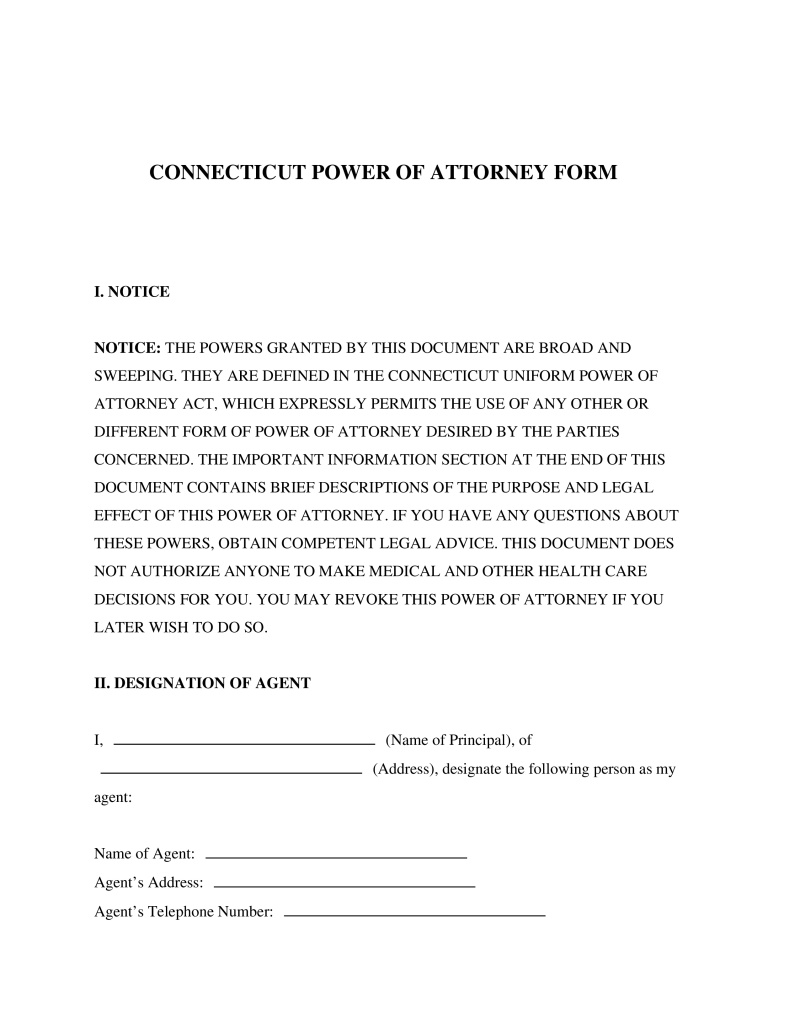

A Connecticut Power of Attorney Form is a legal document that authorizes one person to act on another's behalf in legal or financial matters.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a Connecticut Power of Attorney Form?

A Connecticut Power of Attorney Form is a legal instrument used to delegate authority from one individual, known as the principal, to another trusted person, referred to as the agent or attorney-in-fact. This document allows the agent to manage the principal's financial, legal, and property affairs, particularly in situations where the principal is unable to do so themselves due to absence or incapacity. Governed by the Connecticut Uniform Power of Attorney Act, this form serves as a critical component of estate planning, ensuring that a designated representative can pay bills, manage investments, and handle real estate transactions without court intervention. While typically used for financial matters, separate documents are generally required for medical directives.

Legal Framework and Statutory Requirements

The validity and execution of power of attorney documents in the state are governed by the Connecticut Uniform Power of Attorney Act (Connecticut General Statutes Title 1, Chapter 15c). This legislation, which aligns Connecticut law with national standards, establishes the specific requirements for creating a legally binding delegation of authority. Under C.G.S. § 1-350 et seq., a power of attorney must be signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name.

For the document to be valid in Connecticut, the signature must be acknowledged by a notary public or a commissioner of the superior court. Furthermore, the document requires the signatures of two witnesses. The notary public may serve as one of the two required witnesses. The statutes also provide a "Statutory Short Form Power of Attorney," which is a standardized template that residents may use to ensure compliance with state laws. If a document substantially follows this statutory form, third parties such as banks are generally mandated to accept it.

Types of Power of Attorney in Connecticut

State laws recognize several variations of this legal device, each serving a distinct purpose based on the duration of authority and the scope of powers granted. The selection of the specific type depends on the principal's intent and current circumstances.

Durable Power of Attorney

Under the current Connecticut Uniform Power of Attorney Act, a power of attorney is presumed to be durable unless the document explicitly states otherwise. A durable power of attorney remains effective even if the principal becomes incapacitated or mentally incompetent. This feature makes it a fundamental tool for long-term disability planning, as it prevents the need for a court-appointed conservator to manage the principal's assets.

General vs. Limited Power of Attorney

A general power of attorney grants the agent broad authority to handle almost all financial and legal affairs of the principal. Conversely, a limited or special power of attorney restricts the agent's authority to specific transactions or a set period. For example, a principal might execute a limited Connecticut Power of Attorney Form solely for the purpose of closing a real estate sale while they are out of the country.

Springing Power of Attorney

A springing power of attorney is designed to become effective only upon the occurrence of a specified future event or contingency, most commonly the incapacity of the principal. The document must clearly define how that incapacity is determined, often requiring certification by a medical physician.

How to Complete a Connecticut Power of Attorney Form

Executing this document requires adherence to specific procedural steps to ensuring it is legally binding and recognized by financial institutions.

- Step 1: Select an Agent - The principal must choose a competent and trustworthy individual to act as the agent. Connecticut law allows for the appointment of co-agents who may act independently or jointly, as well as successor agents who take over if the primary agent is unable to serve.

- Step 2: Define the Scope of Authority - Using the statutory form, the principal generally initials specific categories of authority they wish to grant, such as "Real Property," "Banks and Other Financial Institutions," or "Taxes." Alternatively, the principal may grant all listed powers.

- Step 3: Draft Special Instructions - The principal may include limitations or specific instructions in the designated section of the form to restrict the agent's powers or provide guidance on how assets should be managed.

- Step 4: Execute the Document - The principal must sign the document in the presence of two witnesses and a notary public. The witnesses must also sign the document, and the notary must acknowledge the principal's signature.

- Step 5: Agent Acknowledgement - While not strictly required for the validity of the principal's signature, it is best practice for the agent to sign an acknowledgement form accepting their duties and understanding their fiduciary responsibilities.

Fiduciary Duties and Agent Responsibilities

When a person accepts the role of an agent under a Connecticut Power of Attorney Form, they assume a fiduciary relationship with the principal. This legal standard requires the agent to act in good faith, within the scope of authority granted, and solely in the best interest of the principal. The agent is legally obligated to keep the principal's property separate from their own, maintain detailed records of all transactions, and avoid conflicts of interest.

If an agent violates these duties—for instance, by using the principal's funds for personal gain—they can be held liable for civil damages and may face criminal charges for embezzlement or exploitation. The Connecticut Probate Court has jurisdiction to review the conduct of an agent and can compel them to provide an accounting of their actions if misconduct is suspected.

Distinction Between Financial and Medical Authority

It is important to distinguish between financial authority and healthcare decision-making. The standard Connecticut Power of Attorney Form typically covers financial, business, and legal matters. It does not automatically grant the authority to make medical decisions. To designate a representative for healthcare decisions, an individual must execute a separate document known as an Appointment of Health Care Representative. While these documents are often created simultaneously during estate planning, they are distinct legal instruments governed by different sections of the Connecticut General Statutes.

FAQs

Do you have a question about a Connecticut Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!