A Tennessee Power of Attorney form is a legal instrument designating an agent to manage financial or medical affairs on behalf of a principal within the state.

Poa Type

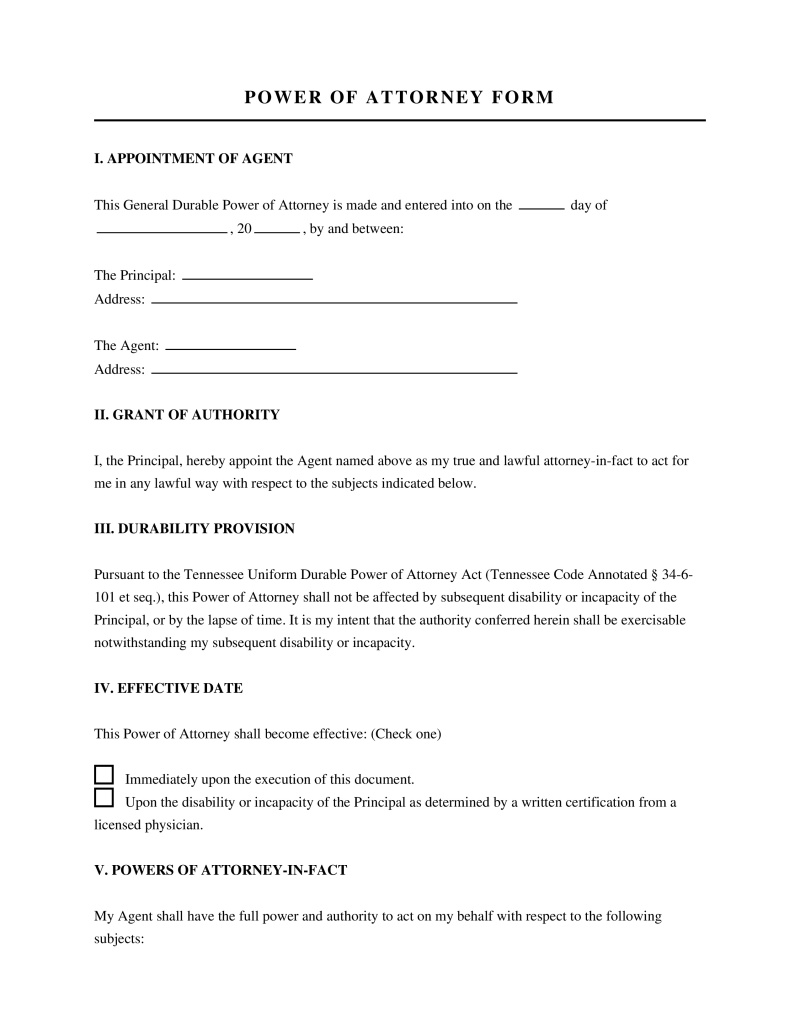

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a Tennessee Power of Attorney Form?

A Tennessee Power of Attorney Form is a legal instrument that authorizes a designated individual to act on behalf of another person regarding specific financial, legal, or medical matters. The person granting authority, known as the principal, appoints an agent or attorney-in-fact to execute decisions and manage affairs according to the terms outlined in the document. Residents of Tennessee utilize this document to ensure their interests remain protected during periods of absence, illness, or incapacitation, allowing for seamless management of assets and healthcare choices without court intervention.

Types of Tennessee Power of Attorney Form

Tennessee law recognizes various forms of delegated authority, each designed to address specific needs and scopes of power. The duration and extent of the agent's authority depend entirely on the specific classification of the document chosen by the principal.

- General Power of Attorney - Grants the agent broad authority to handle financial and legal affairs, such as banking transactions and contract signing, but typically terminates if the principal becomes incapacitated.

- Durable Power of Attorney - Includes specific language stating that the agent's authority remains effective or becomes effective even if the principal becomes mentally incompetent or incapacitated.

