A Texas Power of Attorney is a statutory instrument granting an appointed agent authority to act on behalf of a principal regarding property or healthcare.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a Texas Power of Attorney Form?

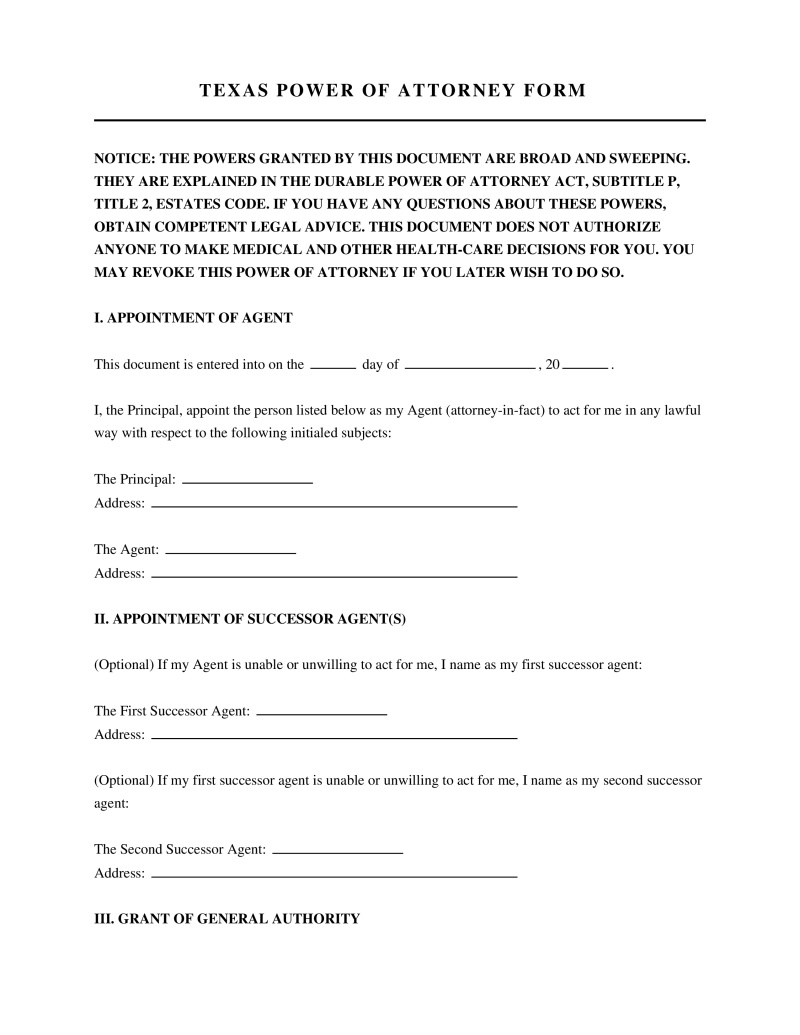

A Texas Power of Attorney Form is a legal instrument that authorizes a designated individual, known as the agent or attorney-in-fact, to act on behalf of another person, referred to as the principal. This document grants specific legal authority to manage financial affairs, real estate transactions, business operations, or healthcare decisions depending on the scope defined within the agreement. Residents of Texas utilize this instrument to ensure continuity of asset management during periods of absence or incapacity. The document functions under strict statutory guidelines provided by the Texas Estates Code to ensure the protection of the principal's interests.

Types of Texas Power of Attorney Form

Texas law recognizes several distinct categories of power of attorney documents, each serving a specific purpose and duration:

- Statutory Durable Power of Attorney - Grants the agent authority to handle financial and property matters that remains effective even if the principal becomes mentally incapacitated.

- Medical Power of Attorney - Authorizes an agent to make healthcare decisions for the principal strictly when the principal is unable to make those decisions personally.

- General Power of Attorney - Confers broad powers to the agent for financial and legal matters but typically terminates upon the incapacity or disability of the principal.

- Limited Power of Attorney - Restricts the agent's authority to specific actions or a defined period, such as signing closing documents for a real estate transaction.

- Springing Power of Attorney - Becomes effective only upon the occurrence of a specified event, usually the certified incapacity of the principal.

Legal Requirements for Validity

To establish a legally binding power of attorney in Texas, specific formalities must be met during the execution process:

- Mental Capacity - The principal must be of sound mind and fully understand the nature and consequences of the document at the time of signing.

- Age Requirement - The principal must be at least 18 years of age or legally emancipated.

- Notarization - Texas law requires the document to be signed before a notary public to be legally valid (Texas Estates Code § 751.0021).

- Written Format - The agreement must be in writing and clearly identify the principal and the agent.

- Disclosure Statement - Statutory forms generally require a specific notice to the principal regarding the powers granted and the duties imposed on the agent.

Relevant Texas and Federal Laws

The creation, execution, and enforcement of power of attorney documents in Texas are governed by specific state statutes and federal regulations:

- Texas Durable Power of Attorney Act - Governs the creation, validity, and scope of financial powers of attorney, including the statutory form (Texas Estates Code § 751.001 et seq.).

- Medical Power of Attorney Act - Establishes the requirements for designating a healthcare agent and the scope of their decision-making authority (Texas Health and Safety Code § 166.151 et seq.).

- HIPAA Authorization Requirements - Mandates that healthcare providers receive written authorization before disclosing protected health information to an agent (45 CFR § 164.508).

- Real Property Records Recording - Requires the recording of the power of attorney in the county clerk's office for transactions involving real estate (Texas Property Code § 11.001).

- Uniform Power of Attorney Act - Influences state laws regarding the uniformity of powers and duties across different jurisdictions (adopted in part by Texas).

Agent Duties and Fiduciary Responsibilities

An individual appointed as an agent assumes a fiduciary role, meaning they are legally obligated to act in the best interest of the principal. This relationship imposes strict duties that prohibit self-dealing or the mismanagement of assets. The agent must maintain accurate records of all transactions made on behalf of the principal, including receipts, disbursements, and significant decisions. Texas law mandates that the agent act in good faith and within the scope of authority granted by the document. Failure to adhere to these standards can result in civil liability and the revocation of the power of attorney.

How to Execute a Texas Power of Attorney Form

- Step 1: Select a Trusted Agent - Choose a reliable individual, such as a spouse, adult child, or close friend, who understands the responsibilities involved.

- Step 2: Determine the Scope of Authority - Decide whether the agent will have broad general powers or limited authority for specific tasks.

- Step 3: Draft the Document - Utilize the Texas Statutory Durable Power of Attorney form or a custom document drafted by an attorney to ensure compliance with state laws.

- Step 4: Sign Before a Notary Public - Execute the document in the presence of a notary public to satisfy the legal acknowledgment requirement.

- Step 5: Distribute Copies - Provide copies of the signed document to the agent, financial institutions, and relevant medical providers.

Revocation of Power of Attorney

A principal retains the right to revoke a power of attorney at any time, provided they maintain the mental capacity to do so. Revocation must be done in writing to ensure clarity and prevent unauthorized actions by the former agent. The principal should deliver a notice of revocation to the agent and any third parties, such as banks or hospitals, that have the original document on file. Recording a revocation in the county property records is necessary if the original power of attorney was recorded for real estate purposes. Certain events, such as the divorce of the principal and agent, automatically revoke the agent's authority under Texas law unless the document states otherwise.

Frequently Asked Questions

Do you have a question about a Texas Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!