An Ohio Power of Attorney form is a legal instrument authorizing a designated agent to manage financial or medical affairs on behalf of a principal party.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is an Ohio Power of Attorney Form?

An Ohio Power of Attorney Form is a legal instrument that authorizes one individual, designated as the principal, to grant specific decision-making powers to another party, known as the agent or attorney-in-fact. This document enables the agent to manage financial affairs, handle real estate transactions, or make healthcare directives on behalf of the principal depending on the scope defined within the text. The arrangement functions under the statutory guidelines of the Ohio Revised Code, ensuring that the appointed representative acts strictly within the principal's interests and adheres to established fiduciary standards. Residents of Ohio utilize this document to prepare for potential incapacitation or to facilitate business transactions when they cannot be physically present.

Types of Ohio Power of Attorney Forms

The state recognizes various forms of delegation, each tailored to specific needs and durations of authority.

- General Power of Attorney - Grants the agent broad authority to handle financial and legal matters for the principal. This authority typically terminates if the principal becomes incapacitated or mentally incompetent.

- Durable Power of Attorney - Includes specific language stating that the agent's authority remains in effect regardless of the principal's subsequent disability or incapacity. This type is frequently used for estate planning and long-term care preparation.

- Limited Power of Attorney - Restricts the agent's authority to specific actions or a defined time period. Principals often use this for single transactions, such as a real estate closing or handling business while traveling.

- Medical Power of Attorney - Designates a representative to make healthcare decisions if the principal is unable to communicate with medical staff. In Ohio, this is formally known as a Durable Power of Attorney for Health Care.

- Springing Power of Attorney - Remains inactive until a specific event occurs, such as the certification of the principal's incapacity by a physician. The document must clearly define the triggering event.

- Tax Power of Attorney (Form TBOR 1) - Authorizes a representative to communicate with the Ohio Department of Taxation regarding tax matters. This form strictly limits the agent to tax-related issues.

Legal Requirements for Validity in Ohio

Ohio statutes impose strict execution requirements to ensure the validity and enforceability of power of attorney documents. A failure to adhere to these standards may result in banks, medical institutions, or courts rejecting the document.

- Principal Capacity - The individual creating the document must be at least 18 years old and of sound mind at the time of signing (ORC § 1337.22).

- Notarization for Financial POA - A power of attorney granting authority over property or financial matters must be signed by the principal and acknowledged before a notary public (ORC § 1337.25).

- Witnessing for Health Care POA - A Durable Power of Attorney for Health Care requires either the signature of a notary public or the signatures of two eligible witnesses (ORC § 1337.12).

- Agent Eligibility - The appointed agent must be a competent adult. Certain restrictions apply to health care agents, preventing the principal's attending physician or the administrator of a nursing home where the principal resides from serving in this role unless related by blood or marriage.

Powers and Duties of the Agent

The individual appointed as an agent assumes a fiduciary role. This position carries significant legal responsibilities and ethical obligations.

- Fiduciary Duty - The agent must act in good faith, within the scope of authority granted, and in the best interest of the principal (ORC § 1337.34).

- Record Keeping - Agents must maintain accurate records of all receipts, disbursements, and transactions made on behalf of the principal.

- Conflict of Interest - Agents must act loyally for the principal's benefit and avoid conflicts of interest that impair their ability to act impartially.

- Preservation of Estate Plan - To the extent known, the agent must attempt to preserve the principal’s estate plan, considering the value of the property and the principal’s foreseeable obligations.

Ohio Statutes and Regulations

The Ohio Revised Code governs the creation, execution, and interpretation of these legal documents.

- Uniform Power of Attorney Act - Establishes the comprehensive legal framework for financial powers of attorney in Ohio, including creation, validity, and termination (ORC § 1337.21 et seq.).

- Durable Power of Attorney for Health Care - Governs the appointment of an agent for medical decisions and outlines the requirements for witnessing and execution (ORC § 1337.11 et seq.).

- Recording Requirements - Mandates that any power of attorney used to convey an interest in real property must be recorded with the county recorder where the property is located (ORC § 1337.04).

- Liability for Refusal to Accept - Protects third parties who rely on a valid power of attorney in good faith and outlines penalties for unreasonable refusal to accept the document (ORC § 1337.41).