- Limited Power of Attorney - Restricts the agent's authority to specific actions or a defined time period, such as selling a specific piece of real estate or handling business while the principal is traveling.

- Medical Power of Attorney - Designates an agent to make healthcare decisions for the principal, including treatment options and end-of-life care, specifically when the principal cannot communicate their own wishes.

- Springing Power of Attorney - Becomes effective only upon the occurrence of a specific future event, typically the medical incapacitation of the principal as certified by a physician.

- Tax Power of Attorney (Form RV-F1311401) - Authorizes a representative to communicate with the Tennessee Department of Revenue regarding the principal's tax matters and filings.

Legal Requirements and Validity in Tennessee

To establish a legally binding power of attorney in Tennessee, specific statutory requirements must be met during the creation and execution of the document. Failure to adhere to these standards may result in the rejection of the document by financial institutions or medical facilities.

- Principal Capacity - The individual creating the document must be at least 18 years old and of sound mind at the time of signing.

- Agent Eligibility - The appointed attorney-in-fact must be a competent adult or a qualifying legal entity.

- Notarization for Financial Powers - Documents granting authority over property or financial matters generally require acknowledgment by a notary public to be presumed genuine.

- Witnessing for Health Care Powers - A Durable Power of Attorney for Health Care requires the signature of two competent witnesses or a notary public.

- Specific Language - Durable powers of attorney must contain statutory language indicating the intent for powers to survive the principal's disability.

Relevant Tennessee Laws and Statutes

The creation, execution, and interpretation of power of attorney documents in Tennessee are governed by specific chapters within the Tennessee Code Annotated. These statutes define the scope of authority and the duties owed by the agent to the principal.

- Uniform Power of Attorney Act - Governs the creation and use of powers of attorney for financial and property matters, outlining the duties and liabilities of the agent (Tenn. Code Ann. § 34-6-101 et seq.).

- Durable Power of Attorney for Health Care - Establishes the legal framework for appointing a healthcare agent and defines the scope of medical decision-making authority (Tenn. Code Ann. § 34-6-201 et seq.).

- HIPAA Authorization Standards - Federal regulations that interact with state laws to allow agents access to the principal's protected health information (45 CFR § 164.508).

- Revocation of Power of Attorney - details the methods by which a principal may terminate the authority of an agent, typically requiring a written instrument (Tenn. Code Ann. § 34-6-106).

How to Complete a Tennessee Power of Attorney Form

Creating a valid Tennessee Power of Attorney Form involves a structured process to ensure the document accurately reflects the principal's intentions and complies with state regulations. Following these steps helps prevent future legal challenges regarding the agent's authority.

Step 1: Select the Appropriate Type - Determine whether the situation requires a general, durable, limited, or medical power of attorney based on the desired scope and duration of authority.

Step 2: Choose a Trustworthy Agent - Identify a reliable individual, usually a spouse, family member, or close friend, who will act in the principal's best interest.

Step 3: Define Powers and Limitations - Clearly specify which actions the agent is permitted to take, such as managing bank accounts, selling real estate, or making medical decisions.

Step 4: Execute the Document - Sign the document in the presence of a notary public for financial powers, or before two witnesses or a notary for healthcare powers.

Step 5: Distribute Copies - Provide a copy of the executed form to the agent, financial institutions, medical providers, and any other relevant parties.

Revocation and Termination of Authority

A principal retains the right to revoke a power of attorney at any time, provided they maintain the mental capacity to do so. Tennessee law provides several mechanisms through which the authority of an agent ceases.

- Written Revocation - The principal executes a formal document stating that the previous power of attorney is revoked.

- Execution of a New Power of Attorney - Creating a new document that expressly revokes all prior powers of attorney typically supersedes older versions.

- Divorce or Annulment - If the spouse was named as the agent, the filing of an action for divorce or annulment generally terminates their authority automatically.

- Death of the Principal - All powers of attorney cease to be effective upon the death of the principal, at which point the executor of the estate assumes control.

Frequently Asked Questions

Do you have a question about a Tennessee Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!