A Trust Amendment Form is a legal document used to make changes to an existing trust agreement without revoking it.

Grantor

Select 'Yes' if you are the Grantor making this amendment.

Table of Contents

What is a Trust Amendment Form?

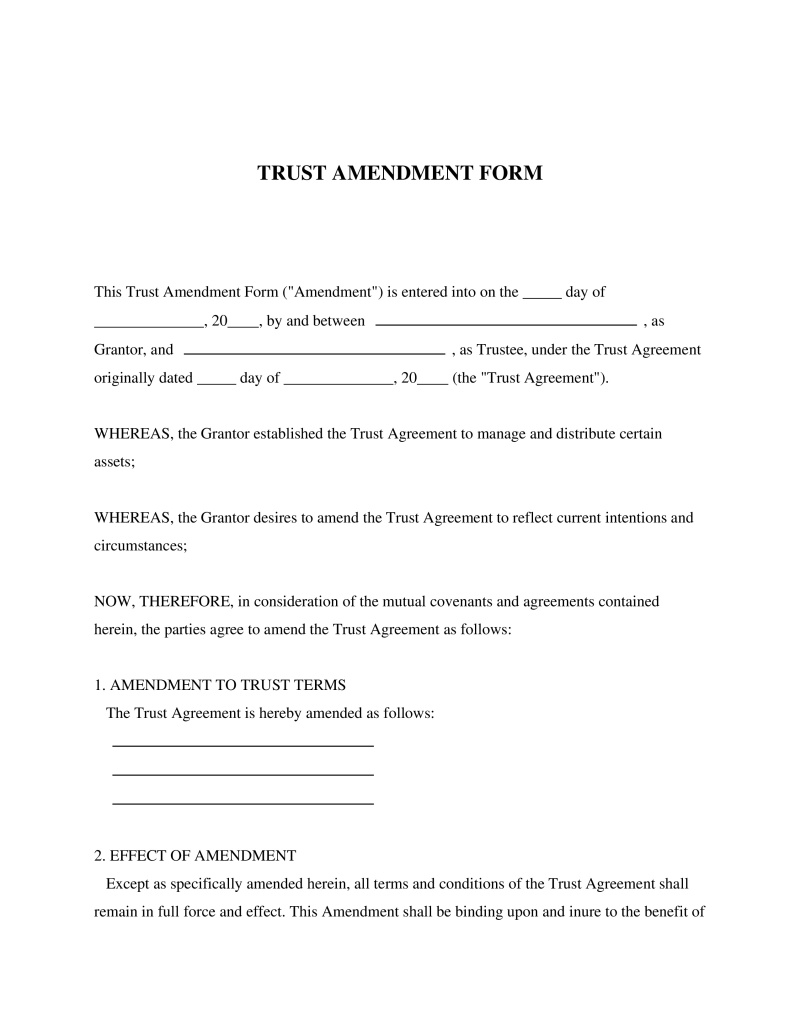

A Trust Amendment Form is a legally binding document that allows the settlor, or creator, of a trust to make specific changes or amendments to an existing trust without the need to create a new one. This flexibility can be essential for adapting to life changes, such as marriage, divorce, birth of children, or significant shifts in financial status. It serves not only as a tool for updating the terms of the trust in accordance with the settlor's evolving wishes but also ensures that these modifications are executed within legal parameters. Individuals who have established a living trust and wish to alter its provisions without revoking it entirely will find this form indispensable for ensuring their estate planning reflects their current intentions.

Key Features

Important Provisions

- Identification of the original trust document including date and parties involved.

- Specific description of each amendment being made and its effect on the original provisions.

- Signatures of all relevant parties, including witnesses or a notary public where required by law.

- An assertion that all other terms of the original trust remain unchanged except those explicitly amended.

Pros and Cons

Pros

- +Simplifies the process of modifying a trust by providing a clear framework for alterations.

- +Helps maintain the validity of the trust by ensuring amendments comply with legal standards.

- +Prevents the need for creating an entirely new trust, saving time and potentially legal fees.

- +Increases flexibility in estate planning by allowing adjustments to reflect current wishes.

- +Enhances clarity and reduces disputes among beneficiaries by documenting changes formally.

Cons

- -May require consultation with a legal professional to ensure amendments do not inadvertently affect other aspects of the trust.

- -Not suitable for revoking a trust entirely; only modifications can be addressed.

- -State laws vary regarding trust amendments, potentially complicating compliance.

Common Uses

- Updating beneficiaries due to life events such as marriage, divorce, or birth of children.

- Modifying trustee appointments if the original trustee can no longer serve or is unsuitable.

- Adjusting distribution instructions to reflect changes in financial circumstances or intentions.

- Adding or removing specific assets from the trust as part of asset management strategies.

- Correcting errors or ambiguities discovered in the original trust document.

Frequently Asked Questions

Do you have a question about a Trust Amendment Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!