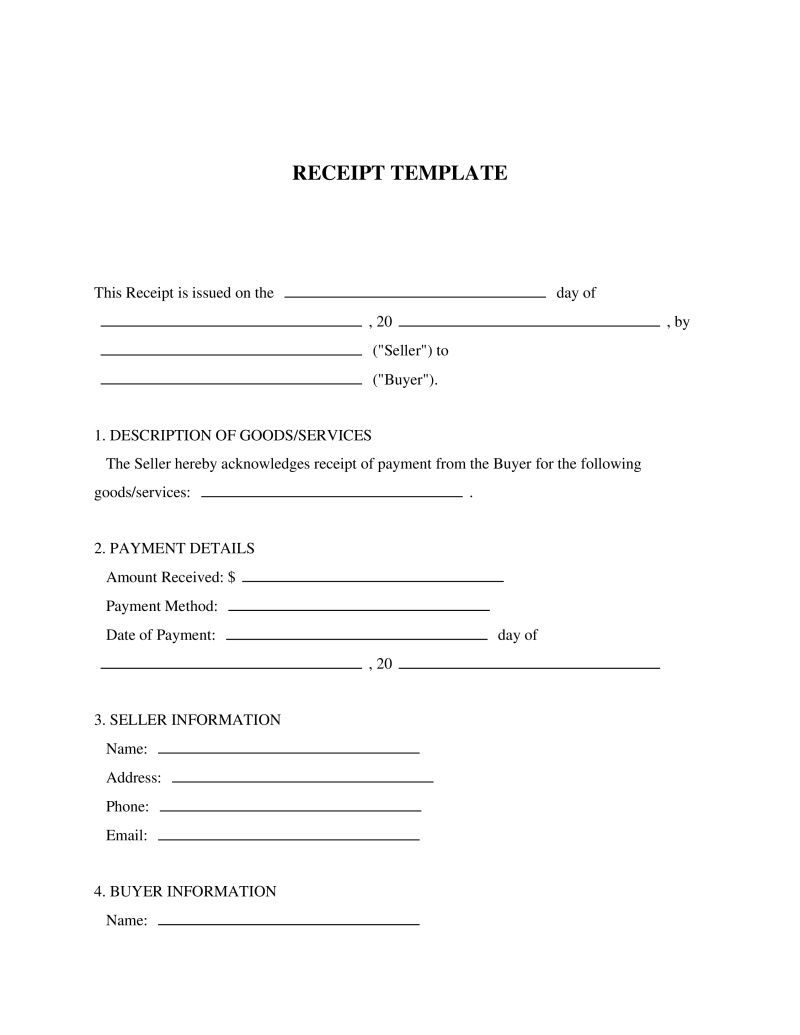

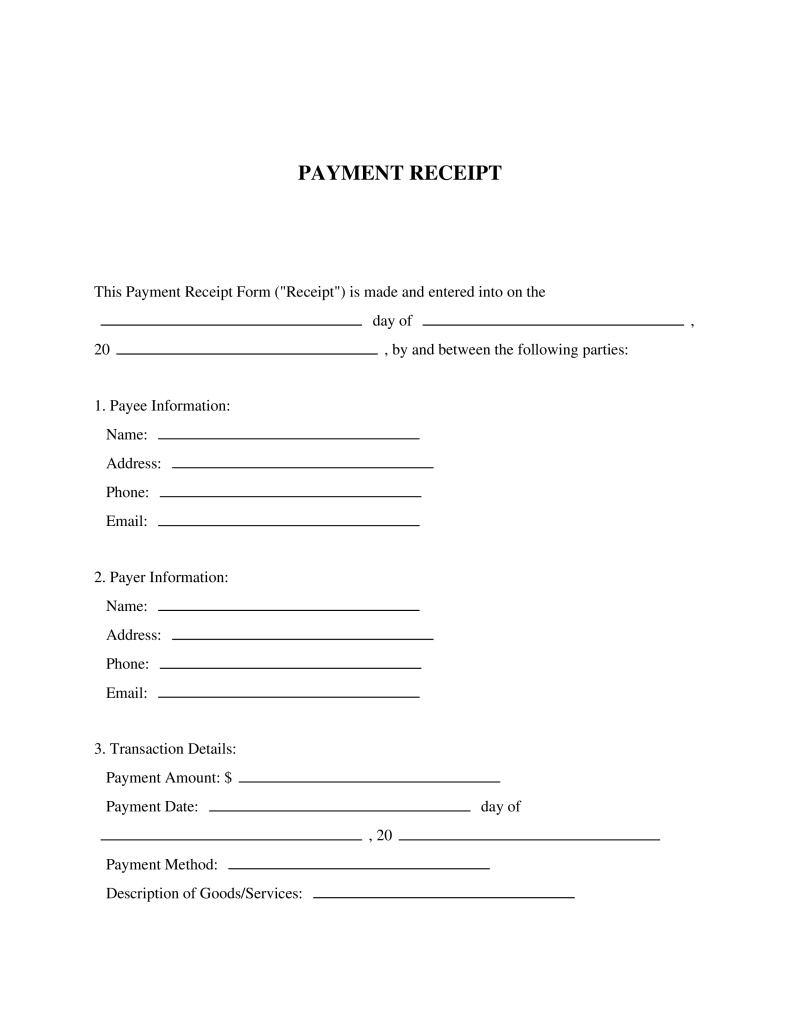

A receipt template provides a standardized format for recording transactions, ensuring clarity and proof of purchase for both buyers and sellers.

