An Artist Invoice Template is a commercial document issued by creative professionals to request payment for artwork, commissions, or design services.

Invoice Type

Select the main type of work being billed. This will customize the invoice fields for your project.

Table of Contents

What is a Artist Invoice Template?

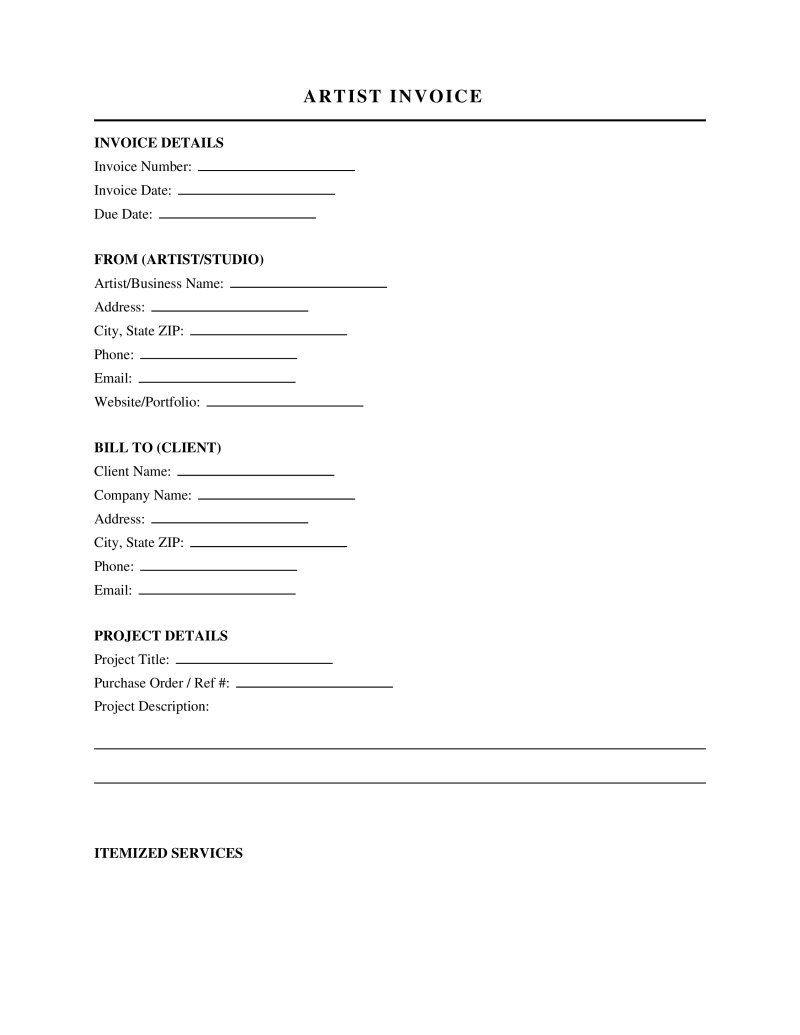

An Artist Invoice Template serves as a formal billing document issued by creative professionals to clients for services rendered, artwork commissions, or the sale of physical goods. This standardized form outlines the essential details of a transaction, including a description of the work, the agreed-upon price, payment due dates, and relevant tax information. Freelance artists, graphic designers, musicians, and galleries utilize this instrument to establish a clear financial record, facilitate timely payments, and maintain professional bookkeeping standards required for tax compliance.

Types of Artist Invoice Templates

Creative professionals utilize various invoicing formats depending on the nature of the project, the payment structure, and the stage of work completion. Specific formats cater to different industry standards and client agreements:

- Standard Invoice - Requests payment for completed work or delivered goods and represents the most common billing format used by freelancers.

- Pro Forma Invoice - Estimates the final cost of a project before work begins, serving as a preliminary bill that outlines the commitment without demanding immediate payment.

- Interim or Milestone Invoice - Breaks down a large project into smaller billing stages, allowing the artist to receive partial payments upon completing specific phases of the work.

- Recurring Invoice - Automates billing for ongoing services such as retainer agreements, subscription-based content, or long-term licensing deals.

- Timesheet Invoice - Calculates the total amount due based on hourly rates and the specific number of hours worked, often used by graphic designers or consultants.

Essential Elements of a Valid Invoice

A legally effective invoice must contain specific data points to serve as proof of the debt and facilitate accurate accounting. Missing information can lead to payment delays or disputes regarding the scope of work.

- Unique Invoice Number - Identifies the specific transaction for tracking and reference purposes, ensuring no duplicates exist in the artist's records.

- Date of Issue - Establishes the timeline for payment terms and aging of accounts receivable.

- Contact Information - Lists the full legal names, addresses, and contact details for both the artist (issuer) and the client (recipient).

- Itemized Description - Details the specific services performed or goods sold, including dimensions, medium, or project scope to avoid ambiguity.

- Payment Terms - Specifies the timeframe for payment, such as "Net 30" or "Due upon receipt," and outlines acceptable payment methods.

- Tax Information - Includes sales tax calculations where applicable or VAT registration numbers for international transactions.

How to Issue an Artist Invoice

Proper issuance procedures increase the likelihood of prompt payment and reduce administrative errors. Following a systematic approach ensures consistency:

- Step 1: Verify Project Completion - Confirm that all deliverables meet the client's specifications and that the work has been accepted.

- Step 2: Calculate Costs - Aggregate all billable hours, flat fees, and reimbursable expenses such as materials or travel costs.

- Step 3: Draft the Document - Input the data into the template, ensuring the invoice number follows a sequential order.

- Step 4: Review Terms - Double-check that the payment due date and methods align with the initial agreement or contract.

- Step 5: Send to Client - Transmit the invoice via the agreed method, typically email or a dedicated invoicing platform, and retain a copy for tax records.

Tax Implications for Artists

Invoices serve as the primary documentation for an artist's gross income. The Internal Revenue Service (IRS) requires independent contractors to report all income earned. Accurate invoicing distinguishes a professional art practice from a hobby, which affects the deductibility of expenses. Key tax considerations include:

- Sales Tax Collection - Artists selling physical goods in states with sales tax must collect and remit these funds to the state revenue department (State statutes vary).

- Form 1099-NEC - Clients paying an artist $600 or more in a tax year for services must report this income to the IRS, and the artist's invoices serve as the basis for this reporting (26 C.F.R. § 1.6041-1).

- Expense Substantiation - Invoices from suppliers for art materials serve as proof of business expenses, offsetting taxable income.

FAQs

Do you have a question about an Artist Invoice Template?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!