A Tennessee Lease Agreement is a legal document that establishes the rights and obligations of landlords and tenants regarding a rental property in Tennessee.

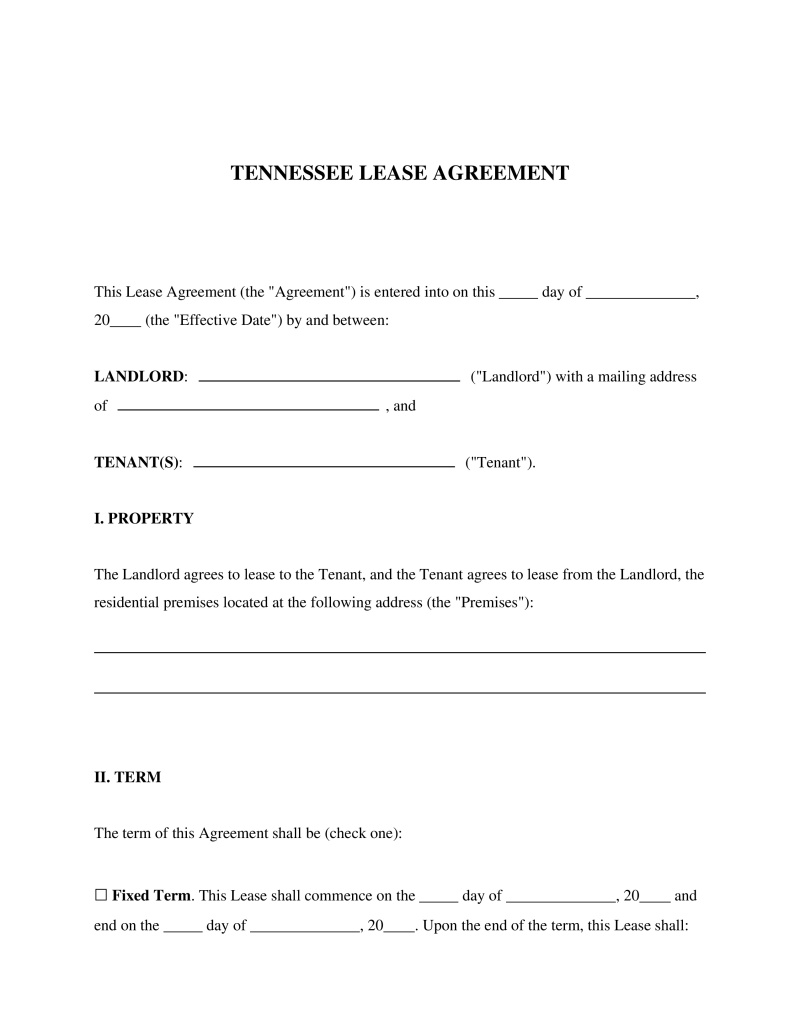

Lease Type

Select the lease structure that best fits your rental arrangement. 'Fixed Term' leases have a set end date, while 'Month-to-Month' leases renew automatically each month.

Table of Contents

What is a Tennessee Lease Agreement?

A Tennessee lease agreement is a legally binding contract entered into by a landlord and a tenant to outline the terms of a rental arrangement for real estate within the state. This document serves as the governing framework for the tenancy, detailing critical information such as the monthly rent amount, payment due dates, security deposit requirements, and the duration of the lease. It is utilized by property owners to secure their assets and by tenants to establish their rights to occupy a specific premise. The agreement ensures that both parties understand their obligations under the Tennessee Uniform Residential Landlord and Tenant Act and other relevant state statutes.

Legal Framework and the URLTA

The legal structure governing rental contracts in Tennessee is primarily found in the Tennessee Uniform Residential Landlord and Tenant Act (URLTA). This Act, located under Title 66, Chapter 28 of the Tennessee Code, applies specifically to counties with a population exceeding 75,000 according to the federal census. In counties with smaller populations, the general Tennessee Code applies, though many landlords voluntarily adopt URLTA standards to ensure comprehensive legal coverage. The URLTA standardizes the rights and remedies available to landlords and tenants, addressing issues such as maintenance duties, access to the premises, and eviction procedures. It explicitly prohibits lease clauses that attempt to waive a tenant's statutory rights or limit the landlord's liability for failing to perform legal duties.

Required Disclosures and Landlord Obligations

State law mandates that specific disclosures be included in or attached to a Tennessee lease agreement before the tenancy commences. The landlord must provide the tenant with the name and address of the property owner and any agent authorized to manage the premises or act on behalf of the owner for service of process. Additionally, if a security deposit is collected, the landlord must disclose the location of the separate bank account where the funds are held. For properties constructed prior to 1978, federal law necessitates the inclusion of a lead-based paint disclosure form to inform tenants of potential health risks associated with lead exposure.

Key Components of a Valid Tennessee Lease

- Identification of Parties: The full legal names of the landlord and all adult tenants responsible for the lease.

- Premises Description: The physical address of the rental unit, including unit numbers and any included storage areas or parking spaces.

- Term of Tenancy: The specific start and end dates for fixed-term leases, or the conditions for month-to-month arrangements.

- Rent Specifics: The total amount due, the due date, acceptable payment methods, and the policy regarding grace periods.

- Security Deposit Terms: The amount of the deposit, the bank location where it is held, and conditions for its return.

- Signatures: The dated signatures of all parties involved to validate the contract.

Security Deposits and Financial Regulations

Tennessee provides specific regulations regarding the handling of security deposits to protect tenant funds. While there is no statutory limit on the amount a landlord may charge, the funds must be deposited into an account used solely for that purpose in a financial institution subject to state or federal regulations. Upon the termination of the lease, the landlord is required to inspect the premises and compile a comprehensive list of damages if they intend to retain any portion of the deposit. The tenant has the right to inspect the premises alongside the landlord to verify these damages. Failure to follow these strict procedural rules regarding the holding and returning of deposits can result in the landlord forfeiting their right to retain the funds.

Rights and Responsibilities of the Parties

A Tennessee lease agreement establishes a reciprocal relationship of rights and duties. Landlords are obligated to maintain the premises in a fit and habitable condition, complying with all applicable building and housing codes materially affecting health and safety. They must also make all necessary repairs to keep the unit in a liveable condition. Tenants, in turn, are responsible for keeping the part of the premises they occupy as clean and safe as conditions permit. They must dispose of waste properly, use all electrical, plumbing, and HVAC systems in a reasonable manner, and refrain from deliberately or negligently destroying or damaging any part of the property.

Relevant Statutes and Legal Penalties

The enforceability of a Tennessee lease agreement relies on adherence to state laws, specifically Tennessee Code Annotated (TCA) Title 66, Chapter 28. Under TCA § 66-28-301, landlords are strictly regulated on security deposit procedures; failing to deposit funds into a separate account prevents the landlord from keeping any part of the deposit for damages. Regarding late fees, TCA § 66-28-201 stipulates a mandatory five-day grace period. Landlords cannot charge a late fee until five days have passed since the rent due date, and the fee cannot exceed 10% of the past-due amount. Federal requirements, such as the Residential Lead-Based Paint Hazard Reduction Act (42 U.S. Code § 4852d), impose heavy fines for non-compliance regarding lead disclosures in older buildings.

Frequently Asked Questions

Do you have a question about a Tennessee Lease Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!