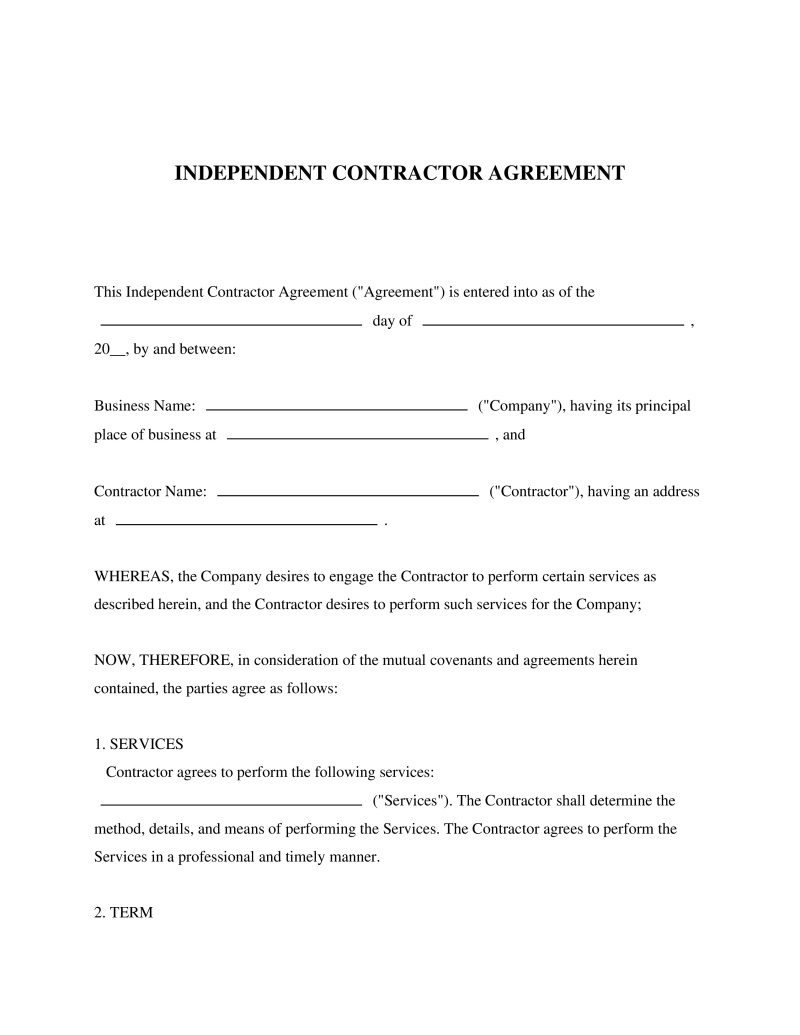

An Independent Contractor Agreement is a legal document that outlines the terms of work between a business and a contractor, clarifying responsibilities, payment, and scope to ensure clear expectations and protect both parties.

Contractor Name

Please provide your legal full name.

Table of Contents

What is an Independent Contractor Agreement?

An Independent Contractor Agreement is a legally binding document that outlines the relationship between a client and an independent contractor, rather than an employer-employee relationship. It specifies the services to be provided, terms of compensation, duration of the contract, and other essential conditions. This document is crucial for both parties to ensure clarity on expectations and responsibilities, thereby minimizing potential disputes. Individuals or businesses looking to hire independent contractors for specific tasks or projects need this agreement to delineate the scope of work and payment arrangements clearly. Conversely, contractors require it to protect their rights as self-employed individuals, ensuring they are not mistakenly classified as employees and are aware of their obligations, especially regarding independent contractor taxes.

Key Features

Important Provisions

- Scope of Work: Describes in detail the services that will be provided by the independent contractor.

- Compensation and Payment Terms: Specifies how much and when the contractor will be paid for their services.

- Confidentiality Agreement: Protects any proprietary information or trade secrets disclosed during the course of work from being shared with third parties.

- Termination Clauses: Details how either party can terminate the agreement before completion of the project under specified conditions.

Pros and Cons

Pros

- +Helps in clearly establishing an individual's status as an independent contractor vs employee, which has significant legal and tax implications.

- +Protects both parties' interests by detailing rights and obligations, reducing chances of misunderstandings.

- +Facilitates compliance with IRS guidelines for what is a 1099 employee, aiding in proper tax reporting and payment.

- +Increases professionalism by providing a written contract that outlines the business relationship.

- +Allows for flexibility in defining terms that suit both parties' needs without adhering to employment law restrictions.

Cons

- -May require negotiations that could delay project start dates until both parties reach an agreement.

- -Could potentially overlook specific legal requirements or protections if not drafted carefully or reviewed by a legal professional.

- -Requires understanding of complex terms related to 1099 vs W2 classifications and independent contractor taxes.

Common Uses

- Hiring freelance professionals for short-term projects without intending to provide employee benefits or withhold taxes.

- Engaging experts in fields such as IT consulting, marketing services, or creative endeavors on a project basis.

- Outsourcing specific tasks to specialists while maintaining organizational flexibility.

- Establishing agreements with consultants who provide advisory services across various industries.

- Working with sales representatives who operate on a commission-only basis without being formal employees.

- Collaborating with construction contractors for specific phases or aspects of building projects.

Frequently Asked Questions

Do you have a question about an Independent Contractor Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!