A Multi Member LLC Operating Agreement is a legal document outlining the management structure and operational procedures of a multi-member LLC.

Llc Management Structure

Choose whether the LLC will be managed by its members or by appointed managers. This affects decision-making authority and daily operations.

Table of Contents

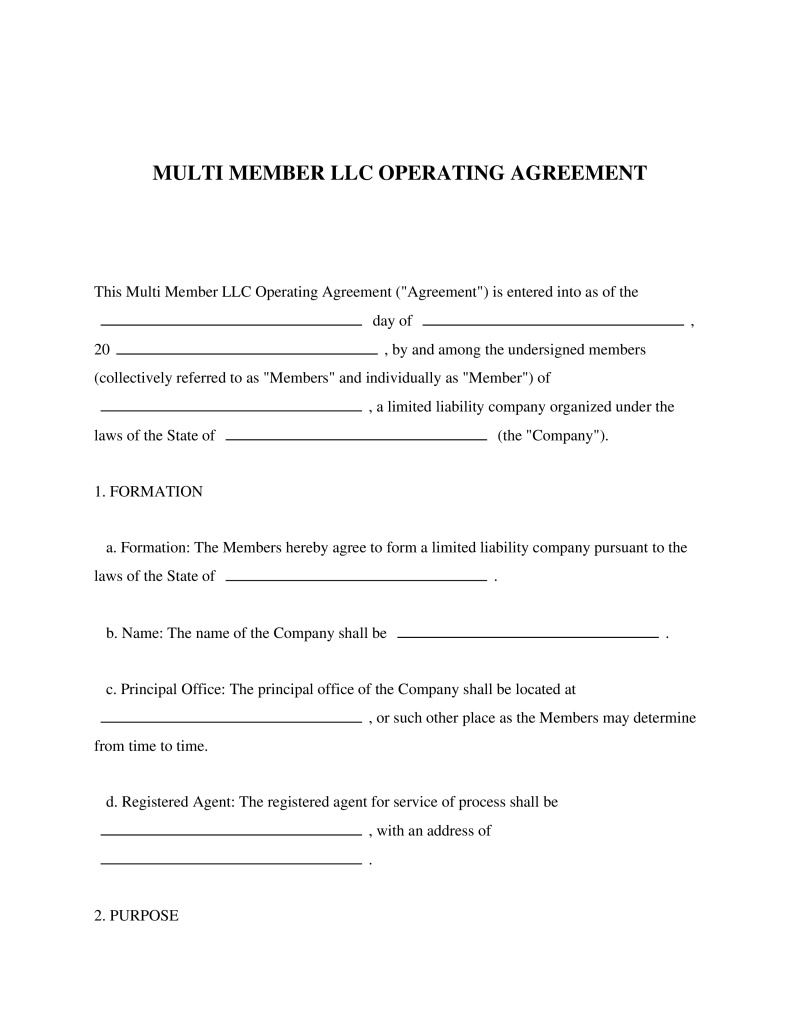

What is a Multi Member LLC Operating Agreement?

A Multi Member LLC Operating Agreement serves as a private, binding contract between the owners (members) of a limited liability company that has two or more stakeholders. This document outlines the internal management structure, financial procedures, and the specific rights and responsibilities governing each member's interaction with the business. While the Articles of Organization establish the company's existence with the state, the Operating Agreement dictates how the business functions internally and overrides default state statutes that might otherwise apply to the entity's operations.

Management Structures in Multi Member LLCs

The operating agreement must explicitly define how the company handles daily operations and high-level decision-making. LLCs generally adopt one of two primary management structures, which significantly impacts the drafting of the agreement:

- Member-Managed Structure - All owners participate directly in the daily operations and decision-making processes of the business. This structure functions similarly to a general partnership where every member has the authority to bind the company to contracts and debts.

- Manager-Managed Structure - The members appoint one or more managers to handle daily operations while the members retain authority only over major decisions such as selling assets or dissolving the company. This structure suits entities where some investors want a passive role without daily involvement.

Essential Components of the Agreement

A comprehensive agreement addresses various operational and financial aspects to prevent future disputes. Key elements typically included in these documents ensure clarity regarding ownership and protocol:

- Capital Contributions - The agreement details the initial amount of money or property each member invests to start the LLC.

- Ownership Percentages - Equity is often divided based on capital contributions, though members may agree to different split percentages.

- Profit and Loss Distribution - The document specifies how the company allocates profits and losses among members, which may differ from ownership percentages.

- Voting Rights and Procedures - Provisions establish whether voting power correlates with ownership percentage or remains equal per head (one person, one vote).

- Transfer of Membership Interest - Restrictions often limit a member's ability to sell or transfer their ownership stake to outside parties without current member approval.

- Dissolution Terms - The text outlines specific events or processes that trigger the winding down and closing of the business.

Legal Statutes and Regulatory Requirements

State and federal laws govern the formation and operation of Limited Liability Companies. These statutes provide the framework for liability protection and tax classification:

- Revised Uniform Limited Liability Company Act - Provides default rules for LLC governance in states that have adopted this model legislation (RULLCA § 101 et seq.).

- New York Publication Requirement - Mandates that LLCs publish a copy of the Articles of Organization or a notice of formation in two newspapers (NY Ltd Liab Co L § 206).

- California Operating Agreement Mandate - Requires all California LLCs to have an operating agreement, though it may be oral or written (Cal. Corp. Code § 17701.02).

- IRS Partnership Taxation Rules - Governs how multi-member LLCs report income and losses as pass-through entities unless they elect corporate taxation (26 U.S.C. § 701 et seq.).

- Self-Employment Tax Requirements - Stipulates that active members generally must pay self-employment taxes on their share of LLC earnings (26 U.S.C. § 1402).

How to Execute a Multi Member LLC Operating Agreement

Finalizing this document involves several critical steps to ensure it holds legal weight and accurately reflects the members' intentions:

Step 1: Negotiate Terms - Members must discuss and agree upon capital contributions, management roles, and profit-sharing ratios before drafting begins.

Step 2: Draft the Document - The entity creates a written agreement incorporating all negotiated terms, state-specific clauses, and necessary boilerplate provisions.

Step 3: Review and Consult - Each member reviews the draft, often with independent legal counsel, to verify that the terms protect their individual interests.

Step 4: Sign and Date - All members sign the final document to indicate their acceptance of the terms and conditions.

Step 5: Store Internally - The company keeps the signed agreement with its core business records; it is rarely filed with a government agency.

Tax Classifications and Financial Implications

The Internal Revenue Service treats multi-member LLCs differently than single-member entities. By default, the IRS classifies a multi-member LLC as a partnership for tax purposes. The business itself does not pay income tax. Instead, profits and losses pass through to the members, who report this information on their personal tax returns. The operating agreement often contains specific language regarding "Special Allocations," allowing the LLC to distribute profits and losses in a manner that does not strictly align with ownership percentages. This flexibility requires strict adherence to substantial economic effect regulations to withstand IRS scrutiny.

FAQs

Do you have a question about a Multi Member LLC Operating Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!