A Trust Agreement is a legal document that establishes a trust to manage and distribute assets for beneficiaries, offering protection and tax benefits.

Grantor Full Name

Please provide the legal name of the grantor.

Table of Contents

What is a Trust Agreement?

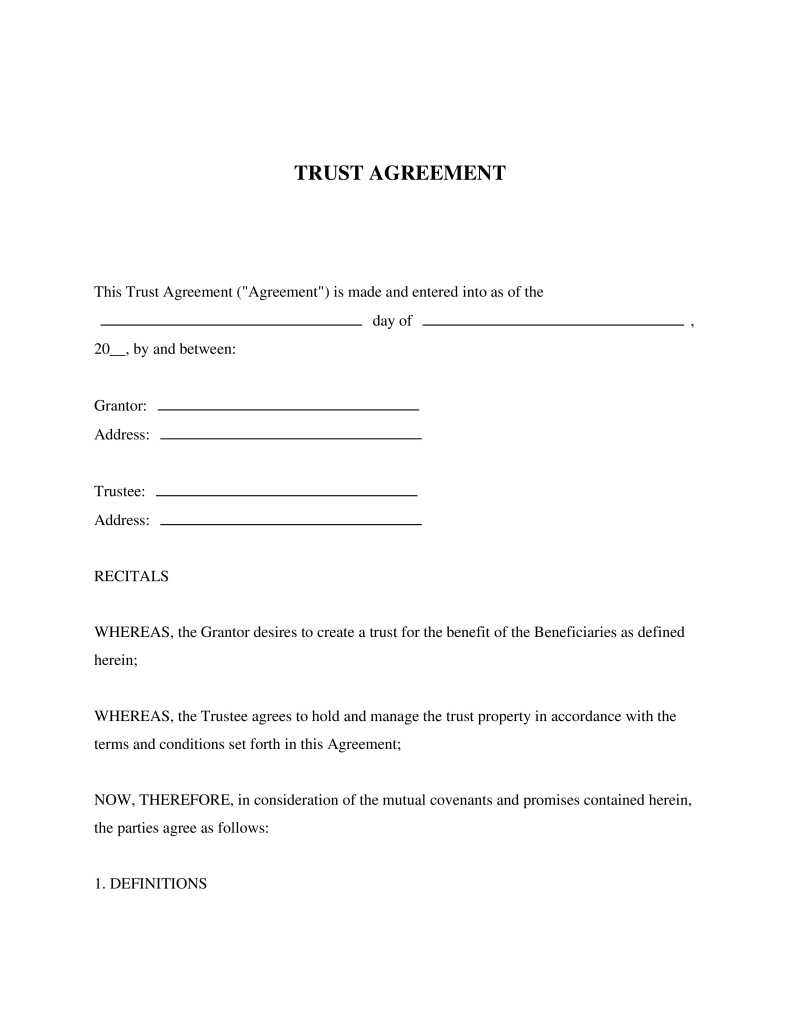

A Trust Agreement is a legally binding document that establishes a trust, detailing the rules and conditions under which assets are held and managed by a trustee for the benefit of designated beneficiaries. It is crafted to provide clarity on how the trust operates, specifying what is a trust, the roles of the grantor (the individual who creates the trust) and the trustee (the entity or person responsible for managing the trust according to its terms), and how assets within the trust are to be distributed. This document is crucial for individuals seeking to manage their estate, protect their assets, or ensure financial provision for loved ones without the need for probate proceedings. By setting up a trust, grantors can potentially safeguard their wealth and secure a financial future for their beneficiaries under terms they specify.