- Revocation Rules - Stipulates that a principal may revoke a power of attorney at any time provided they have the capacity to do so, and outlines how notice must be given (ORC § 1337.13).

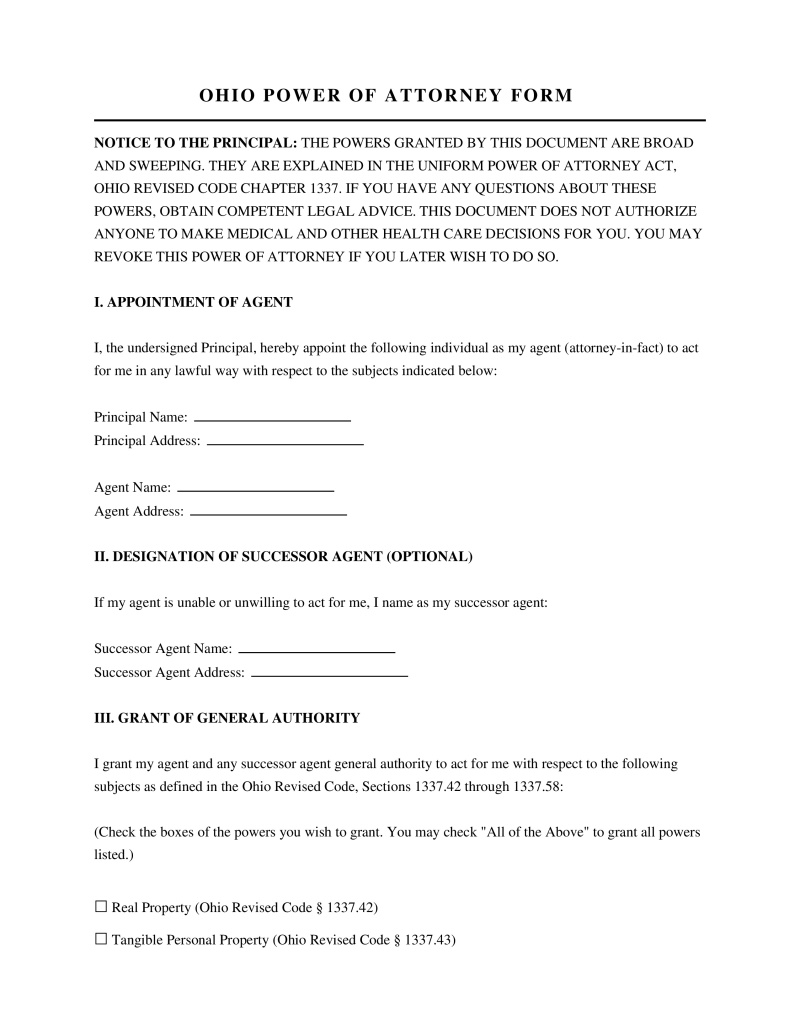

How to Execute an Ohio Power of Attorney

Step 1: Select the Document Type - Determine whether the situation requires a financial, medical, or limited scope document based on the specific needs of the principal.

Step 2: Appoint an Agent - Choose a trustworthy individual to act as the attorney-in-fact. Many principals also select a successor agent to serve if the primary choice becomes unavailable.

Step 3: Define Powers - Clearly outline which authorities are granted and which are withheld. The Ohio statutory form allows principals to initial specific lines to grant or deny powers.

Step 4: Execute the Document - Sign the document in the presence of a notary public. If executing a healthcare directive, alternative witnessing by two competent adults is permissible.

Step 5: Distribute Copies - Provide a copy of the executed form to the agent, financial institutions, and healthcare providers. The original should be stored in a secure location.

Revocation of Authority

A principal retains the right to revoke a power of attorney at any time, provided they maintain mental competency. The revocation process requires specific steps to ensure all parties recognize the termination of authority.

- Written Notice - The principal should execute a formal revocation of power of attorney document.

- Notification of Agent - The agent must receive actual notice of the revocation to terminate their authority effectively.

- Third-Party Notification - Banks, hospitals, and other institutions holding the original POA on file must receive a copy of the revocation to stop accepting the agent's instructions.

- Recording Revocation - If the original POA was recorded with a county recorder for real estate purposes, the revocation instrument must also be recorded in the same county (ORC § 1337.05).

FAQs

Do you have a question about an Ohio Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!