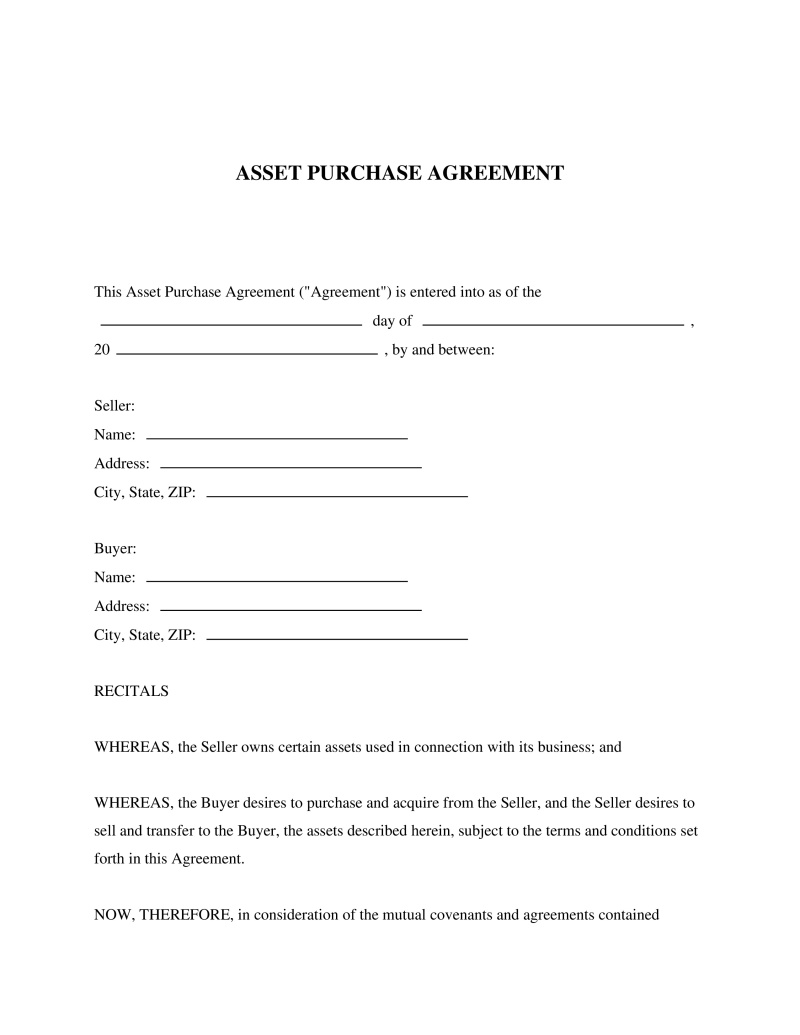

An Asset Purchase Agreement outlines the terms for the sale of specific assets from one party to another, defining rights and obligations.

Buyer Name

Write the full legal name of the Buyer, including first name, middle initial (if any), and last name. For example, "John A. Smith." This name will be used in the contract, so it must match the Buyer’s official identification to avoid any legal issues later.

Table of Contents

What is an Asset Purchase Agreement?

An Asset Purchase Agreement is a legally binding document that outlines the terms and conditions under which one party agrees to purchase assets from another. Unlike a stock purchase, where entire ownership stakes in a business are transferred, an asset purchase focuses on acquiring specific assets, which could include tangible assets like equipment and inventory or intangible assets such as intellectual property and customer lists. This type of agreement is crucial for individuals or entities looking to acquire or sell parts of a business, as it provides a detailed framework that specifies what is being bought or sold, the purchase price, and other essential terms of the transaction. It offers flexibility in selecting specific assets and liabilities, making it a preferred choice for many businesses aiming to streamline their operations or expand into new areas without assuming the entirety of another entity's obligations.

Key Features

Important Provisions

- Description of Assets: A comprehensive list detailing all tangible and intangible assets being acquired.

- Purchase Price and Payment Terms: Specifies how much will be paid for the assets and the method of payment.

- Representations and Warranties: Statements made by both buyer and seller regarding the condition and legal status of the business assets.

- Covenants: Agreements on actions that both parties agree to undertake before and after the transaction.

Pros and Cons

Pros

- +Allows for targeted acquisition of assets, enabling buyers to specifically choose what they want to acquire.

- +Mitigates certain risks associated with buying an entire company, such as inheriting unknown liabilities.

- +Can offer tax advantages in some jurisdictions by allowing the buyer to step up the basis of acquired assets.

- +Provides flexibility in structuring transactions to meet specific needs of both buyers and sellers.

- +Facilitates smoother transitions with potentially less regulatory approval compared to stock purchases.

Cons

- -May require more due diligence compared to stock purchases to identify all relevant assets and liabilities accurately.

- -Could involve complex negotiations over which assets and liabilities are included in the sale.

- -Possibility of third-party consents being required for the transfer of certain contracts or licenses.

Common Uses

- Acquiring specific assets from another company, such as equipment or intellectual property.

- Selling off parts of a business that are no longer considered core operations.

- Restructuring a company by divesting non-essential assets for strategic or financial reasons.

- Expanding into new markets by purchasing customer lists or distribution rights from another entity.

- Transitioning ownership of certain business segments while retaining control over others.

Frequently Asked Questions

Do you have a question about an Asset Purchase Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!