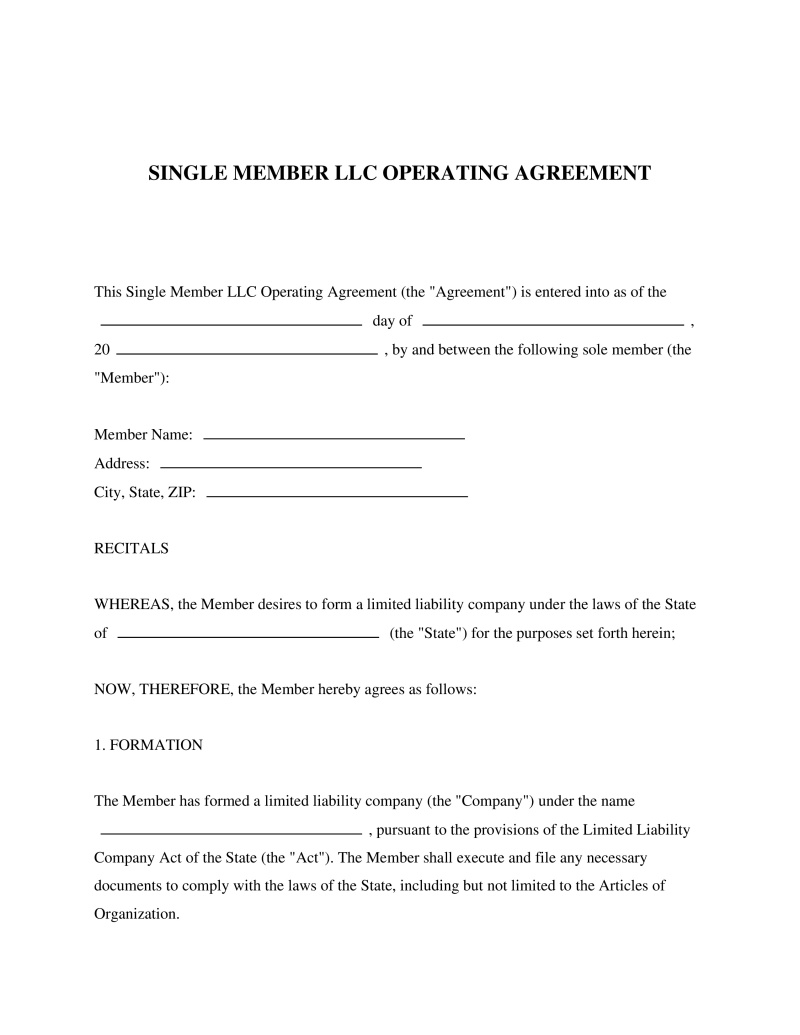

A Single Member LLC Operating Agreement outlines the management structure and operating procedures for a single-member limited liability company.

Owner Name

Write your full legal name as it appears on official documents, including your first name, middle name (if any), and last name. For example, if your name is John Michael Smith, you should write "John Michael Smith." This name will be used in legal proceedings, so it’s important to ensure it is accurate and complete.

Table of Contents

What is a Single Member LLC Operating Agreement?

A Single Member LLC Operating Agreement is a formal document that outlines the operational and financial decisions of a limited liability company (LLC) operated by a single owner, rather than multiple members. This document serves not only to establish the guidelines under which the LLC will operate but also to separate the business liabilities from the personal liabilities of the owner, providing a layer of protection for the owner's personal assets. It is an essential tool for any sole proprietor who wishes to structure their business as an LLC, ensuring that there is a clear legal distinction between the owner and the business itself. This agreement becomes particularly critical in providing documentation to financial institutions and potential investors, detailing the structure and policies of the business.

Key Features

Important Provisions

- "Organization" details concerning formation date, registered agent, and principal place of business.

- "Management and Voting" clauses specifying how decisions are made within the LLC by its single member.

- "Capital Contributions" section outlining how investments are made into the LLC by the member.

- "Distributions" provision detailing how profits are divided or reinvested back into the company.

- "Dissolution" clause explaining procedures for winding down or exiting the business.

Pros and Cons

Pros

- +Enhances credibility with lenders and investors by presenting a formalized structure of business operations.

- +Simplifies decision-making processes with predefined rules and procedures.

- +Protects personal assets from business debts and liabilities through clear separation.

- +Facilitates easier tax filing by outlining financial arrangements within the LLC.

- +Customizability allows for modifications tailored to specific business needs.

Cons

- -Requires time and effort to thoroughly customize and adapt to specific business situations.

- -May necessitate consultation with legal professionals to ensure comprehensive coverage and compliance.

- -In some jurisdictions, failing to adhere strictly to the agreement's terms could lead to loss of liability protection.

Common Uses

- Establishing operational guidelines for a new single-member LLC.

- Restructuring a sole proprietorship into an LLC for liability protection.

- Updating governance structures or operational procedures as a business evolves.

- Documenting financial arrangements such as profit sharing and capital contributions.

- Providing legal documentation to financial institutions or investors when required.

- Clarifying succession planning or dissolution terms for a single-member LLC.

Frequently Asked Questions

Do you have a question about a Single Member LLC Operating Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!