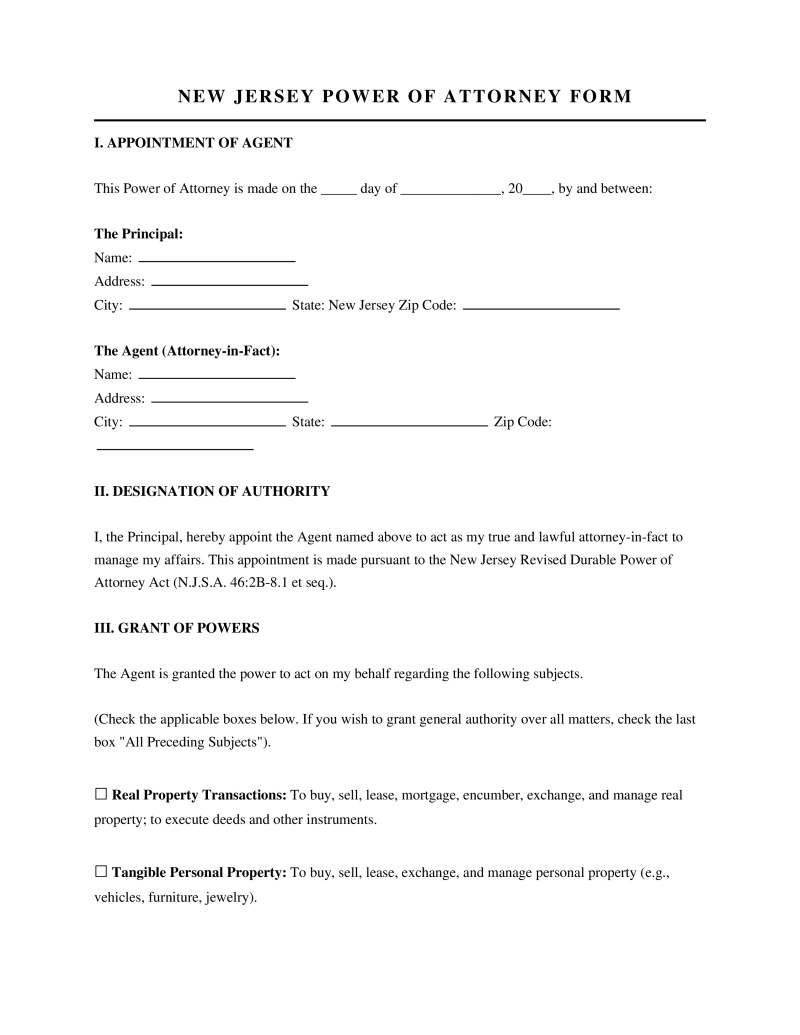

A New Jersey Power of Attorney form is a legal instrument authorizing an agent to manage financial or medical affairs on behalf of a principal under state law.

Poa Type

Select the type of authority you wish to grant. 'General' grants broad powers; 'Limited/Special' restricts authority to specific acts; 'Durable' remains in effect if the Principal becomes incapacitated; 'Springing' only becomes effective upon a specified event.

Table of Contents

What is a New Jersey Power of Attorney Form?

A New Jersey Power of Attorney Form is a legal instrument that authorizes an individual, referred to as the principal, to designate another person, known as the agent or attorney-in-fact, to make decisions and act on their behalf. This document allows the agent to manage financial affairs, real estate transactions, business operations, or healthcare decisions depending on the specific authority granted within the agreement. Residents of New Jersey utilize this tool to ensure their personal and professional matters continue to be managed efficiently during periods of absence, illness, or incapacitation.

Types of New Jersey Power of Attorney Form

State laws recognize several distinct variations of this document, each designed to address specific needs and durations of authority.

- General Power of Attorney - Grants the agent broad authority to handle financial and legal matters for the principal, effectively terminating if the principal becomes incapacitated or mentally incompetent.

- Durable Power of Attorney - Includes specific language stating that the agent's authority remains in effect or becomes effective upon the disability or incapacity of the principal.

- Limited Power of Attorney - Restricts the agent's powers to specific tasks, transactions, or time periods, such as handling a single real estate closing or managing affairs during a temporary absence.

- Medical Power of Attorney - Designates a healthcare representative to make medical decisions for the principal when they are unable to communicate their own wishes, often referred to in New Jersey as a Proxy Directive.

- Tax Power of Attorney - Authorizes a representative to handle tax matters, filings, and communications with the New Jersey Division of Taxation.

New Jersey Legal Statutes and Regulations

The creation, validity, and enforcement of power of attorney documents in New Jersey are governed by specific state statutes.

- Revised Uniform Power of Attorney Act - Establishes the comprehensive legal framework for financial powers of attorney, outlining the duties of agents and the rights of principals (N.J.S.A. 46:2B-8.1 et seq.).

- New Jersey Advance Directives for Health Care Act - Governs the appointment of healthcare representatives and the execution of medical directives (N.J.S.A. 26:2H-53 et seq.).

- Banking Power of Attorney Act - regulate the acceptance of powers of attorney by banking institutions and outlines the liability of banks regarding these documents (N.J.S.A. 46:2B-10 et seq.).

- Recording Requirements - Mandates that any power of attorney used to convey real estate must be acknowledged and recorded with the county clerk (N.J.S.A. 46:14-2.1).

Execution and Signing Requirements

For a Power of Attorney to be legally binding and accepted by third parties in New Jersey, specific execution formalities must be observed.

- Signature of Principal - The individual granting power must sign the document voluntarily and while of sound mind.

- Notarization - Financial powers of attorney should be signed before a Notary Public, especially if the agent will handle real estate transactions or record the document.

- Witnesses for Medical Directives - Healthcare proxies generally require the signatures of two witnesses or a Notary Public to be valid.

- Acknowledgement Language - The document must contain statutory language confirming the principal understands the significance of the powers being granted.

Agent Authority and Fiduciary Duties

The individual appointed as an agent assumes a fiduciary role, requiring them to act with the highest degree of good faith and loyalty toward the principal. New Jersey law imposes strict standards on the conduct of an attorney-in-fact to prevent abuse and exploitation.

- Duty of Loyalty - The agent must act solely in the best interest of the principal and avoid conflicts of interest.

- Record Keeping - Agents are required to maintain accurate records of all transactions, receipts, and disbursements made on behalf of the principal.

- Competence - The agent must act with the care, competence, and diligence tailored to the circumstances and the terms of the document.

- Preservation of Estate Plan - An agent should attempt to preserve the principal's estate plan if they possess knowledge of the plan and preservation is consistent with the principal's best interest.

Revocation of Power of Attorney

A principal retains the right to revoke a Power of Attorney at any time, provided they maintain the mental capacity to do so. Revocation effectively terminates the agent's authority to act. The process typically involves creating a formal revocation document.

- Written Notice - A formal document stating the intent to revoke the power of attorney should be drafted and signed.

- Distribution of Notice - Copies of the revocation must be delivered to the agent and any third parties, such as banks or hospitals, that have the original power of attorney on file.

- Recording Revocation - If the original power of attorney was recorded with the county clerk, the revocation instrument must also be recorded to legally terminate the authority regarding real estate.

- Automatic Revocation - Certain events, such as the death of the principal, automatically terminate the power of attorney.

FAQs

Do you have a question about a New Jersey Power of Attorney Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!