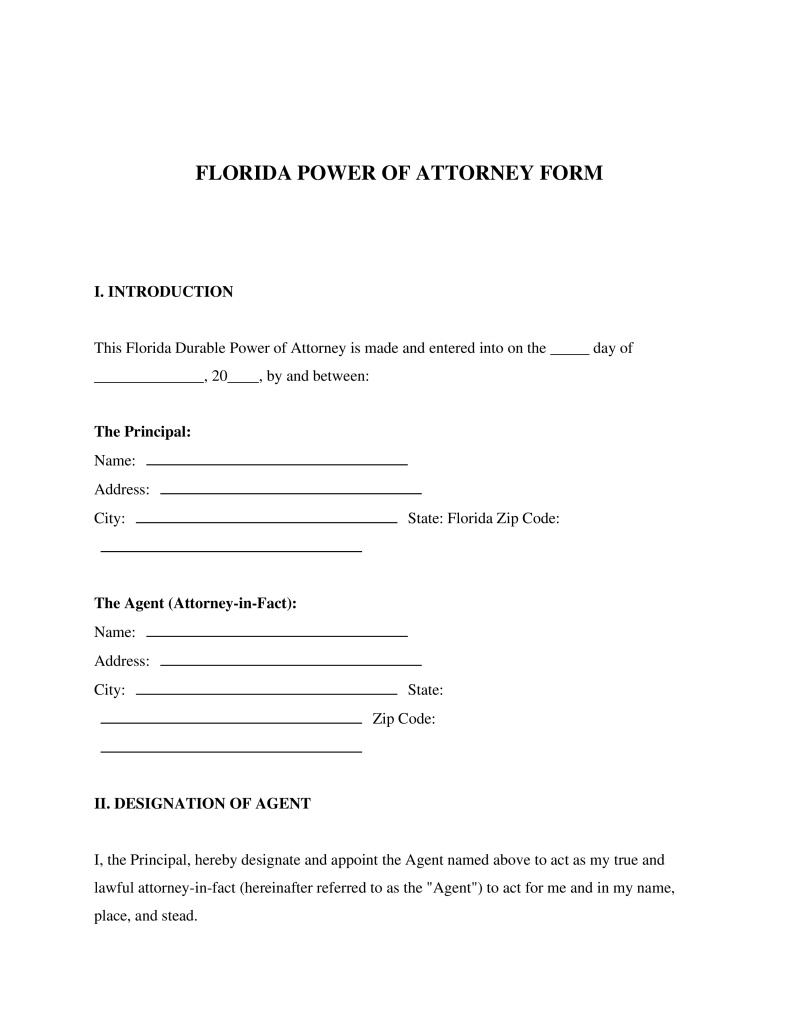

A Florida Power of Attorney Form is a legal document that authorizes one person to act on another's behalf in legal or financial matters in Florida.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a Florida Power of Attorney Form?

A Florida Power of Attorney Form is a legal instrument used to delegate authority from one individual, known as the principal, to another trusted person, referred to as the agent or attorney-in-fact. This document allows the agent to manage specific financial, legal, or business affairs on behalf of the principal, operating under the guidelines established by state statutes. While the scope of authority can range from handling a single real estate transaction to managing all financial accounts, the primary purpose is to ensure that the principal's affairs can be maintained, particularly in the event of absence or incapacity.

Legal Framework: The Florida Power of Attorney Act

The creation and enforcement of power of attorney documents in the state are governed by the Florida Power of Attorney Act, codified in Chapter 709 of the Florida Statutes. This comprehensive legislative framework outlines the requirements for validity, the duties of the agent, and the rights of the principal. Under Florida law, a power of attorney is durable unless the document explicitly states otherwise, meaning the authority granted survives the incapacity of the principal. The statutes emphasize strict adherence to execution formalities to prevent fraud and exploitation.

One significant aspect of Florida law is the treatment of "springing" powers of attorney. Prior to October 1, 2011, residents could create documents that only became effective upon a specific event, such as a doctor declaring the principal incapacitated. However, the 2011 statutory overhaul eliminated the creation of new springing powers of attorney. Consequently, any Florida Power of Attorney Form executed after that date becomes effective immediately upon signature, regardless of the principal's current capacity, although documents created before the legislative change remain valid if they met the laws at the time of execution.

Types of Power of Attorney in Florida

Florida law recognizes different variations of this document, each serving distinct purposes based on the duration and scope of authority granted. A General Power of Attorney confers broad powers to the agent, allowing them to handle most financial and legal transactions. However, if this document is not specified as "durable," the authority terminates if the principal becomes incapacitated.

A Durable Power of Attorney is the most common form used for estate planning. It contains specific language indicating that the agent's authority is exercisable notwithstanding the principal's subsequent incapacity. Conversely, a Limited or Special Power of Attorney restricts the agent's authority to specific acts or a defined time period, such as signing closing documents for a property sale while the principal is out of the country.

Required Elements of a Valid Florida Power of Attorney Form

For a power of attorney to be legally binding in Florida, it must strictly adhere to the execution requirements set forth in Fla. Stat. § 709.2105. Failure to include these elements may result in banks or other third parties refusing to honor the document.

- Principal's Competency: The principal must be a natural person who is 18 years of age or older and of sound mind at the time of signing.

- Two Witnesses: The document must be signed by the principal in the presence of two subscribing witnesses.

- Notarization: The principal's signature must be acknowledged by a notary public. Note that the notary may serve as one of the two witnesses.

- Specific Authority Initials: Certain "super powers," such as the authority to change beneficiary designations or create a trust, must be separately initialed by the principal to be valid.

Agent Authority and Fiduciary Duties

The agent appointed in a Florida Power of Attorney Form acts in a fiduciary capacity. This imposes a high legal standard, requiring the agent to act in good faith, within the scope of authority granted, and solely in the best interest of the principal. Under the Florida Power of Attorney Act, agents are required to keep accurate records of all receipts, disbursements, and transactions made on behalf of the principal. They must also attempt to preserve the principal's estate plan if they have knowledge of it.

Despite broad grants of authority, there are specific actions an agent is prohibited from taking under Florida law. An agent cannot execute or revoke a will on behalf of the principal, nor can they vote in public elections for the principal. Furthermore, unless the power of attorney specifically grants the authority and the principal has initialed the corresponding section, an agent generally cannot make gifts or change rights of survivorship on accounts.

Revocation and Termination

A principal retains the right to revoke a Florida Power of Attorney Form at any time, provided they are competent to do so. Revocation must be done in writing and should be communicated to the agent and any third parties, such as banks, that have the document on file. Aside from voluntary revocation, the authority of the agent automatically terminates upon the death of the principal. Additionally, if the agent is the principal's spouse, the filing of a petition for dissolution of marriage automatically terminates the agent's authority unless the power of attorney document expressly states otherwise.

Frequently Asked Questions

Do you have a question about a Florida Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!