A payment receipt is a document acknowledging that payment has been received for goods or services, serving as proof for both buyer and seller.

Payer Name

Enter the full legal name of the individual or business making the payment.

Table of Contents

What is a Payment Receipt?

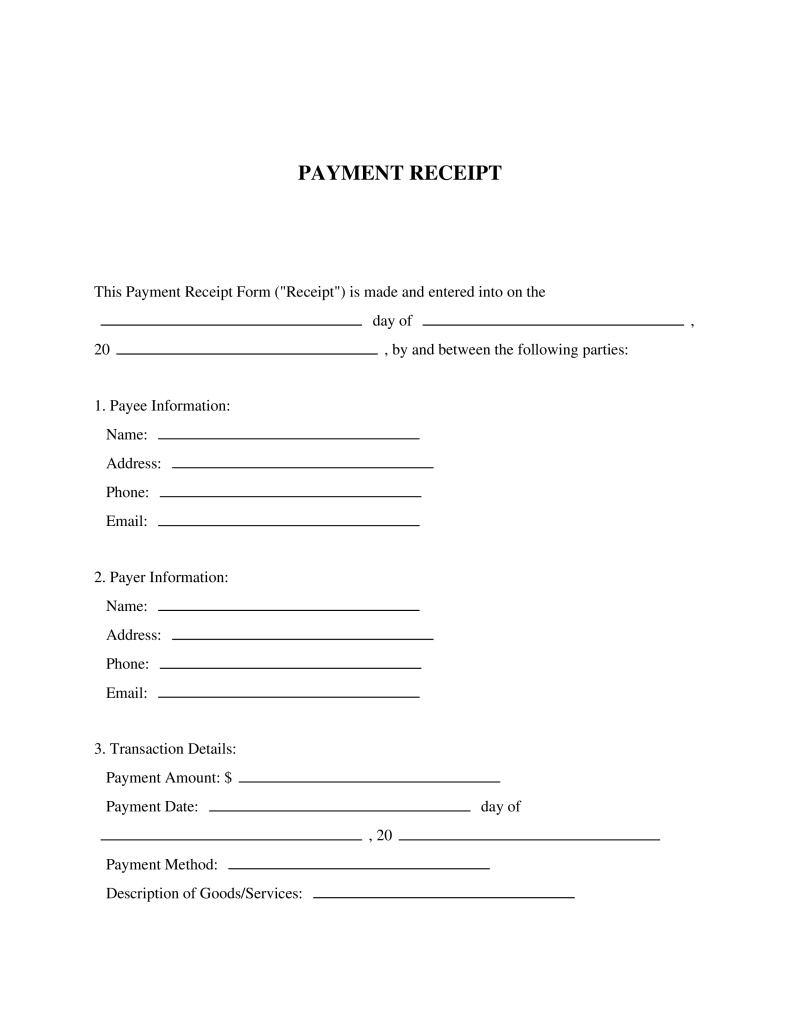

A Payment Receipt is a document that acknowledges the receipt of payment for goods or services rendered. It serves as proof that a transaction occurred between two parties, often detailing the amount paid, the date of payment, and the method of payment. Essential for both businesses and customers, this document provides a record that can be used for financial tracking, tax purposes, and resolving any disputes over payments. Individuals or entities involved in any form of transaction, whether it be retail, freelance services, or contractual agreements, will find this document indispensable for maintaining transparent and accurate financial records.

Key Features

Important Provisions

- Payment Information: Specifies amount paid, currency, method of payment (cash, check, credit), and date of payment.

- Goods or Services Description: Details what was paid for, including quantities, prices per unit, if applicable, and total cost.

- Payer and Payee Information: Identifies both parties involved in the transaction with contact information where necessary.

- Signature or Authorization: Includes space for signatures or electronic authorization from the payee as proof of receipt.

Pros and Cons

Pros

- +Enhances the professionalism of financial transactions with an official acknowledgment.

- +Reduces potential conflicts by providing clear evidence of payments made and received.

- +Improves financial management through meticulous record-keeping and tracking.

- +Supports compliance with tax laws by documenting income accurately.

- +Strengthens customer trust by offering tangible proof of purchase and payment.

Cons

- -May require customization to fully meet the specific needs of complex transactions or unique business models.

- -The effectiveness is contingent on accurate completion and timely issuance after a transaction.

- -Digital receipts may necessitate additional measures to ensure authenticity and prevent fraud.

Common Uses

- Recording retail sales transactions to provide customers with proof of purchase.

- Acknowledging payment for freelance or contractual services rendered.

- Documenting rent payments received by landlords from tenants.

- Confirming donation amounts for non-profit organizations and charities.

- Validating partial payments toward larger debts or installment plans.

- Providing proof of final payment upon completion of service contracts.

Frequently Asked Questions

Do you have a question about a Payment Receipt?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!