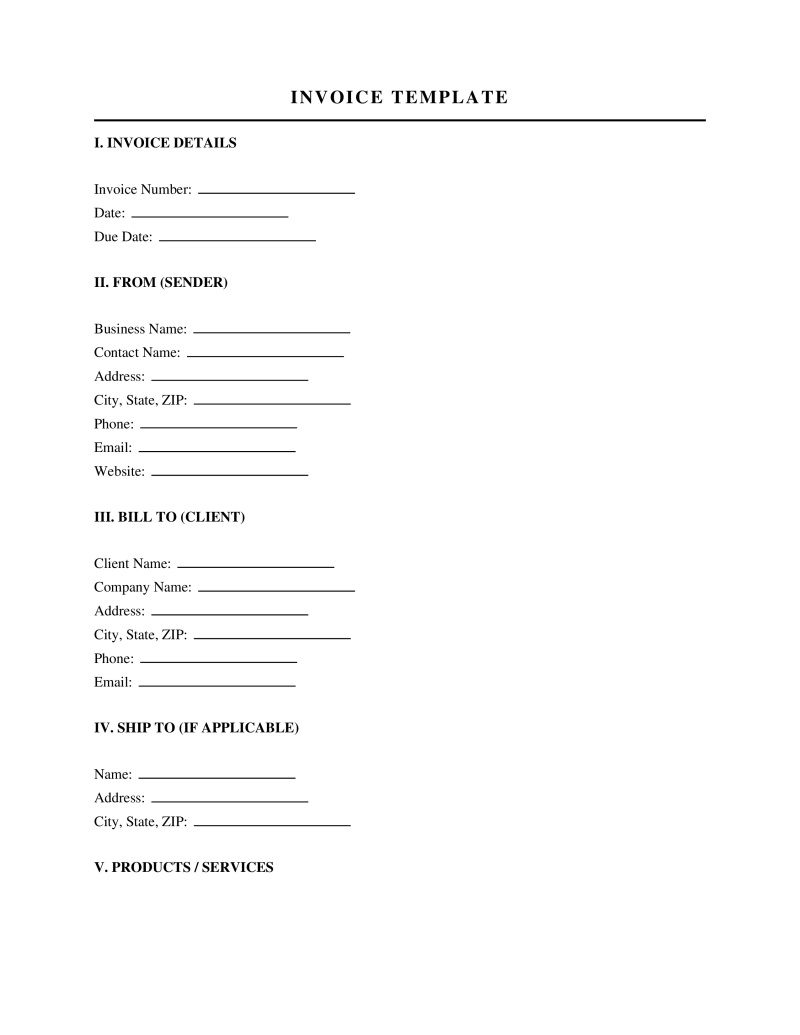

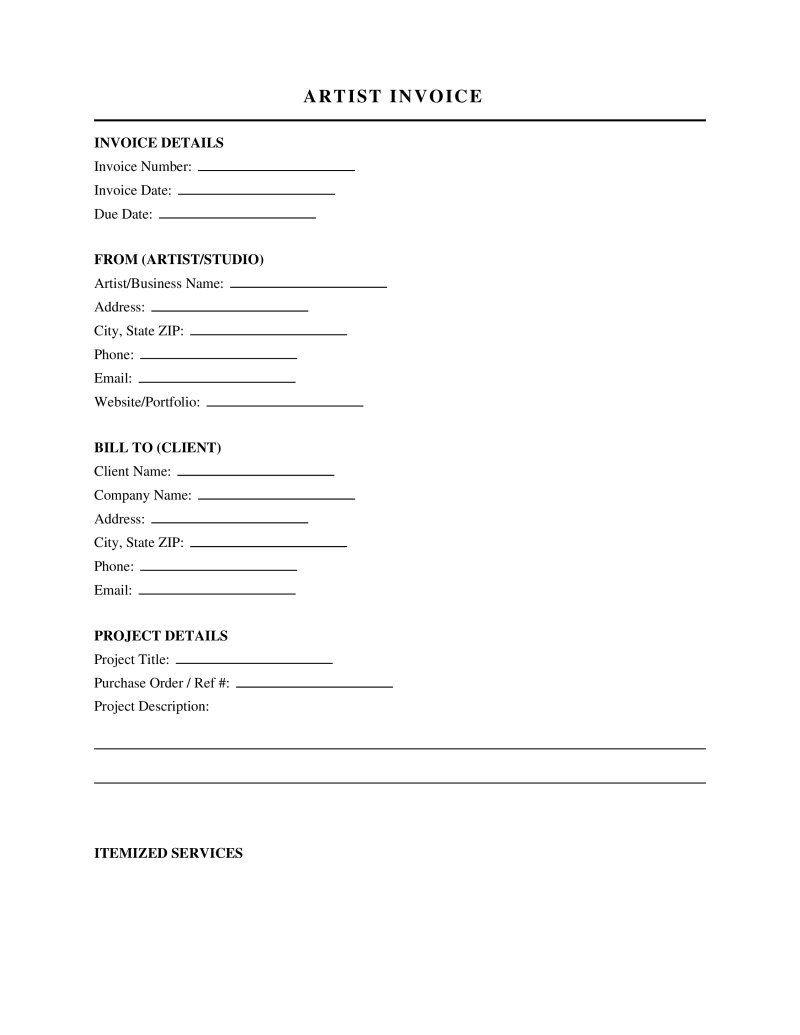

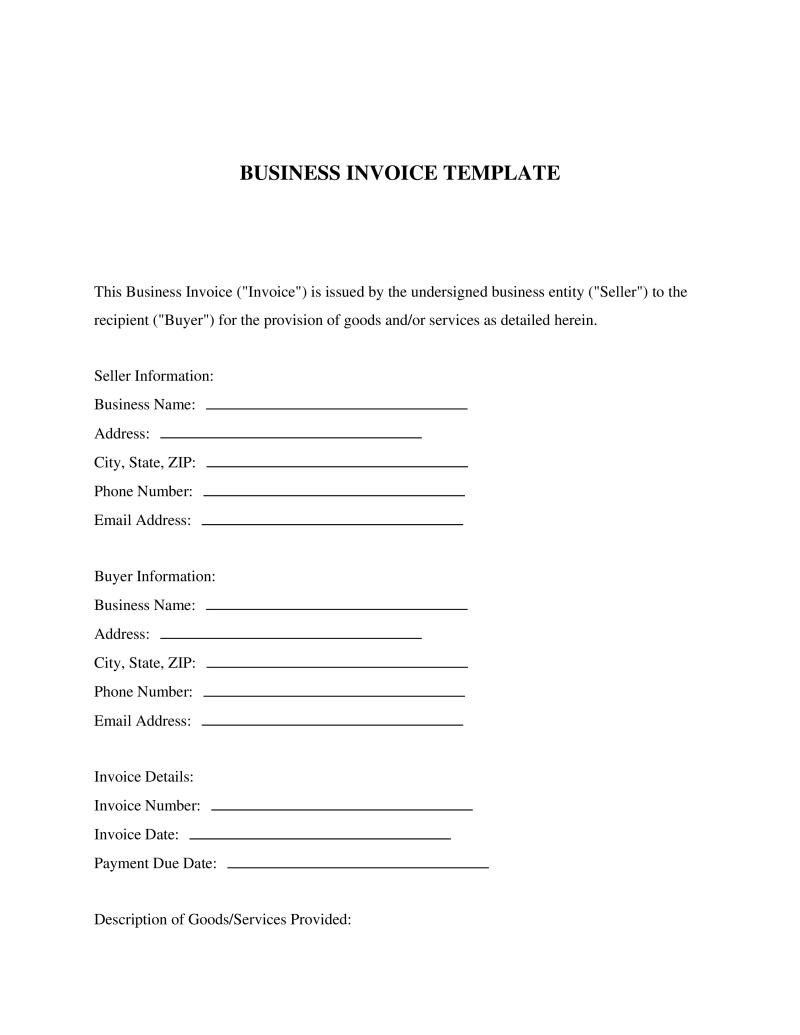

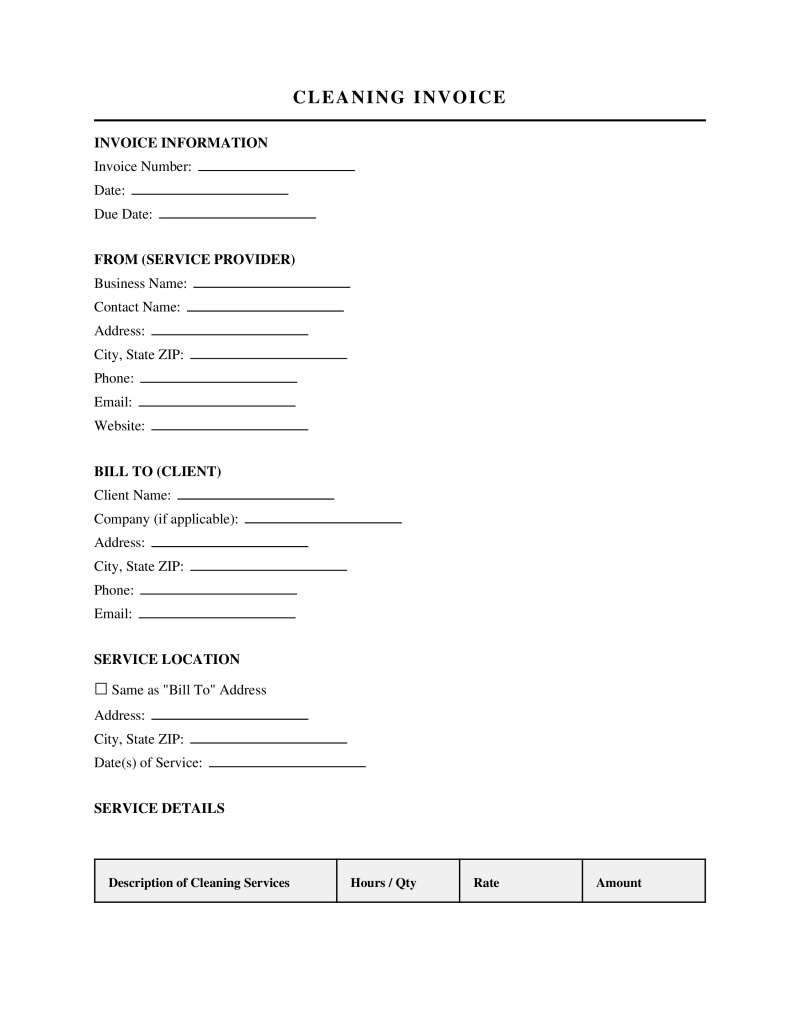

What is an Invoice Template?

An invoice template is a standardized billing document used by commercial entities, freelancers, and contractors to formally request payment for goods sold or services rendered. This instrument serves as the primary record of a transaction between a buyer and a seller, establishing an obligation to pay according to agreed-upon terms. By utilizing a pre-formatted structure, businesses ensure consistency in their financial reporting, facilitate accurate tax filing, and maintain a professional method of communication with clients regarding financial liabilities.

Required Elements of a Valid Invoice Template

While the aesthetic design of billing documents varies across industries, certain components are essential for the document to be legally recognized and useful for accounting purposes. Whether one uses a manual method or an automated invoice generator, the following data points are typically required for validity under standard commercial practices and tax regulations.

- Identification: The word "Invoice" must be clearly displayed, typically at the top of the document.

