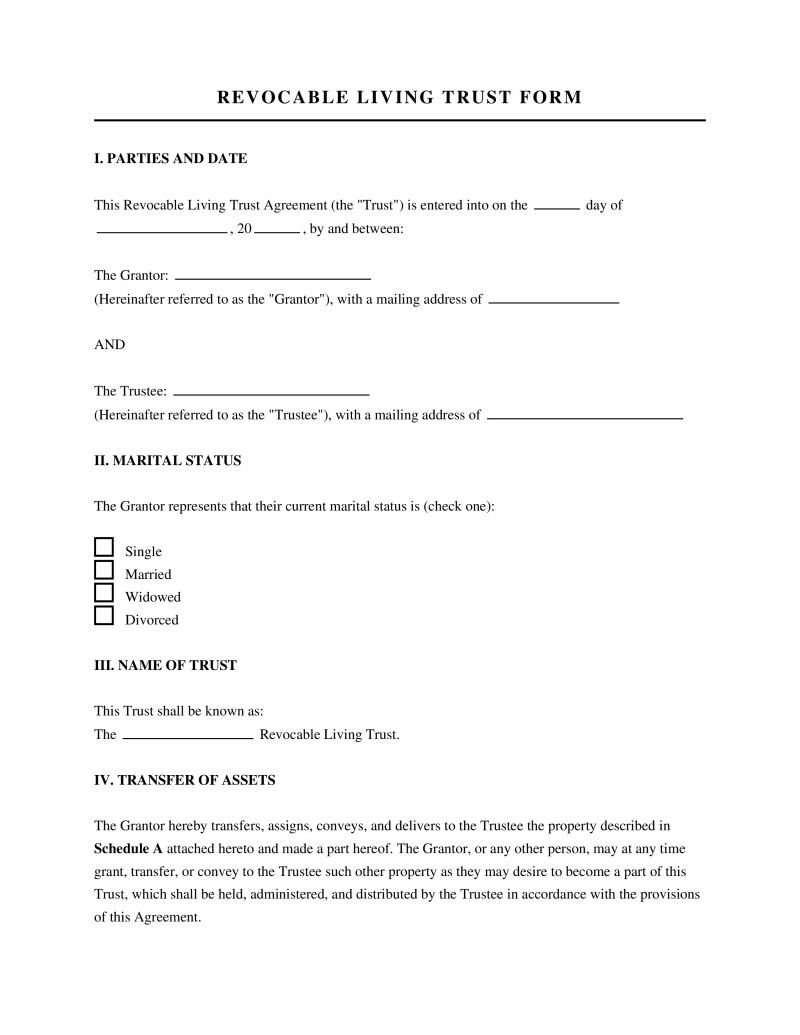

Revocable Living Trust Form

A revocable living trust form establishes a trust that can be altered or revoked during the grantor's lifetime, facilitating asset management.

Trust Type

Select whether this trust is for an individual or a married couple. Joint trusts are common for married couples.

Table of Contents

What is a Revocable Living Trust Form?

A Revocable Living Trust Form is a legal instrument used to create a fiduciary arrangement where a designated trustee manages assets for the benefit of specific beneficiaries. This document allows the individual creating the trust, known as the grantor, to transfer ownership of assets into the trust entity while retaining control and the ability to alter, amend, or dissolve the agreement during their lifetime. Individuals utilize this estate planning tool primarily to bypass probate proceedings, ensure privacy regarding asset distribution, and provide specific instructions for asset management in the event of incapacitation or death.

Key Parties and Roles

The execution and administration of a revocable living trust involve specific roles that define the legal relationship between the parties and the assets.

- Grantor - The individual who establishes the trust and transfers their assets into it, often serving as the initial trustee to maintain control.

- Trustee - The person or entity appointed to hold legal title to the trust property and administer it according to the terms of the trust document.

- Successor Trustee - An individual designated to assume management responsibilities if the original trustee resigns, becomes incapacitated, or passes away.

- Beneficiary - The person or entity entitled to receive the income, principal, or other benefits generated by the trust assets.

Types of Trust Structures

Estate planning strategies utilize various configurations of trust documents to address specific ownership situations and beneficiary needs.

- Individual Revocable Trust - Established by a single person to manage their separate property and assets during their lifetime and distribute them upon death.

- Joint Revocable Trust - Created by a married couple to handle shared assets within a single document, often simplifying administration for community property.

- Testamentary Trust - Established through a will and only becomes active upon the death of the testator, distinct from a living trust which functions immediately.

- AB Trust - A joint trust arrangement that splits into two separate trusts upon the death of the first spouse to maximize estate tax exemptions.

Legal Framework and Statutory Requirements

The validity, administration, and taxation of revocable living trusts rely on adherence to federal and state regulations.

- Uniform Trust Code - Provides a standardized set of rules for creating, modifying, and terminating trusts adopted by many jurisdictions (UTC § 101 et seq.).

- Grantor Trust Rules - Defines tax implications where the grantor retains control, causing income to be taxed on the grantor's personal return (26 U.S.C. §§ 671-679).

- Capacity Requirements - Mandates that the grantor must be of sound mind and legal age at the time of trust creation (UTC § 402).

- Statute of Frauds - Requires trusts involving real property to be evidenced by a written instrument to be enforceable (varies by state statute).

- Rule Against Perpetuities - Limits the duration a trust can exist to prevent property from being tied up indefinitely (common law doctrine modified by many states).

Process for Funding a Revocable Living Trust

The creation of the trust document serves only as the first step; the grantor must transfer assets into the trust for the instrument to be effective.

Step 1: Real Estate Transfer - Execute a new deed, such as a quitclaim or warranty deed, transferring title from the individual's name to the trust.

Step 2: Financial Accounts Updates - Contact banks and brokerage firms to retitle accounts or designate the trust as the pay-on-death beneficiary.

Step 3: Business Interest Assignment - Transfer stock certificates, LLC membership units, or partnership interests into the name of the trust.

Step 4: Personal Property Assignment - Create a general assignment of property document to cover tangible items like furniture, jewelry, and art.

Revocable Living Trust vs. Will

Estate planning often involves choosing between or combining a trust and a traditional will, as each serves distinct functions regarding probate and asset control.

- Probate Avoidance - Assets held in a trust generally bypass the court-supervised probate process, allowing for faster distribution to beneficiaries.

- Privacy Levels - Trust documents remain private contracts and do not become public record, unlike wills which enter the public domain upon probate.

- Incapacity Management - Trusts allow a successor trustee to manage assets immediately if the grantor becomes incapacitated, offering protection without court intervention.

- Effective Timeline - A living trust takes effect immediately upon signature and funding, while a will only becomes legally operative upon the death of the testator.

Required Elements of a Valid Trust Document

State laws dictate specific components that must be present for a revocable living trust form to be legally binding.

- Intent to Create Trust - The language must clearly demonstrate the grantor's intention to establish a trust relationship.

- Identifiable Property - The document must specify the assets or property, known as the trust corpus, being transferred into the trust.

- Definite Beneficiaries - The agreement must name specific individuals or entities who will benefit from the trust assets to ensure enforceability.

- Valid Purpose - The objectives of the trust must be lawful and not contrary to public policy.

FAQs

Not the form you're looking for?

Try our legal document generator to create a custom document

Ask about a Revocable Living Trust Form

Example questions: