A direct deposit form is a document that authorizes an organization to electronically transfer funds directly into an individual's bank account.

Employee Name

Write your full name as it appears on your official documents, including your first name, middle name (if any), and last name. For example, "John Michael Smith." This information is important for legal identification and will be used in any official correspondence or documentation related to your employment.

Table of Contents

What is a Direct Deposit Form?

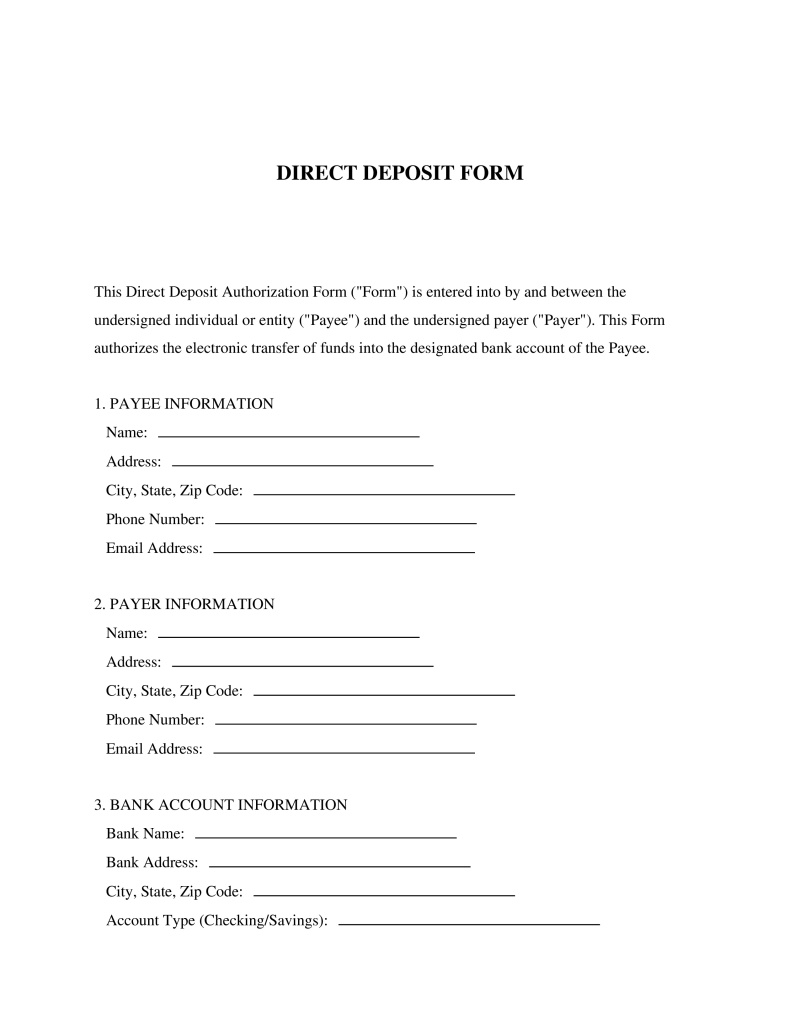

A Direct Deposit Form is a legal document used by individuals to authorize the transfer of funds electronically from one bank account to another, often from an employer to an employee's account. This form is crucial for ensuring that payments, including salaries, pensions, or government benefits such as the SSA $3200 direct deposit payment for 2025, are made securely and efficiently. It requires the account holder's bank information, consent for depositing funds, and sometimes further identification details. Individuals needing to receive their payments without delay or inconvenience find this document indispensable. Moreover, organizations benefit from streamlined payroll processes and reduced handling of physical checks.

Key Features

Important Provisions

- Authorization clause allowing the payer to deposit funds into the designated account.

- Account holder's banking information, including bank name, routing number, and account number.

- Terms and conditions outlining the responsibilities of both parties and procedures for resolving disputes.

- Privacy policy detailing how personal and financial information will be protected.

Pros and Cons

Pros

- +Significantly reduces the risk of lost or stolen checks.

- +Ensures faster access to funds as compared to traditional check deposits.

- +Simplifies the payroll process for employers and streamlines financial management for individuals.

- +Minimizes processing fees and other expenses related to paper checks.

- +Provides a reliable method of payment that is both convenient and environmentally friendly.

Cons

- -Requires sharing sensitive banking information, which must be protected to prevent unauthorized access.

- -May not be available for use with all financial institutions or in every geographical location.

- -Potential errors in banking details can lead to delays in receiving payments.

Common Uses

- For employees opting to receive their salary through direct deposit instead of a physical paycheck.

- When setting up automatic deposits for government benefits, including the anticipated SSA $3200 direct deposit payment in 2025.

- To receive tax refunds directly into a bank account without waiting for a mailed check.

- For freelancers or contractors preferring electronic payments from clients.

- In arranging automatic deposits into savings or investment accounts regularly.

- By retirees ensuring their pension or social security benefits are deposited promptly.

Frequently Asked Questions

Do you have a question about a Direct Deposit Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!