A New Hampshire Power of Attorney Form is a legal instrument that authorizes an agent to execute financial or medical decisions on behalf of a principal.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a New Hampshire Power of Attorney Form?

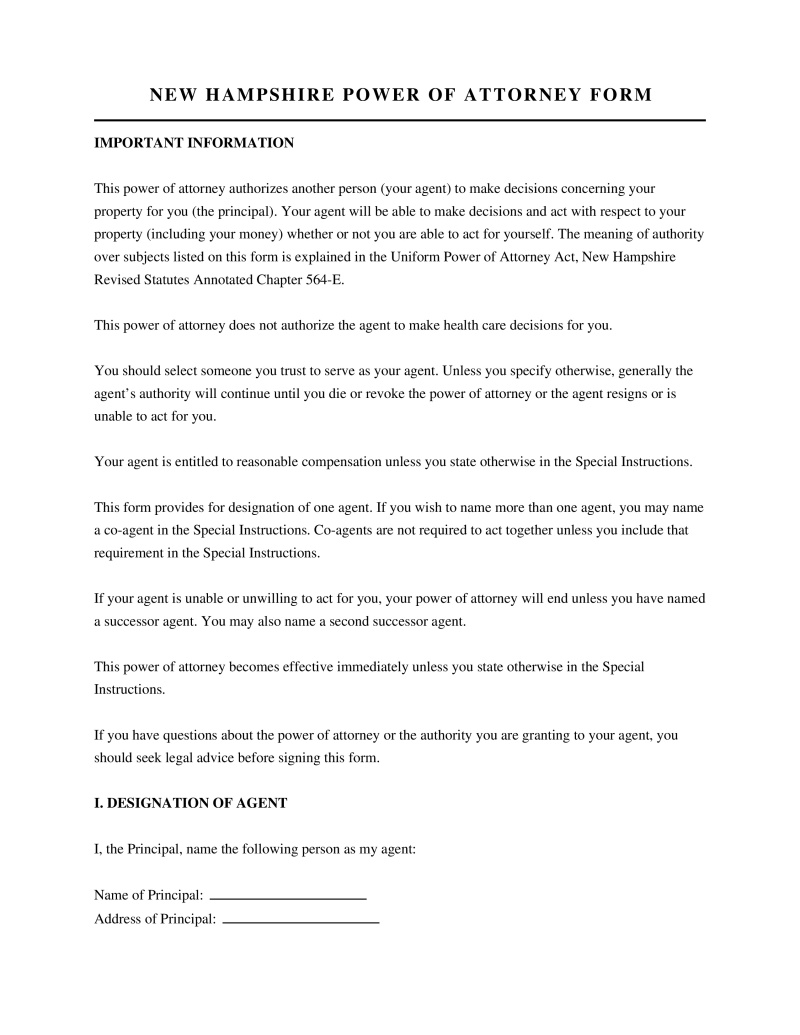

A New Hampshire Power of Attorney Form constitutes a legal instrument that authorizes an individual, referred to as the principal, to designate another party, known as the agent or attorney-in-fact, to manage specific affairs on their behalf. This document serves as a fundamental component of estate planning by allowing for the seamless management of financial, business, or healthcare matters during periods where the principal may be unavailable or incapacitated. The instrument operates under the Uniform Power of Attorney Act as adopted by the state legislature, ensuring that the delegated authority adheres to strict legal standards and clearly defined limitations. Valid execution of this document requires adherence to specific statutory formalities regarding witnessing and notarization to ensure acceptance by financial institutions and medical facilities.

Legal Requirements for Validity in New Hampshire

The state enforces specific procedural standards to establish a legally binding power of attorney. Failure to adhere to these protocols may result in the rejection of the document by banks, courts, or healthcare providers. The New Hampshire Uniform Power of Attorney Act mandates the following elements for execution:

- Notarization Requirement - The signature of the principal must be acknowledged by a notary public or other individual authorized by law to take acknowledgments (RSA 564-E:105).

- Mental Capacity - The principal must possess the mental capacity to understand the nature and consequences of executing the document at the time of signing.

- Agent Acceptance - While not always required on the initial form, agents typically must sign an acknowledgment of their duties before acting under the authority granted.

- Clear Identification - The document must explicitly identify the principal, the agent, and the specific powers being granted or withheld.

Types of New Hampshire Power of Attorney Form

Residents may utilize various forms depending on the duration of authority and the specific nature of the powers required. Each variation serves a distinct purpose within the realm of asset management and personal care.

- General Power of Attorney - Grants the agent broad authority to handle financial and business transactions effective immediately upon signing but terminates if the principal becomes incapacitated.

- Durable Power of Attorney - Maintains the agent's authority even if the principal becomes mentally incompetent or physically incapacitated, making it essential for long-term disability planning.

- Limited Power of Attorney - Restricts the agent's authority to specific actions or a defined time period, such as a real estate closing or a single business transaction.

- Durable Power of Attorney for Health Care - Designates an agent to make medical decisions specifically when the principal is unable to communicate their own healthcare preferences.

- Springing Power of Attorney - Becomes effective only upon the occurrence of a specified future event, typically the determination of the principal's incapacity by a physician.

New Hampshire Statutes and Regulations

The creation, execution, and interpretation of these documents fall under specific chapters of the New Hampshire Revised Statutes Annotated (RSA). These laws define the scope of authority and the duties owed by the agent to the principal.

- Uniform Power of Attorney Act - Governs the creation and validity of financial powers of attorney, including the durability of the document and statutory definitions of powers (RSA Chapter 564-E).

- Durable Power of Attorney for Health Care - Establishes the legal framework for appointing a healthcare agent and creating advance directives (RSA Chapter 137-J).

- Agent Liability and Duties - Imposes a fiduciary duty on the agent to act in good faith, within the scope of authority, and in the principal's best interest (RSA 564-E:114).

- Execution Requirements - Mandates that a signature on a power of attorney is presumed genuine if the principal acknowledges the signature before a notary public (RSA 564-E:105).

- Termination of Authority - Outlines the circumstances under which an agent's authority ceases, including the death of the principal or revocation of the document (RSA 564-E:110).

How to Revoke a Power of Attorney

A principal retains the right to revoke a power of attorney at any time, provided they maintain the mental capacity to do so. The process requires specific actions to ensure third parties recognize the cancellation of authority. Proper revocation involves specific steps:

- Written Revocation - The principal should execute a formal written statement explicitly stating that the previous power of attorney is revoked.

- Notice to Agent - The agent must receive actual notice of the revocation to terminate their authority effectively.

- Notice to Third Parties - Banks, medical providers, and business partners who relied on the original document must receive a copy of the revocation to stop accepting the agent's authority.

- Recording - If the original power of attorney was recorded with a Registry of Deeds regarding real estate matters, the revocation instrument must also be recorded in the same registry.

Agent Responsibilities and Ethical Standards

An individual appointed as an agent assumes a fiduciary role, placing them under strict legal obligations regarding their conduct. New Hampshire law requires agents to act with competence and diligence. The agent must maintain a clear distinction between their personal assets and the assets of the principal. Record-keeping remains a primary duty, requiring the agent to document all receipts, disbursements, and transactions made on behalf of the principal. Violating these duties can result in civil liability or criminal charges for exploitation. The agent must act according to the principal's reasonable expectations and, if those expectations are unknown, in the principal's best interest.

Frequently Asked Questions

Do you have a question about a New Hampshire Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!