A Georgia Bill of Sale is a legal document recording the transfer of personal property ownership from a seller to a buyer within the state of Georgia.

Sale Type

Select the category that best describes the item or property being sold. This will tailor the form to your transaction.

Table of Contents

What is a Georgia Bill of Sale?

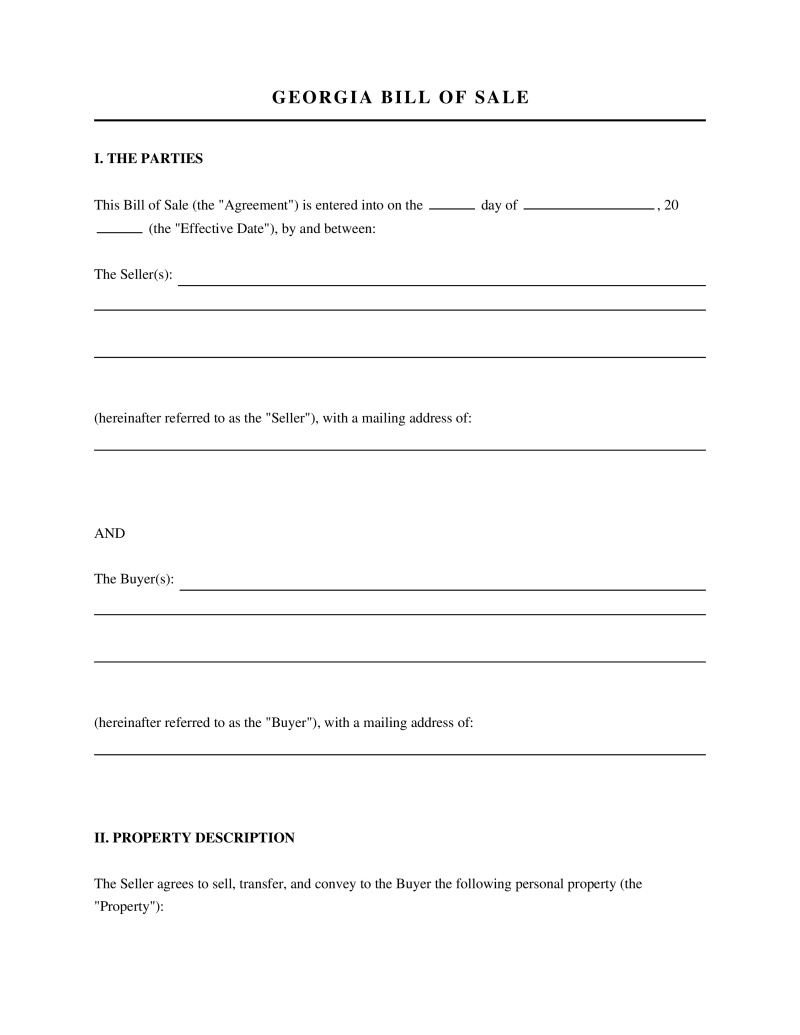

A Georgia bill of sale serves as a legal instrument that records the transfer of ownership of personal property from a seller to a buyer. This document acts as a receipt for the transaction, outlining specific details such as the purchase price, description of the item, and the identities of the parties involved. Residents utilize this form to establish proprietary rights and release the seller from liability associated with the asset after the date of sale. While commonly used for motor vehicles, vessels, and firearms, the document applies to any tangible personal property sold within the state.

Legal Requirements and Validity

To function as a legally binding proof of purchase in Georgia, the document must contain specific elements that clearly define the terms of the transfer. The state does not require a government-issued template for general property, but the content must satisfy contract law principles. A valid bill of sale generally includes:

- Party Identification - Full legal names, physical addresses, and contact information for both the buyer and the seller.

- Property Description - Detailed identification of the item, including serial numbers, Vehicle Identification Numbers (VIN), make, model, and year.

- Consideration Details - The agreed-upon purchase price or value of the trade exchanged for the property.

- Date of Transaction - The specific day, month, and year the ownership transfer occurred.

- Signatures - Hand-written or electronic signatures of the seller and buyer acknowledging the terms.

Vehicle Registration and Form T-7

The Georgia Department of Revenue (DOR) maintains specific protocols for the sale and registration of motor vehicles. While a generic bill of sale suffices for many transactions, the state provides an official document known as Form T-7 (Bill of Sale) to streamline the titling process. This form is mandatory for certain transactions, particularly when the vehicle does not have a title or when the seller is not the registered owner on the current title. County tag offices utilize this document to verify the chain of ownership and calculate the Title Ad Valorem Tax (TAVT) based on the fair market value or sale price of the vehicle.

How to Complete a Georgia Bill of Sale

Executing a bill of sale involves a systematic process to ensure accuracy and legal compliance during a property transfer.

- Information Collection - Gather all necessary details regarding the property and the parties involved before drafting the document. For vehicles, this includes the Vehicle Identification Number (VIN), make, model, year, and current odometer reading, while general items require serial numbers or distinct physical descriptions.

- Negotiation of Terms - Determine the final sale price, payment method, and any specific conditions of the transfer. The parties must agree on whether the item sells in "as-is" condition or if the seller provides any warranties regarding the item's functionality or title status.

- Document Execution - Complete the bill of sale with accurate information and ensure both the buyer and seller sign the document. While Georgia law does not strictly require a witness or notary for all private sales, having the signatures notarized prevents future disputes regarding the authenticity of the transaction.

- Title Transfer and Registration - Present the signed bill of sale to the appropriate government agency to finalize the legal transfer of ownership. For motor vehicles, the buyer must take the document to the County Tag Office within seven days of purchase to apply for a title and registration.

"As-Is" Clauses and Warranty Disclaimers

Most private sales in Georgia occur on an "as-is" basis, meaning the buyer accepts the property in its current condition with all faults. A properly drafted bill of sale explicitly states this condition to protect the seller from post-sale claims regarding the item's performance or quality. Without this explicit disclaimer, implied warranties under the Uniform Commercial Code might apply. The inclusion of an "as-is" clause alerts the buyer to inspect the item thoroughly before finalizing the purchase, as they assume full responsibility for repairs or maintenance immediately upon transfer.

State and Federal Laws

Various statutes govern the transfer of personal property, vehicle registration, and consumer protection in Georgia:

- Motor Vehicle Title and Registration Act - Governs the transfer of vehicle ownership, titling procedures, and the use of Form T-7 (O.C.G.A. § 40-3-1 et seq.).

- Uniform Commercial Code (Sales) - Regulates the sale of goods, contract formation, and implied warranties for personal property transactions (O.C.G.A. § 11-2-101 et seq.).

- Federal Odometer Disclosure Requirements - Mandates the written disclosure of mileage for motor vehicles under 20 years old at the time of transfer (49 U.S.C. § 32705).

- Vessel Registration and Titling - Outlines the requirements for registering boats and watercraft with the Department of Natural Resources (O.C.G.A. § 52-7-1 et seq.).

- Casual Sale Tax Exemption - Defines the tax implications for occasional sales between individuals who are not in the business of selling such property (Ga. Comp. R. & Regs. 560-12-1-.07).

Frequently Asked Questions

Do you have a question about a Georgia Bill of Sale?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!