An Indiana Power of Attorney Form is a legal document that lets a person appoint someone they trust to manage specific financial or legal matters on their behalf.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is an Indiana Power of Attorney Form?

An Indiana Power of Attorney Form is a legal instrument that enables an individual, referred to as the principal, to delegate authority to another person, known as the agent or attorney-in-fact. This document is designed to allow the agent to manage the principal's affairs, which may range from specific financial transactions to comprehensive health care decisions. Residents of Indiana utilize this form to ensure that their assets are managed and personal matters are attended to in the event of their absence, illness, or incapacitation, thereby maintaining continuity in legal and financial obligations.

Legal Framework and Statutory Requirements

The creation and enforcement of power of attorney documents in the state are governed primarily by the Indiana Power of Attorney Act, found within Indiana Code Title 30, Article 5. For an Indiana Power of Attorney Form to be legally valid, specific statutory formalities must be observed. The principal must be at least 18 years of age and of sound mind at the time of execution. According to Indiana Code § 30-5-4-1, the document must be in writing and signed by the principal or by another person in the principal's presence and at the principal's direction.

A crucial requirement in Indiana is notarization. The signature of the principal must be acknowledged by a notary public. While some states require witnesses for financial powers of attorney, Indiana law focuses heavily on the notarial acknowledgment for validity, specifically regarding the recording of the document for real estate transactions. If the power of attorney is intended to convey interests in real property, it must be recorded in the county where the property is located, necessitating strict adherence to notarization standards.

Fiduciary Duties of the Agent

Upon accepting the appointment, the attorney-in-fact assumes a fiduciary relationship with the principal. Indiana Code § 30-5-6 outlines the duties of the agent, which include acting in good faith and in the best interest of the principal. The agent is required to keep complete records of all transactions entered into on behalf of the principal and must preserve the principal's estate plan. Mismanagement or self-dealing can lead to civil liability and the revocation of powers. Unless the document specifically authorizes it, agents generally cannot use the principal's assets to benefit themselves.

Required Elements of a Valid Indiana Power of Attorney Form

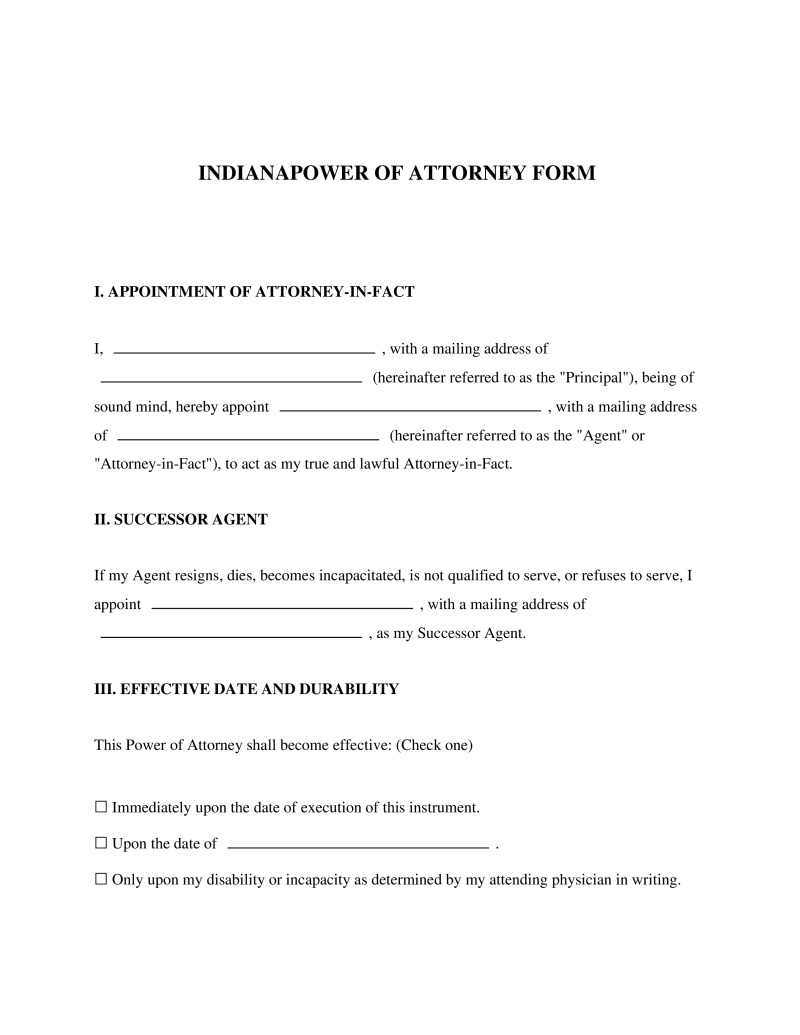

To ensure that the document is accepted by financial institutions, hospitals, and courts, it must contain specific information and follow formatting guidelines. Below are the essential components required for validity.

- Identification of Parties: The full legal names and addresses of both the principal and the designated attorney-in-fact.

- Grant of Authority: A clear enumeration of the powers being granted. Indiana statutes allow for the incorporation of powers by reference to specific code sections (e.g., citing IC 30-5-5-2 for real property transactions).

- Durability Provision: Explicit language stating whether the power of attorney survives the principal's incapacity.

- Signatures and Notarization: The principal's signature must be executed in the presence of a notary public, who must then affix their seal and signature.

- Date of Execution: The specific date on which the document is signed is required to establish its timeline of validity.

Termination and Revocation

The authority granted by an Indiana Power of Attorney Form is not indefinite. It terminates automatically upon the death of the principal. Additionally, a competent principal retains the right to revoke the power of attorney at any time. This revocation should be done in writing and delivered to the agent and any third parties (such as banks) that relied on the original document. Under Indiana law, if the designated agent is the principal's spouse, the filing of a petition for dissolution of marriage (divorce) or legal separation automatically terminates the spouse's authority as an agent, unless the power of attorney document expressly states otherwise.

Frequently Asked Questions

Do you have a question about an Indiana Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!