A Debt Settlement Agreement is a legal contract between a debtor and creditor to reduce the total amount owed, outlining repayment terms.

Debtor Name

Enter the full legal name of the individual or business owing the debt.

Table of Contents

What is a Debt Settlement Agreement?

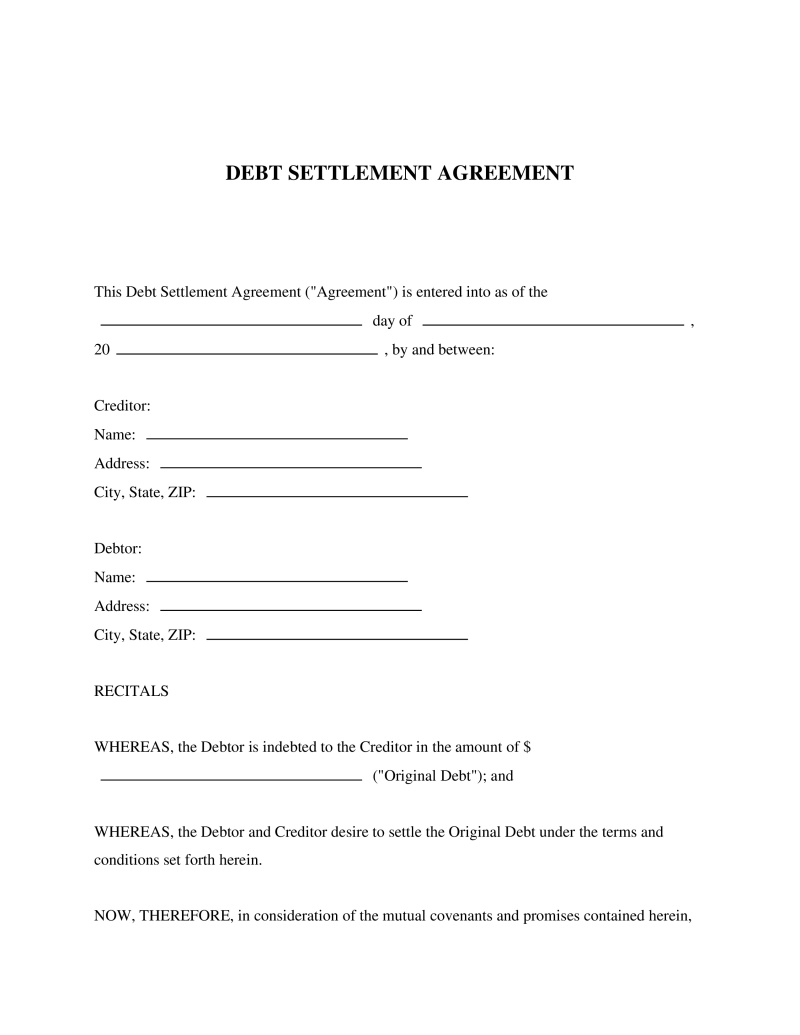

A Debt Settlement Agreement is a legally binding document that outlines the terms under which a debtor agrees to pay off a portion of the outstanding debt to the creditor, in lieu of paying the full amount owed. This document is particularly useful for individuals or businesses seeking to negotiate credit card debt or looking to resolve debts in collections. By entering into such an agreement, both parties can avoid the potential complications and costs associated with more aggressive collection tactics or legal actions. It serves as a negotiated compromise, where the creditor agrees to accept a lesser amount than is owed, and the debtor gains the opportunity to clear their debt under more manageable terms. This arrangement can be pivotal for those wondering how they can pay a collection agency or manage overwhelming credit card obligations.

Key Features

Important Provisions

- Debt Amount and Settlement Terms: Details including the original amount owed and the agreed-upon settlement figure.

- Payment Schedule: A clear outline of payment dates, amounts, and methods acceptable for settling the agreed-upon amount.

- Release Clause: A provision that absolves the debtor of further liability upon completion of agreed payments.

- Confidentiality Clause: Ensures both parties keep terms and conditions of agreement private.

Pros and Cons

Pros

- +Enables individuals to potentially reduce their overall debt burden through negotiation.

- +Provides a structured plan for how to pay off collections or negotiate credit card debt efficiently.

- +Helps avoid more drastic financial consequences like bankruptcy or continued accumulation of interest.

- +Can lead to improved credit scores over time once debts are settled and payments are made as agreed.

- +Offers legal protection against future claims for the settled debt once the agreement is fully executed.

Cons

- -Not all creditors may agree to enter into a Debt Settlement Agreement, limiting its applicability.

- -May require upfront payment of a significant portion of the debt, which could be challenging for some debtors.

- -Settling a debt for less than what was originally owed could potentially have tax implications for the debtor.

Common Uses

- Negotiating lower payoff amounts for outstanding credit card balances.

- Resolving debts that have been sold to collection agencies.

- Settling medical bills that cannot be fully paid due to financial hardship.

- Addressing multiple debts by consolidating them into a single, manageable payment plan.

- Avoiding litigation related to unpaid debts by reaching an out-of-court settlement.

Frequently Asked Questions

Do you have a question about a Debt Settlement Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!