A Minnesota Power of Attorney Form is a legal document that authorizes an agent to manage financial, business, or medical affairs on behalf of a principal.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a Minnesota Power of Attorney Form?

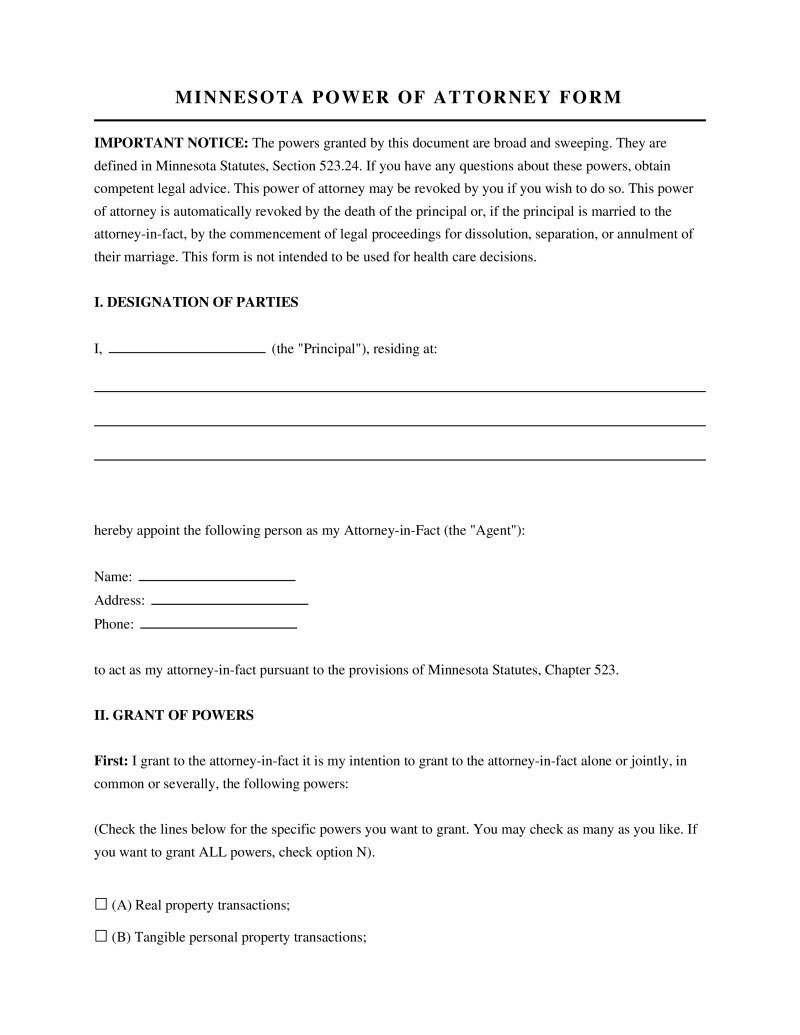

A Minnesota Power of Attorney Form is a legal instrument that allows an individual, referred to as the principal, to designate another person, known as the attorney-in-fact, to handle financial and legal affairs on their behalf. This document adheres to the specific language and regulations outlined in Minnesota Statutes Chapter 523, ensuring that the authority granted is legally recognized by banks, government agencies, and other institutions within the state. Principals utilize this form to prepare for potential incapacity, manage business transactions during absences, or delegate specific tasks such as real estate closings.

Types of Minnesota Power of Attorney Form

Minnesota law recognizes several distinct categories of power of attorney documents, each serving a specific scope and duration of authority.

- General Power of Attorney - Grants the attorney-in-fact broad authority to manage the principal's financial affairs, including banking, real estate, and business transactions, but typically terminates if the principal becomes incapacitated.

- Durable Power of Attorney - Contains specific language stating that the agent's authority remains in effect even if the principal becomes mentally incompetent or incapacitated.

- Limited Power of Attorney - Restricts the agent's authority to specific transactions or a set period, such as signing closing documents for a property sale or managing a single bank account.

