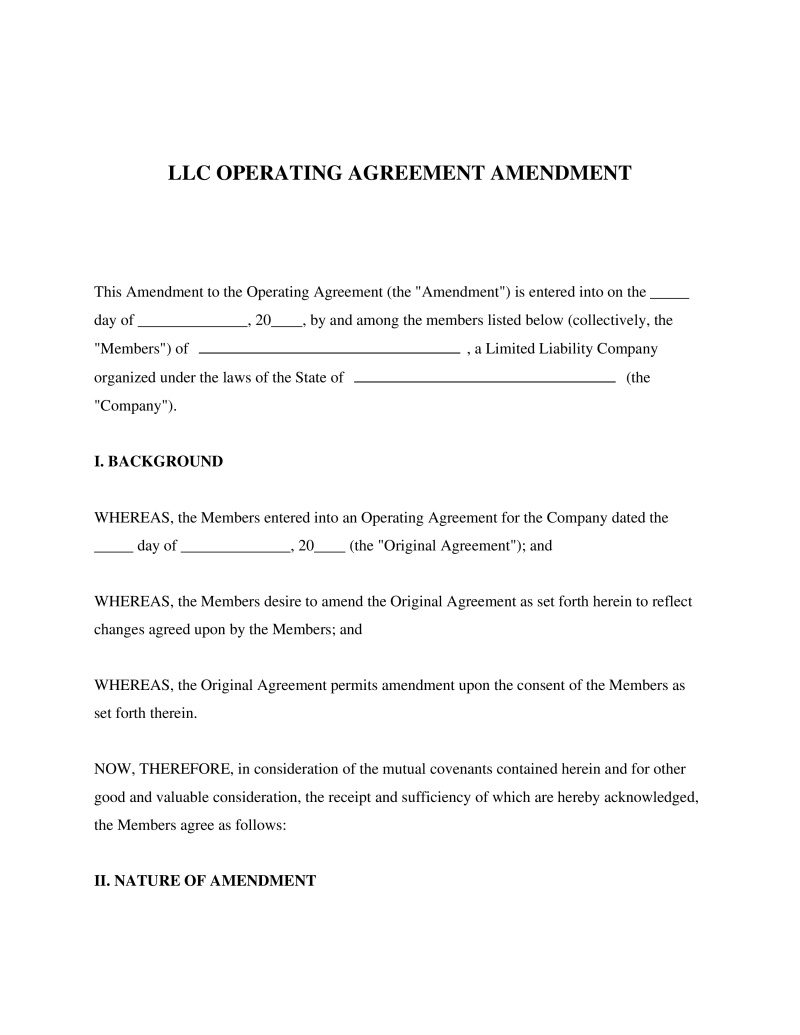

A LLC Operating Agreement Amendment is a legal document that modifies the original LLC agreement terms.

Amendment Type

Select the primary reason for this amendment. You can specify additional changes later.

Table of Contents

What is an Amendment to an LLC Operating Agreement?

An Amendment to an LLC Operating Agreement is a formal legal document utilized to modify, alter, or revoke specific provisions within a limited liability company's existing governance contract. This instrument serves as the official record of changes agreed upon by the members, allowing the business to evolve without the necessity of dissolving the entity or drafting an entirely new foundational agreement. It is primarily used to document significant structural shifts, such as changes in ownership percentages, the admission of new members, modifications to management protocols, or adjustments to capital contribution requirements. By executing this document, the entity ensures that its internal records remain consistent with current business practices and state compliance standards.

Legal Framework and Statutory Authority

Limited Liability Companies are creatures of state statute, and the validity of any modification to their governing documents is rooted in state-specific legislation. While federal laws like the Internal Revenue Code impact how these changes affect taxation, the procedural mechanics of an LLC Operating Agreement amendment are governed by laws such as the Revised Uniform Limited Liability Company Act (RULLCA) or specific state codes like the Delaware Limited Liability Company Act. These statutes generally provide default rules that apply when an operating agreement is silent on a particular issue. However, courts typically uphold the contractual freedom of the members to define their own amendment procedures within the original agreement, provided these procedures do not violate mandatory statutory provisions or public policy.

Voting Thresholds and Member Consent

The process for approving a modification to the company's internal rules is dictated primarily by the amendment provision contained in the original operating agreement. This clause establishes the voting threshold required to ratify changes, which may range from a simple majority of percentage interests to a supermajority or unanimous consent. In the absence of a specific provision in the original document, state default rules apply. Under the Uniform Limited Liability Company Act (ULLCA), for instance, the default rule often requires the unanimous consent of all members to amend the operating agreement. This requirement protects minority members from being unfairly prejudiced by fundamental changes to the business structure or profit allocations without their agreement.

Essential Elements of a Valid Amendment

To ensure enforceability and clarity, specific components must be present within the document. A well-drafted amendment functions as an addendum to the original contract and must clearly identify the relationship between the old and new terms. Failure to include these elements can lead to ambiguity in the event of a member dispute or litigation.

- Identification of the Original Agreement: The document must cite the name of the LLC and the date of the original operating agreement being modified.

- Specific Reference to Amended Clauses: The text should clearly state which articles or sections are being changed, deleted, or added.

- Text of the Amendment: The new language must be written explicitly to replace or supplement the previous terms.

- Effective Date: The date upon which the changes become legally binding must be specified.

- Signatures of Authorized Members: The document requires signatures from the number of members necessary to meet the voting threshold defined in the original agreement.

Common Reasons for Modification

Business entities are dynamic, and an LLC Operating Agreement amendment is frequently necessary to reflect operational realities. One of the most common triggers is the alteration of membership structure, occurring when a member departs, sells their interest, or when a new investor is brought on board. This often necessitates a recalculation of ownership percentages and voting rights. Additionally, changes in the managerial structure—shifting from member-managed to manager-managed, or vice versa—require formal amendments to redefine roles and fiduciary duties. Financial adjustments, such as changes to the distribution of profits and losses or requirements for additional capital calls, are also critical events that demand formal documentation to prevent future liability issues.

Restated Operating Agreements vs. Amendments

When a company undergoes substantial changes or has accumulated multiple amendments over time, members may opt for a "Restated Operating Agreement" rather than a simple amendment. While an amendment changes specific sections while leaving the remainder of the contract intact, a restated agreement integrates all prior amendments and current changes into a single, consolidated document. This supersedes the previous agreement entirely. Legal professionals often recommend restating the agreement when the volume of changes makes the governing documents difficult to read or interpret, thereby reducing the risk of conflicting clauses.

Regulatory Compliance and Record Keeping

Unlike Articles of Organization, which are filed publicly with the Secretary of State, an amendment to the operating agreement is typically an internal document. However, maintaining a pristine paper trail is vital for preserving the limited liability protection of the entity. Courts may "pierce the corporate veil" if an LLC fails to maintain proper records, treating the entity as a sole proprietorship or partnership and exposing members to personal liability. Furthermore, certain changes reflected in an amendment, such as a change in the company's name or management structure, may trigger a requirement to file distinct forms with state authorities or update information with the Internal Revenue Service, specifically regarding the Employer Identification Number (EIN) or tax classification.

FAQs

Do you have a question about a LLC Operating Agreement Amendment?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!