Key Features

Important Provisions

- Identification of parties involved: Grantor(s), Trustee(s), and Beneficiary(ies)

- Detailed description of trust property subject to management under the agreement

- Distribution terms specifying how and when assets will be distributed to beneficiaries

- Trustee powers and duties outlining what actions trustees are authorized and obligated to perform

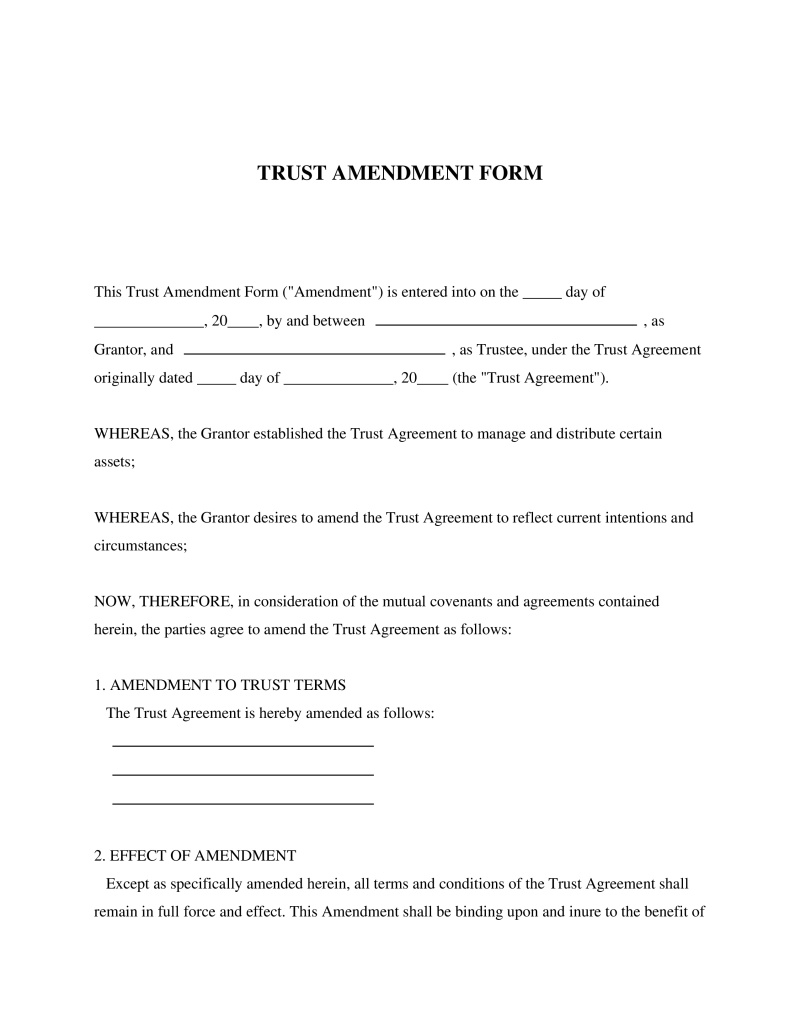

- Revocation or amendment clauses detailing under what circumstances the trust can be changed or dissolved

Pros and Cons

Pros

- +Helps avoid probate by directly transferring assets to beneficiaries, potentially saving time and reducing legal fees.

- +Offers a high level of privacy since trusts typically do not become public record, unlike wills that go through probate.

- +Can be tailored to specific wishes regarding asset distribution, including staggered distributions or conditions beneficiaries must meet.

- +Provides asset protection against creditors or legal judgments under certain conditions.

- +Allows for efficient management and transfer of diverse types of assets across generations.

Cons

- -Setting up a trust can be complex and may require assistance from a legal professional, increasing initial costs.

- -Requires active management and administration by the trustee, which could lead to potential conflicts if not carefully chosen.

- -May have tax implications that need to be thoroughly understood and planned for.

Common Uses

- Managing and protecting family wealth across generations

- Providing for minors or dependents with special needs without disrupting government aid

- Ensuring financial privacy and avoiding probate proceedings

- Holding life insurance policies to provide liquidity for estate taxes or other expenses

- Consolidating ownership of various types of property (real estate, investments) under one management structure

- Setting aside funds for charitable purposes while retaining some control over how they are used

Frequently Asked Questions

Related Documents

Do you have a question about a Trust Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!