A Colorado Bill of Sale is a legal document recording the transfer of ownership of personal property from a seller to a buyer within the state of Colorado.

Sale Type

Select the category that best describes the item or property being sold. This will tailor the form to your transaction.

Table of Contents

What is a Colorado Bill of Sale?

A Colorado bill of sale serves as a legal instrument recording the transfer of ownership of personal property from a seller to a buyer. This document acts as a receipt and proof of purchase, outlining the specific details of the transaction, the identities of the parties involved, and a description of the item being sold. Residents utilize this form for various private transactions, including the sale of motor vehicles, firearms, livestock, and general personal property, to establish a clear chain of title and protect against future liability claims.

Types of Colorado Bill of Sale

Different transactions require specific forms to ensure all legal criteria are met for the particular asset class. Common variations include:

- Vehicle Bill of Sale - Documents the sale of cars, trucks, and motorcycles, often required by the Division of Motor Vehicles (DMV) for registration and titling purposes.

- Firearm Bill of Sale - Records the transfer of a gun between private parties, detailing the make, model, and serial number of the weapon.

- Vessel (Boat) Bill of Sale - Used for the transfer of watercraft, including necessary hull identification numbers (HIN) required by Colorado Parks and Wildlife.

- Livestock Bill of Sale - Functions as a critical document for the sale of cattle, horses, or sheep, often requiring coordination with a brand inspector.

Required Elements for Validity

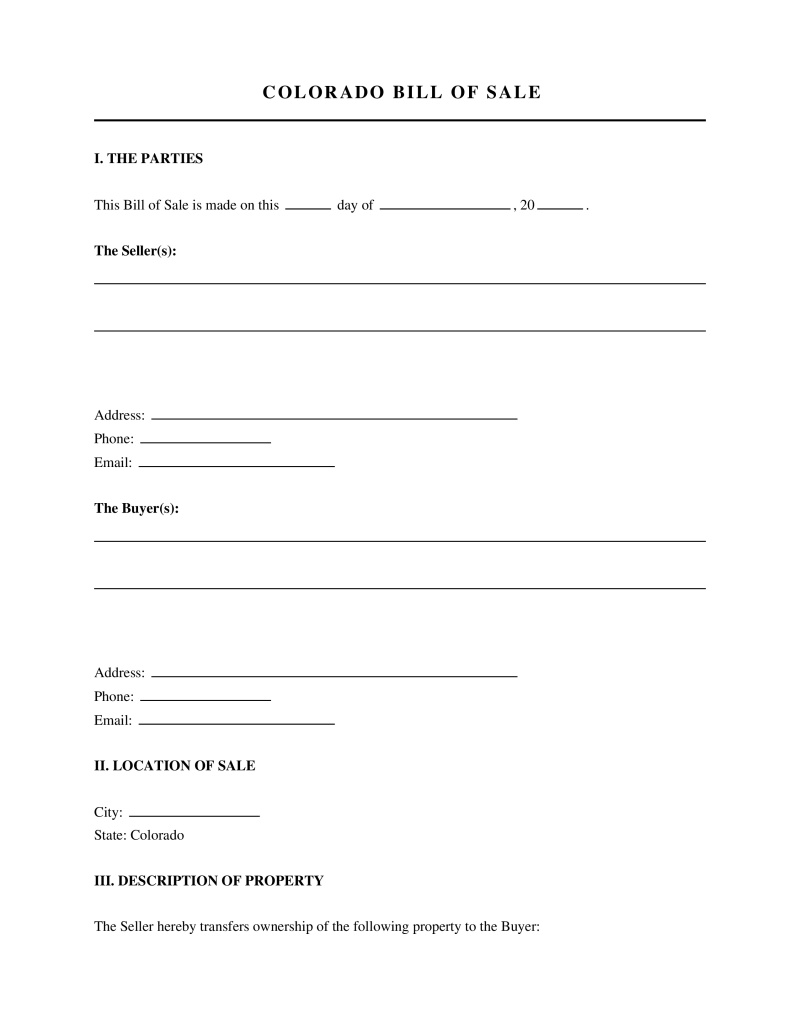

To be legally binding and acceptable for registration purposes in Colorado, the document must contain specific information. The Colorado Division of Motor Vehicles and other state agencies look for the following components:

- Parties' Identification - Full legal names and physical addresses of both the buyer and the seller.

- Property Description - Detailed identification of the item, including VIN (for vehicles), HIN (for boats), serial numbers, make, model, and year.

- Transaction Details - The final purchase price and the date of the sale.

- Odometer Disclosure - A statement regarding the mileage of a motor vehicle, required for vehicles under 20 years old.

- Signatures - The handwritten signatures of both parties to affirm the accuracy of the information.

Colorado Vehicle Registration Requirements

When a vehicle is purchased through a private sale, the new owner must complete specific steps to transfer the title and obtain registration. The state enforces strict timelines for this process:

- Registration Deadline - New owners must register the vehicle within 60 days of the purchase date (C.R.S. § 42-3-103).

- Late Fees - Failure to register within the 60-day window results in a late fee of $25 per month, up to a maximum of $100.

- Emissions Testing - Vehicles registered in specific counties (such as Denver, Boulder, and Jefferson) may require a passing emissions test certificate.

- Proof of Insurance - The buyer must provide evidence of valid insurance coverage meeting state minimums.

- Secure and Verifiable ID - The applicant must present a valid driver's license or identification card.

Legal Statutes and Regulations

The creation and use of bills of sale in Colorado are governed by various state and federal laws depending on the asset type:

- Uniform Commercial Code (Sales) - Governs the general sale of goods and the transfer of ownership rights between parties (C.R.S. § 4-2-101 et seq.).

- Motor Vehicle Registration Laws - Mandates the requirements for titling and registering vehicles purchased via private sale (C.R.S. § 42-3-115).

- Odometer Disclosure Requirements - Requires sellers to disclose the true mileage of vehicles less than 20 years old (49 CFR § 580.5).

- Livestock Brand Inspection - Requires a brand inspection certificate for the sale or transport of livestock to prove ownership (C.R.S. § 35-53-105).

- Vessel Registration and Numbering - Outlines the requirements for registering boats and watercraft with Colorado Parks and Wildlife (C.R.S. § 33-13-103).

How to Complete a Colorado Bill of Sale

Executing this document correctly ensures the smooth transfer of ownership. The process involves the following steps:

Step 1: Negotiate Terms - The buyer and seller agree on the price and method of payment (cash, check, or trade).

Step 2: Gather Information - The seller collects necessary details such as the VIN, hull ID, or serial numbers.

Step 3: Draft the Document - The parties fill out the form with personal information, item description, and purchase price.

Step 4: Sign and Date - Both parties sign the document; notarization is not strictly required by state law but provides additional legal security.

Step 5: Transfer Possession - The seller delivers the item and any associated title documents to the buyer.

As-Is Clauses and Warranties

Most private sales in Colorado are conducted on an "as-is" basis unless otherwise specified. This legal concept has significant implications for both parties:

- Implied Warranty Disclaimer - An "as-is" clause effectively disclaims implied warranties, meaning the seller guarantees only that they have the right to sell the item.

- Buyer Responsibility - The buyer accepts the item in its current condition, including all visible and hidden faults.

- Fraud Exception - Sellers remain liable if they intentionally conceal defects or make false representations about the item's condition.

FAQs

Do you have a question about a Colorado Bill of Sale?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!