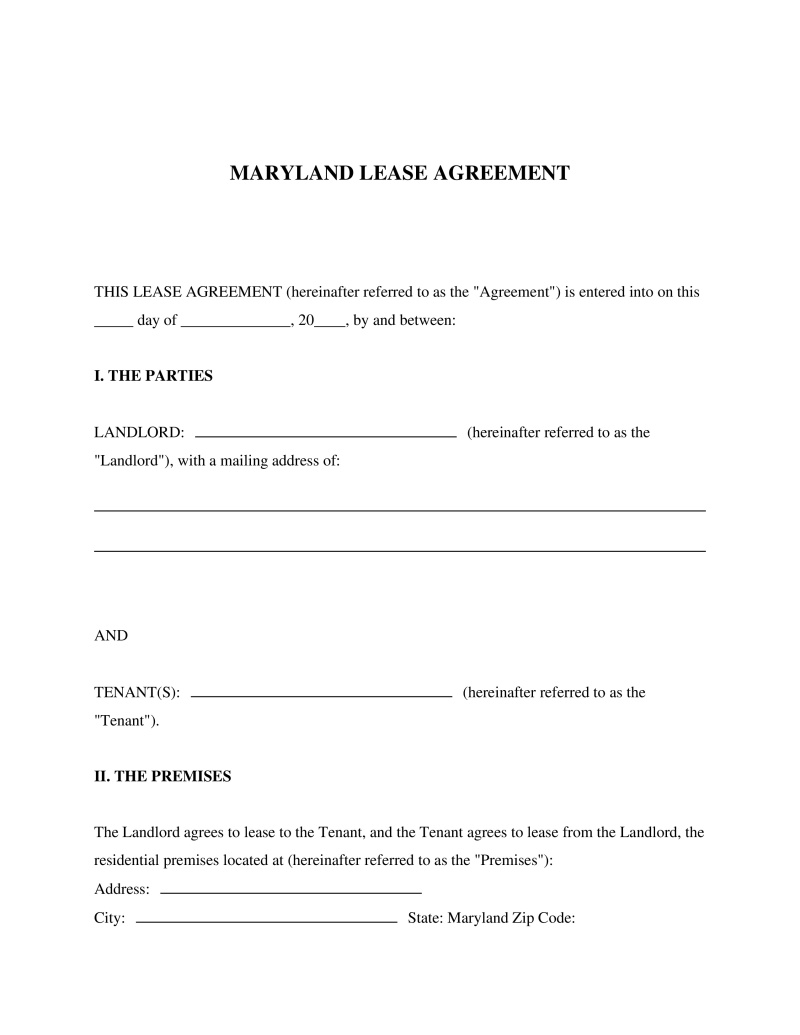

A Maryland Lease Agreement is a legal form used to set the rules, rental terms, and obligations that govern the landlord-tenant relationship for any property rented within the state of Maryland.

Lease Type

Select the lease structure that best fits your rental arrangement. 'Fixed Term' leases have a set end date, while 'Month-to-Month' leases renew automatically each month.

Table of Contents

What is a Maryland Lease Agreement?

A Maryland Lease Agreement is a legally binding contract executed between a landlord (lessor) and a tenant (lessee) granting the tenant the right to occupy a specific property for a defined period in exchange for rent. This document outlines the specific terms and conditions governing the tenancy, including payment schedules, maintenance responsibilities, and rules regarding property usage. It serves as the primary legal framework for the landlord-tenant relationship within the state, providing recourse for both parties should disputes arise regarding the occupancy or financial obligations. While oral agreements can exist for short tenancies, written contracts are standard for clearly defining the rights and obligations of both parties.

Legal Framework and Governing Statutes

The governance of lease agreements in Maryland is primarily dictated by the Real Property Article of the Annotated Code of Maryland. Specifically, Title 8 covers Landlord and Tenant regulations, establishing the baseline requirements for residential and commercial tenancies. These statutes define everything from security deposit limits to eviction procedures. Unlike some jurisdictions that rely heavily on common law, Maryland has codified specific requirements that override conflicting lease terms. For instance, provisions that attempt to waive a tenant's right to a jury trial or authorize the landlord to seize tenant property without a court order are generally void under state law regardless of what the signed document states.

Security Deposit Regulations

One of the most strictly regulated aspects of a Maryland Lease Agreement is the handling of security deposits. Under the Real Property Article, a landlord cannot charge a security deposit greater than the equivalent of two months' rent. If a landlord collects an amount exceeding this limit, the tenant may be entitled to recover up to three times the extra amount. Furthermore, landlords must return the deposit, minus any lawful deductions for damages or unpaid rent, within 45 days of the tenancy termination. Simple interest must accrue on security deposits of $50 or more if held for at least six months, calculated according to the daily U.S. Treasury yield curve rate or a statutory minimum of 1.5% per year.

Required Disclosures and Addenda

To ensure the validity of the contract and avoid potential legal penalties, landlords must provide specific information to tenants prior to or at the time of lease signing. Failure to include these disclosures can result in legal penalties or the inability to withhold security deposits for damages.

- Security Deposit Receipt: A written receipt describing the tenant's rights regarding the security deposit, including the right to be present for a move-out inspection.

- Habitability Statement: A statement confirming the premises are in a habitable condition and identifying any known defects that might affect the tenant's use of the property.

- Agent Identification: The name and address of the landlord or the agent authorized to accept service of process on behalf of the owner.

- Lead-Based Paint Disclosure: Required for all properties built before 1978, complying with federal regulations under 42 U.S. Code § 4852d.

How to Execute a Maryland Lease Agreement

Establishing a formal tenancy involves several procedural steps to ensure compliance with state laws and local ordinances. Following a structured process helps protect the interests of both the property owner and the occupant.

Step 1: Tenant Screening - The landlord reviews the potential tenant's credit history, criminal background, and rental references to assess suitability and financial stability.

Step 2: Drafting the Agreement - The lease is prepared using a template that complies with Maryland Real Property Code, Title 8, ensuring all prohibited clauses are excluded and local laws (such as those in Montgomery County or Baltimore City) are respected.

Step 3: Providing Disclosures - The landlord presents federally required lead paint documents and state-mandated security deposit receipts to the tenant for review.

Step 4: Signing and Deposit - Both parties sign the document, and the tenant pays the security deposit and first month's rent as stipulated in the contract.

Step 5: Move-In Inspection - The landlord and tenant conduct a walkthrough to document existing damages within 15 days of occupancy, which protects the tenant's deposit upon move-out.

Termination and Eviction Procedures

The termination of a lease requires adherence to specific notice periods, which vary depending on the term of the lease and the location of the property. For a standard year-to-year lease, the state generally requires a written notice of intent to terminate at least three months before the expiration date. However, month-to-month tenancies typically require a 30-day notice from the tenant or a 60-day notice from the landlord. It is important to note that Baltimore City and Montgomery County have local ordinances that may impose different notice requirements or "just cause" eviction standards. Landlords are prohibited from engaging in retaliatory evictions against tenants who file complaints with housing authorities or join tenant associations.

Frequently Asked Questions

Do you have a question about a Maryland Lease Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!