Transaction Date

Provide the date when the transaction was completed. Use the format MM/DD/YYYY (for example, 01/15/2023 for January 15, 2023). This date is important for legal records and may affect deadlines for any claims or disputes related to the transaction.

Table of Contents

What is a Receipt Template?

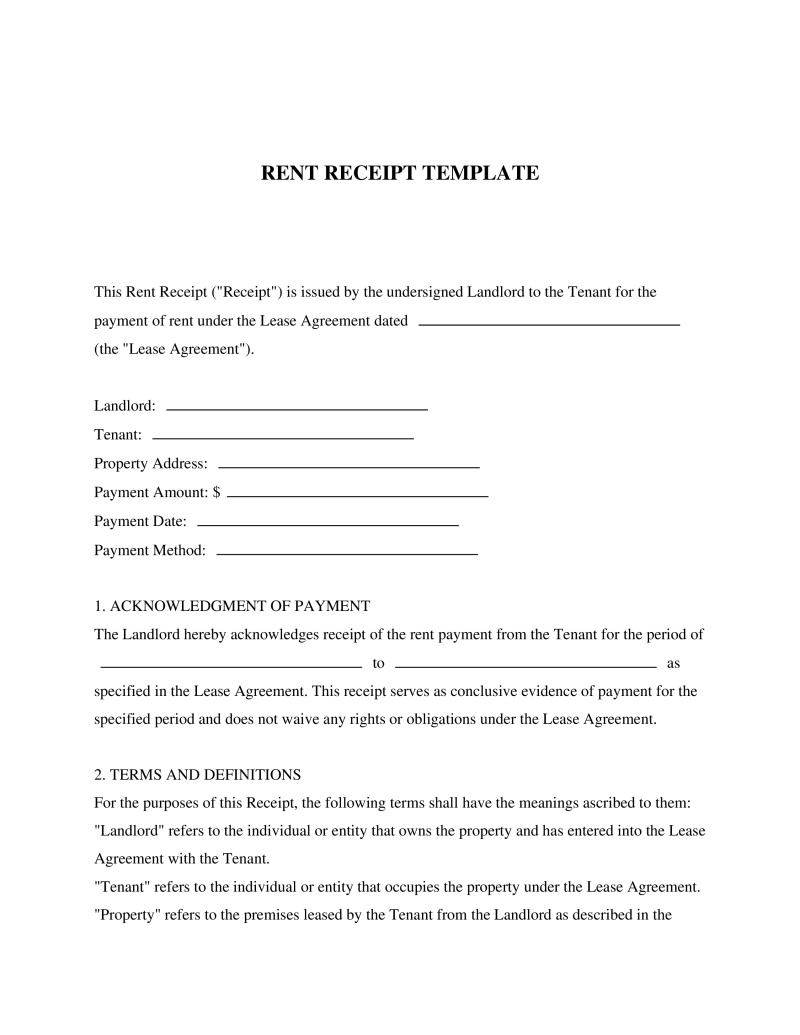

A Receipt Template serves as a versatile document, pivotal for both the issuer and the recipient in documenting transactions of various kinds. It acts as proof of payment or delivery, detailing the specifics of a transaction, including but not limited to the date, amount paid, mode of payment, and a description of the transaction. This document is indispensable for businesses of all sizes, freelancers, and service providers who require a straightforward method to acknowledge payments received from clients or customers. The utility of such a template lies in its adaptability across numerous transactional contexts, safeguarding the interests of both parties by providing a verifiable record that can be essential for accounting purposes, dispute resolution, or tax filings.

Key Features

Important Provisions

- Complete identification details of both the payor and payee including names and contact information.

- Detailed description of the transaction including quantity, price per unit if applicable, and total amount paid.

- Payment method used (e.g., cash, credit card, bank transfer) along with any relevant details (e.g., last four digits of credit card).

- Date of payment and signature lines for both parties involved in the transaction.

Pros and Cons

Pros

- +Facilitates accurate record-keeping and simplifies accounting processes by providing standardized documentation.

- +Enhances trust between parties by offering tangible proof of transactions completed.

- +Reduces potential disputes over payments with clear, agreed-upon terms and conditions laid out in writing.

- +Versatility makes it suitable for a wide range of industries and transaction types.

- +Availability as a free template reduces overhead costs associated with document creation and management.

Cons

- -Generic nature might require customization to meet specific legal requirements or industry standards.

- -Reliance on honesty and accuracy from both parties in reporting transaction details.

- -Potential need for legal review to ensure compliance with local laws and regulations.

Common Uses

- Sales transactions between businesses and customers for goods sold or services rendered.

- Acknowledgment of cash payments where digital records are not feasible or preferred.

- Rental payments receipting for properties or equipment.

- Donations received by non-profit organizations or charities.

- Freelance services payment acknowledgment across various sectors such as writing, design, or consulting.

- Deposits for bookings or reservations in hospitality or service industries.

Frequently Asked Questions

Related Documents

Do you have a question about a Receipt Template (General)?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!