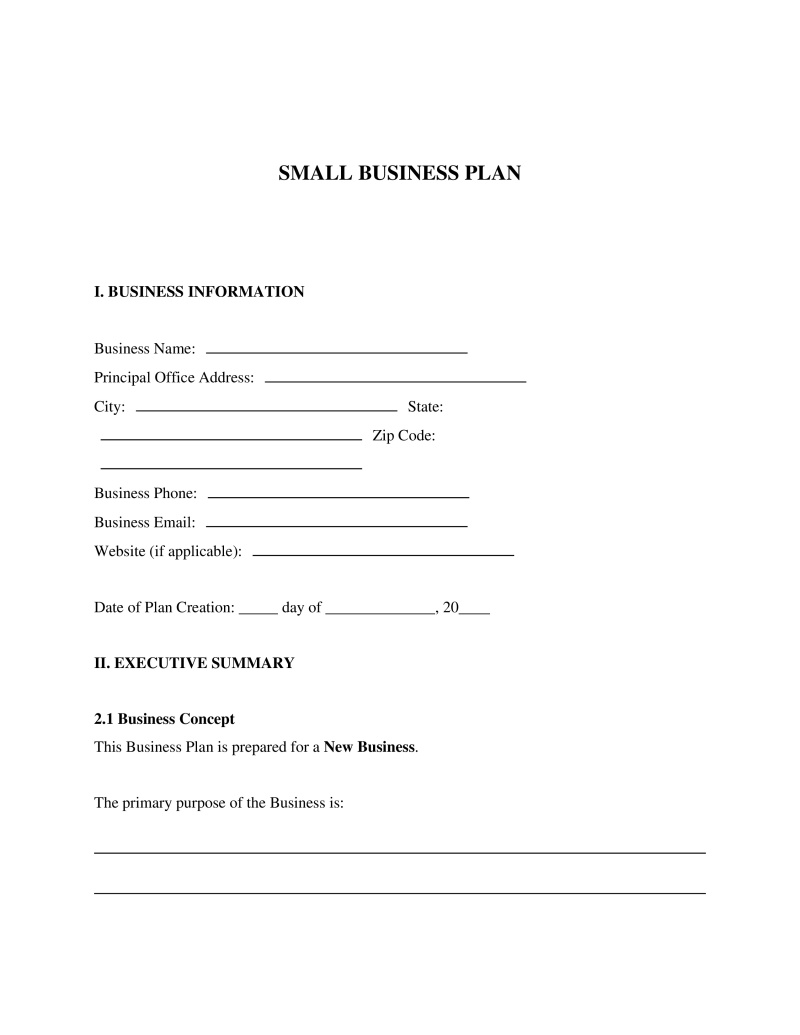

A Small Business Plan is a legal document that outlines the operational and financial objectives of a small business.

New/Existing

Select whether you are starting a new business or planning for an existing one.

Table of Contents

What is a Small Business Plan?

A Small Business Plan is a foundational document that outlines the objectives, strategies, and financial forecasts of a small business. It serves as a roadmap for the business's growth and operations, detailing how resources will be allocated and what measures will be taken to achieve specific goals. This document is crucial for entrepreneurs and small business owners seeking to establish a clear path forward, secure financing, or attract investors. Additionally, it can be instrumental in managing the company more effectively by providing a structured approach to decision-making and strategy implementation.

Key Features

Important Provisions

- Confidentiality clause to protect sensitive business information discussed within the plan.

- Non-compete agreements for key employees mentioned in the organizational structure section.

- Intellectual property rights protection, particularly if the business model involves unique products or services.

- Legal compliance statements ensuring that proposed operations meet local, state, and federal regulations.

Pros and Cons

Pros

- +Facilitates clearer strategic planning and goal setting for small business owners.

- +Enhances the ability to secure financing or investment by providing detailed business insights.

- +Helps in identifying potential challenges and opportunities within the market early on.

- +Assists in tracking progress and making informed adjustments to strategies as needed.

- +Can support efforts in attracting top talent by outlining growth prospects and stability.

Cons

- -Requires significant time investment to research and compile accurately.

- -May need regular updates to remain relevant as the business environment changes.

- -Potential risk of over-reliance on projections that could lead to misguided decision-making.

Common Uses

- Seeking initial startup funding from banks or investors.

- Defining clear objectives and strategies for new or pivoting businesses.

- Evaluating new market opportunities or expansions.

- Planning for long-term growth and scalability.

- Implementing a small business health insurance plan as part of employee benefits packages.

Frequently Asked Questions

Do you have a question about a Small Business Plan?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!