An Arkansas Bill of Sale is a written instrument documenting the legal transfer of title for personal property between parties in Arkansas jurisdiction.

Sale Type

Select the category that best describes the item or property being sold. This will tailor the form to your transaction.

Table of Contents

What is an Arkansas Bill of Sale?

An Arkansas Bill of Sale serves as a legal document recording the transfer of ownership for personal property from a seller to a buyer. This instrument functions primarily as proof of purchase and establishes the details of the transaction, including the purchase price, date of sale, and property condition. Residents typically utilize this form for vehicle registration with the Department of Finance and Administration, though it applies to firearms, watercraft, livestock, and general personal items.

Types of Arkansas Bill of Sale

Various forms exist to accommodate specific categories of property, each requiring distinct information to satisfy legal or registration standards:

- Motor Vehicle Bill of Sale - Records the transaction of a car, truck, or motorcycle and acts as a supporting document for titling and registration with the Office of Motor Vehicle.

- Vessel Bill of Sale - Documents the transfer of motorboats or sailboats which requires registration with the Arkansas Department of Finance and Administration.

- Firearm Bill of Sale - Establishes a paper trail for the private sale of handguns or rifles, proving a change in ownership without a federal background check.

- General Bill of Sale - Covers the sale of non-regulated personal property such as electronics, furniture, tools, or musical instruments.

- Livestock Bill of Sale - Details the transfer of farm animals, often including specific descriptions of breed, weight, and branding marks.

Legal Requirements and Validity

A valid Arkansas Bill of Sale must contain specific elements to be legally binding and acceptable for official use. The document functions as a contract between the parties and protects the seller from liability regarding the property after the transaction date. While the state does not mandate a specific government-issued form for all private sales, the Department of Finance and Administration provides Form 10-313 specifically for motor vehicles. This form serves multiple purposes, including tax credit verification.

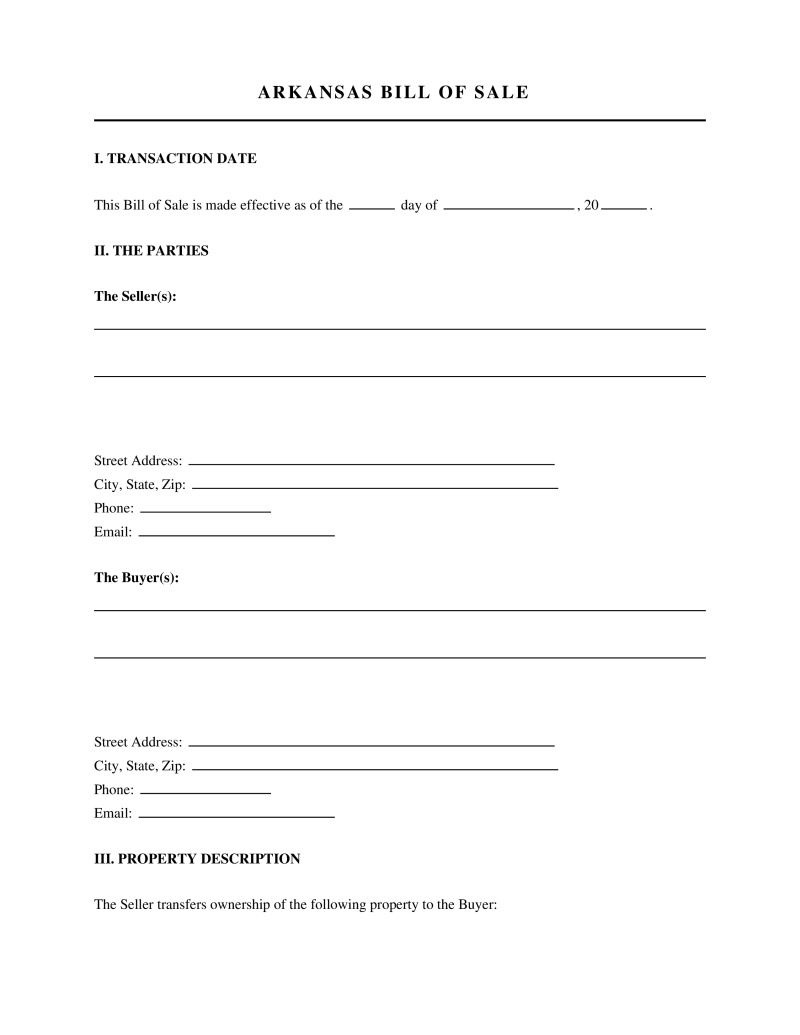

Essential Elements of the Document

For the document to hold weight in legal disputes or registration processes, it must include:

- Party Information - Full legal names, physical addresses, and contact information for both the buyer and the seller.

- Property Description - Detailed identification of the item, including VIN, Hull ID, serial numbers, make, model, year, and color.

- Transaction Details - The agreed-upon purchase price, the date of the transaction, and the method of payment.

- Odometer Disclosure - A statement of the vehicle's mileage at the time of transfer, required for most motor vehicles under federal and state law.

- Signatures - Hand-written signatures from both parties indicating agreement to the terms.

State Laws and Regulations

Arkansas statutes govern the sale of personal property, specifically regarding taxation, registration, and consumer protection:

- Sales Tax Credit for Private Sales - Allows a deduction from the taxable price of a newly purchased vehicle if a previous vehicle was sold within 45 days (Ark. Code Ann. § 26-52-510).

- Odometer Fraud Prevention - Prohibits the disconnection, resetting, or alteration of a vehicle's odometer with the intent to change the mileage registered (Ark. Code Ann. § 4-90-204).

- Vehicle Registration Requirements - Mandates that owners register vehicles within 30 days of purchase, often requiring a bill of sale as proof of ownership (Ark. Code Ann. § 27-14-903).

- Implied Warranties - Establishes that goods sold are merchantable unless specific "as-is" language is included in the sales contract (Ark. Code Ann. § 4-2-314).

- Federal Odometer Disclosure - Requires sellers to disclose mileage for vehicles under 10 years old and below 16,000 pounds (49 U.S.C. § 32705).

Registration and Tax Credit Procedures

Arkansas offers a unique benefit known as the sales tax credit for private vehicle sales. When a resident sells a vehicle and purchases a replacement within 45 days, they may pay sales tax only on the difference in value. The Arkansas Bill of Sale is the critical evidence required to claim this credit. The seller must provide a signed copy to the buyer, and the buyer must present this document at the revenue office. Without this specific documentation, the new owner may be liable for sales tax on the full purchase price of the new vehicle.

How to Complete an Arkansas Bill of Sale

Executing this document correctly ensures a smooth transfer of title and registration. The process involves several distinct steps:

Step 1: Negotiate Terms - The buyer and seller agree on the price and whether the item is sold "as-is" or with a warranty.

Step 2: Gather Identification - Locate the Vehicle Identification Number (VIN), Hull Identification Number (HIN), or serial numbers found on the property.

Step 3: Draft the Document - Fill out the bill of sale with all required party and property information, ensuring accuracy to avoid rejection by state agencies.

Step 4: Sign and Date - Both parties sign the document; notarization is optional in Arkansas but recommended for high-value transactions.

Step 5: Transfer Funds and Property - The buyer provides payment, and the seller hands over the property along with any existing titles or maintenance records.

Frequently Asked Questions

Do you have a question about an Arkansas Bill of Sale?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!