- Unique Reference Number: A sequential invoice number is necessary for tracking and audit trails.

- Date of Issue: The specific date the document was created and sent to the client.

- Vendor and Client Information: Full legal names, addresses, and contact details for both the seller and the buyer.

- Line Item Description: A detailed breakdown of goods or services provided, including quantity, unit price, and subtotal.

- Total Amount Due: The aggregate sum owed, including any applicable taxes, shipping fees, or discounts.

- Payment Terms: Specific instructions regarding the due date, acceptable payment methods, and penalties for late payment.

Legal Requirements and Regulatory Framework

In the United States, invoices are governed by a combination of federal and state laws, primarily revolving around tax compliance and commercial contract law. The Internal Revenue Service (IRS) mandates that businesses maintain accurate records of income and expenses. Under IRS Publication 583, businesses are required to keep supporting documents, such as sales slips, invoices, and receipts, to substantiate the entries in their tax returns. Failure to maintain these records can result in penalties or the disallowance of deductions during an audit.

From a contractual standpoint, the Uniform Commercial Code (UCC) plays a significant role, particularly Article 2, which governs the sale of goods. While the UCC does not strictly dictate the format of an invoice, it establishes that an invoice can serve as a confirmation of a contract between merchants. If a buyer receives an invoice and does not object to its contents within a reasonable time (often 10 days under the UCC), the terms listed may become binding. Additionally, the Electronic Signatures in Global and National Commerce Act (E-SIGN Act) ensures that electronic invoices sent via email or through a digital invoice generator hold the same legal validity as paper documents, provided the consumer has consented to electronic delivery.

Types of Commercial Invoices

Different business scenarios require specific variations of the standard invoice template. Understanding these distinctions is vital when learning how to create invoices for complex transactions.

- Pro Forma Invoice – A preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It acts as a quotation and commitment to sell but is not a demand for payment, often used for customs purposes in international trade.

- Commercial Invoice – The final bill used for customs declaration and payment requests, as opposed to the preliminary pro forma version.

- Recurring Invoice – Used to bill clients at regular intervals for ongoing services, such as monthly subscriptions or retainer fees.

- Interim Invoice – Also known as progress billing, this is common in construction and contracting sectors, allowing providers to bill for partial completion of a large project.

- Credit Memo – A negative invoice issued to correct errors or process refunds, effectively reducing the amount a client owes.

How to Complete a Invoice Template

Accurately filling out billing documentation is critical to ensuring prompt payment and avoiding disputes. The process involves systematically entering transaction details to create a clear financial record.

Step 1: Header Configuration – Input your business logo, legal name, and contact information at the top. Ensure the client's details are accurate to prevent delivery issues.

Step 2: Assign Identifiers – Generate a unique invoice number. If using manual methods, ensure the number follows the sequence of previous bills to maintain a gapless record.

Step 3: Itemize Services or Goods – List each product or service on a separate line. Include a clear description, quantity delivered, and rate per unit. Ambiguity in this section is a common cause of payment delays.

Step 4: Calculate Financials – Sum the subtotal of all lines. Apply necessary sales tax rates based on the jurisdiction of the buyer or seller, and deduct any agreed-upon discounts to reach the Grand Total.

Step 5: Define Terms – Clearly state the payment due date (e.g., "Net 30") and specify how the client should pay, such as via bank transfer, check, or credit card portal.

Digital Invoicing and Automation

The evolution of financial technology has shifted many businesses away from manual word processing documents toward specialized software. An online invoice generator streamlines the billing process by automating calculations, sequential numbering, and tax application. These tools often integrate directly with accounting software, reducing the risk of human error associated with manual entry. Furthermore, digital platforms facilitate the immediate delivery of documents and allow for tracking when a client views the bill, providing greater visibility into the accounts receivable process.

Frequently Asked Questions

Related Documents

Do you have a question about an Invoice Template?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!