A Washington Lease Agreement is a legal contract between a landlord and tenant that outlines the terms of a rental arrangement within the state jurisdiction.

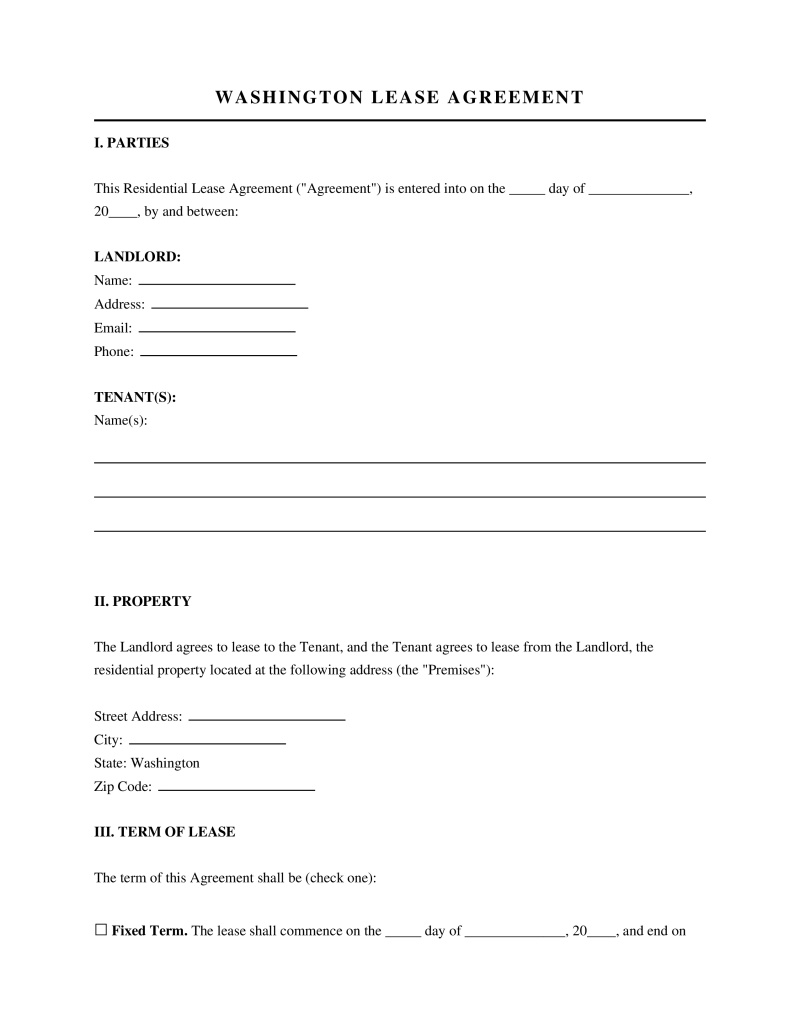

Lease Type

Select the lease structure that best fits your rental arrangement. 'Fixed Term' leases have a set end date, while 'Month-to-Month' leases renew automatically each month.

Table of Contents

What is a Washington Lease Agreement?

A Washington Lease Agreement is a legally binding contract executed between a landlord and a tenant to establish the terms for renting property within the state. This document outlines critical details such as the monthly rental amount, the duration of the tenancy, and the specific responsibilities assigned to each party regarding maintenance and utilities. It serves as the primary legal framework governing the landlord-tenant relationship, ensuring that both parties adhere to the Revised Code of Washington (RCW) regarding residential or commercial tenancies.

Legal Framework and Statutory Requirements

The primary statutory framework governing rental contracts in the state is the Residential Landlord-Tenant Act, found under Title 59 of the Revised Code of Washington (RCW 59.18). This legislation establishes minimum standards for habitable housing, security deposit regulations, and eviction procedures. Unlike some jurisdictions that rely heavily on common law, Washington provides a comprehensive statutory code that supersedes conflicting lease terms; any provision in a lease that attempts to waive rights guaranteed by the Act is generally considered void and unenforceable. Furthermore, specific municipalities, such as Seattle, have enacted additional ordinances that provide enhanced protections for tenants, requiring landlords to navigate both state and local regulations when drafting these documents.

Mandatory Disclosures in Washington

To ensure a Washington Lease Agreement is valid and enforceable, landlords must include specific disclosures mandated by state and federal law. Failure to include these items can lead to legal penalties or the inability to withhold security deposits.

- Fire Safety and Protection: Landlords must provide a written notice describing the fire safety and protection information, including whether the unit has a smoking policy, if it has a fire sprinkler system, and where smoke detectors are located.

- Mold Handout: Under RCW 59.18.060, a handout provided by the Department of Health regarding the dangers of mold and how to minimize it must be distributed to tenants.

- Lead-Based Paint: For any property built before 1978, federal law requires the disclosure of known lead-based paint hazards and the provision of an EPA-approved information pamphlet.

- Security Deposit Receipt: The name and address of the financial institution where the security deposit is held must be disclosed in the agreement.

- Move-In Checklist: A signed statement detailing the condition of the unit is required if a security deposit is collected, per RCW 59.18.260. Without this checklist, the landlord is liable for the entire deposit amount.

- Voter Registration: In Seattle specifically, landlords are often required to provide voter registration information to new tenants.

Security Deposits and Financial Regulations

Washington law imposes strict regulations on how security deposits are handled to prevent misappropriation of funds. Landlords are required to hold security deposits in a trust account separate from their personal funds, and they must provide the tenant with the location of these funds. Upon the termination of a Washington Lease Agreement, the landlord has 21 days to return the deposit or provide a written statement explaining why any portion was retained. If a landlord fails to adhere to the move-in checklist requirement or the 21-day return window, they may be liable for the full amount of the deposit plus potential legal costs. Non-refundable fees, such as cleaning fees, must be clearly distinguished from refundable deposits in the written contract to avoid confusion.

Lease Termination and Eviction Procedures

The termination of a tenancy depends heavily on the type of lease structure, such as a fixed-term versus a month-to-month arrangement. For month-to-month tenancies, Washington state law traditionally required a 20-day written notice from the landlord to terminate the agreement without cause, although recent legislative changes and local ordinances have introduced "just cause" eviction requirements in many areas. Fixed-term leases typically expire automatically at the end of the specified period unless the contract states otherwise. In cases of non-payment of rent, landlords must issue a 14-day notice to pay or vacate before commencing formal eviction proceedings. This period allows the tenant time to cure the default before the landlord can file an unlawful detainer action.

Landlord and Tenant Duties

Under the warranty of habitability implied in every residential lease, landlords are obligated to keep the premises fit for human habitation. This includes maintaining structural components, plumbing, heating, and electrical systems in good working order. Tenants, conversely, are responsible for maintaining the unit in a sanitary condition, paying rent on time, and refraining from causing intentional damage to the property. If a landlord fails to make necessary repairs within a statutory timeframe after receiving written notice, tenants may have legal remedies, including the right to repair and deduct the cost from rent or, in severe cases, terminate the lease without penalty.

Frequently Asked Questions

Do you have a question about a Washington Lease Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!