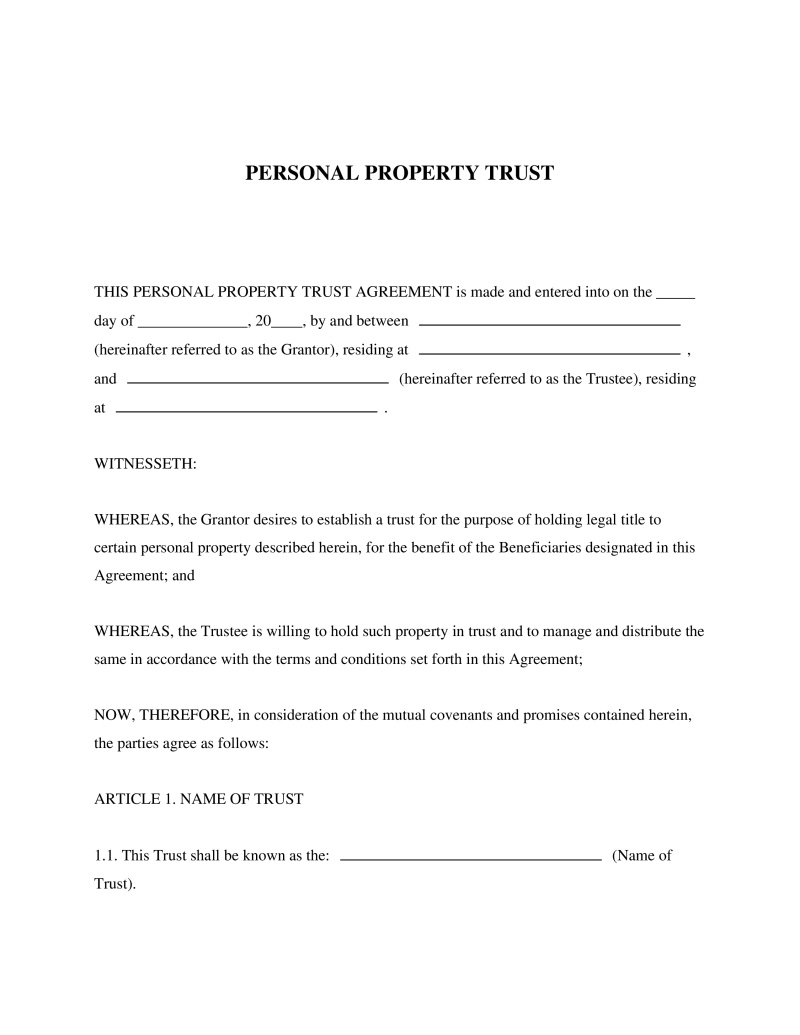

A Personal Property Trust is a legal document designed for individuals looking to establish a trust to manage and distribute personal assets. This document can be utilized by anyone seeking to safeguard their personal property and ensure its orderly transfer to beneficiaries.

Trust Type

Select 'Yes' if this is a new trust, or 'No' if you are amending an existing trust.

Table of Contents

What is a Personal Property Trust?

A Personal Property Trust is a legal arrangement that allows an individual to transfer ownership of their personal assets to a trust. This type of trust is designed to provide privacy and protect the assets from certain liabilities, while still allowing the grantor (the person who creates the trust) to control and benefit from the property. It is particularly beneficial for those who own valuable personal property, such as art collections, jewelry, or other significant assets, and wish to keep these assets protected and private. By placing assets into a Personal Property Trust, owners can potentially avoid probate, reduce their exposure to legal judgments, and manage how their assets are distributed upon their death.

Key Features

Important Provisions

- Identification of Trust Assets: A detailed list specifying which items are placed into trust.

- Designation of Trustee: Naming who will manage the trust's assets according to its terms.

- Beneficiary Designations: Outlining who will receive benefits from the trust's assets.

- Distribution Terms: Specific instructions on how and when beneficiaries are to receive trust assets.

Pros and Cons

Pros

- +Enhances privacy by keeping details of the asset holdings out of public record.

- +Reduces legal risk by potentially protecting assets from creditors and lawsuits.

- +Simplifies the process of transferring ownership of assets to beneficiaries without going through probate.

- +Grants the grantor continued control over their assets while they are alive.

- +Offers a structured way to plan for the orderly distribution of personal property upon death.

Cons

- -Setting up and maintaining a Personal Property Trust may incur administrative costs and fees.

- -Does not provide absolute protection against all legal claims or creditors.

- -Requires careful management to ensure that it remains effective and complies with relevant laws.

Common Uses

- Protecting valuable personal property such as art, antiques, or collectibles from potential lawsuits or claims.

- Ensuring privacy in the ownership and transfer of high-value items.

- Planning for succession or inheritance without the complications of probate court.

- Holding intellectual property or copyrights in a secure manner.

- Managing investments in tangible personal property with confidentiality.

Frequently Asked Questions

Do you have a question about a Personal Property Trust?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!