- Statutory Short Form Power of Attorney - Follows the exact template provided in Minnesota state statutes, allowing the principal to check boxes indicating which specific powers are granted to the agent.

- Health Care Directive - Designates an agent to make medical decisions on behalf of the principal if they are unable to communicate their wishes, replacing the traditional Medical Power of Attorney in Minnesota.

Legal Requirements for Validity

For a Minnesota Power of Attorney Form to be legally enforceable, it must adhere to strict execution standards mandated by state law. Failure to meet these criteria may result in rejection by financial institutions or courts.

- Principal Competency - The individual creating the document must be of sound mind and legal age (18 years or older) at the time of signing.

- Notarization - The document must be signed by the principal in the presence of a notary public to be valid.

- Written Format - The authority must be granted in a written document; verbal appointments are not legally binding for these purposes.

- Dated Signature - The principal must date the document at the time of signing to establish the commencement of authority.

- Clear Identification - The document must clearly identify the principal and the appointed attorney-in-fact by their legal names.

Powers and Authority Options

The Minnesota Statutory Short Form allows principals to grant authority across various categories by initialing specific lines. The scope of these powers is defined by statute.

- Real Property Transactions - Authorizes the agent to buy, sell, lease, or mortgage real estate on behalf of the principal.

- Banking Transactions - Permits the agent to open accounts, withdraw funds, write checks, and manage safe deposit boxes.

- Tax Matters - Grants authority to represent the principal before the IRS or Minnesota Department of Revenue and sign tax returns.

- Beneficiary Transactions - Allows the agent to handle matters related to trusts, probate estates, and guardianships where the principal is a beneficiary.

- Claims and Litigation - Empowers the agent to sue, settle, or defend legal actions on behalf of the principal.

How to Complete a Minnesota Power of Attorney Form

Executing this document involves a specific process to ensure it complies with the Minnesota Statutory Short Form requirements.

- Step 1: Select an Attorney-in-Fact - Choose a trustworthy individual, typically a spouse, family member, or close friend, who understands the fiduciary duties involved.

- Step 2: Choose the Powers - Review the list of statutory powers on the form and initial the lines next to the specific authorities the principal wishes to grant.

- Step 3: Determine Durability - Decide whether the power of attorney should continue if the principal becomes incapacitated and include the necessary statutory language if durability is desired.

- Step 4: Execute the Document - The principal must sign and date the form in the presence of a notary public.

- Step 5: Distribution - Provide the original or a certified copy to the attorney-in-fact and any relevant third parties, such as banks or title companies.

State Statutes and Federal Laws

The creation, validity, and interpretation of power of attorney documents in Minnesota are governed by specific state chapters and applicable federal regulations.

- Minn. Stat. § 523.23 - Establishes the Statutory Short Form Power of Attorney and outlines the exact language required for the document.

- Minn. Stat. § 523.01 - Authorizes the use of a statutory short form power of attorney to grant an agent powers regarding property and financial matters.

- Minn. Stat. § 523.11 - Defines the duties of an attorney-in-fact, including the obligation to keep complete records of all transactions.

- Minn. Stat. § 523.08 - States that a third party who relies in good faith on a power of attorney is not liable to the principal or their successors.

- HIPAA (45 CFR § 164.508) - Federal regulation requiring specific authorization for an agent to access a principal's protected health information, often relevant for Health Care Directives.

Revocation and Termination

A power of attorney does not remain in effect indefinitely. Specific events or actions will terminate the authority granted to the agent.

- Revocation by Principal - The principal may revoke the power of attorney at any time, provided they are competent, by signing a written revocation form.

- Death of Principal - All powers of attorney automatically terminate upon the death of the principal.

- Divorce Proceedings - In Minnesota, the authority granted to a spouse is automatically terminated upon the commencement of dissolution or annulment proceedings.

- Guardianship Appointment - If a court appoints a guardian or conservator for the principal, the power of attorney may be suspended or terminated depending on the court's order.

FAQs

Do you have a question about a Minnesota Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!