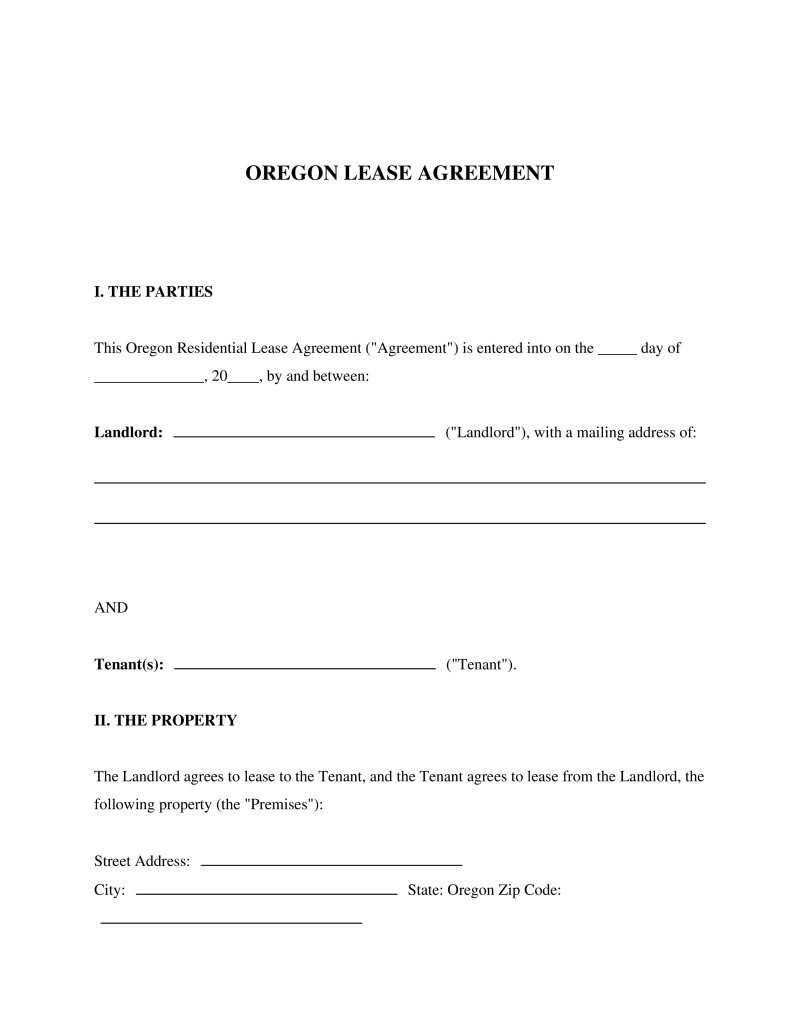

An Oregon Lease Agreement is a legal contract that outlines the rental arrangement between a landlord and tenant, detailing the terms, expectations, and obligations for leasing property in Oregon.

Lease Type

Select the lease structure that best fits your rental arrangement. 'Fixed Term' leases have a set end date, while 'Month-to-Month' leases renew automatically each month.

Table of Contents

What is an Oregon Lease Agreement?

An Oregon Lease Agreement is a legally binding contract entered into by a landlord and a tenant to outline the terms and conditions of renting a residential or commercial property within the state. This document serves as the formal record of the tenancy, detailing the rights, responsibilities, and obligations of all parties involved in the transaction. It is utilized by property owners, property management firms, and renters to establish clear guidelines regarding rent payments, property maintenance, and the duration of occupancy. By signing this agreement, both parties consent to adhere to the stipulations set forth, which must comply with Oregon state laws regarding landlord-tenant relationships.

Legal Framework and Statutory Requirements

The landlord-tenant relationship in Oregon is primarily governed by the Oregon Residential Landlord and Tenant Act, codified in Chapter 90 of the Oregon Revised Statutes (ORS). This comprehensive body of law dictates the permissible content of a lease and establishes minimum habitability standards that all rental units must meet. Unlike some jurisdictions that rely heavily on common law, Oregon has specific statutes addressing security deposits, fee structures, and eviction proceedings. Additionally, the state has implemented unique legislation, such as Senate Bill 608, which established statewide rent control and limitations on no-cause evictions, making it distinct from many other US jurisdictions.

Mandatory Disclosures in Oregon

For an Oregon Lease Agreement to be fully compliant, state law requires the landlord to provide specific disclosures to the tenant. These disclosures ensure that the tenant is fully informed about the condition of the property and the policies governing the tenancy. Omitting these required elements can result in legal liabilities for the property owner.

- Flood Plain Disclosure: If the rental property is located within a 100-year flood plain, the landlord must notify the tenant of this fact in the rental agreement.

- Smoking Policy: Oregon law requires a disclosure stating whether smoking is prohibited on the premises, allowed in specific areas, or allowed throughout the property.

- Pending Legal Actions: Landlords must disclose if the property is currently the subject of a foreclosure suit or if the property is in default.

- Utility and Service Charges: If the tenant is responsible for paying utilities that benefit other units or common areas, this must be clearly disclosed and explained in the agreement.

- Carbon Monoxide Alarms: The agreement or an addendum should confirm that the dwelling is equipped with functioning carbon monoxide alarms in compliance with state fire codes.

How to Execute an Oregon Lease Agreement

Creating and finalizing a valid lease requires attention to detail and adherence to statutory procedures. The following steps outline the standard process for executing this document.

- Step 1: Tenant Screening and Application – Before drafting the lease, the landlord typically collects a rental application to verify the tenant's income, credit history, and rental background, complying with fair housing laws.

- Step 2: Drafting the Agreement – The landlord prepares the document, inserting specific details such as the rent amount, due date, security deposit specifics, and all mandatory disclosures required by ORS Chapter 90.

- Step 3: Review and Negotiation – Both parties review the terms. While statutory rights cannot be waived, specific terms like pet policies or parking assignments may be negotiated.

- Step 4: Move-In Inspection – Prior to signing, the parties should conduct a walkthrough to document the current condition of the premises, often using a move-in checklist to avoid future disputes over security deposits.

- Step 5: Signing and Delivery – Both the landlord and tenant sign the agreement. The landlord is legally required to provide the tenant with a copy of the signed lease.

Rent Control and Security Deposits

Oregon imposes strict regulations on financial transactions between landlords and tenants. Under the statewide rent control measures, landlords are limited in the percentage by which they can increase rent annually. This cap is calculated based on the Consumer Price Index (CPI) plus a set percentage. Exemptions exist for government-subsidized housing and new construction less than 15 years old. Regarding security deposits, ORS 90.300 mandates that landlords must provide a receipt for any deposit collected.

- Landlords are required to return the deposit or provide a written accounting of any withholdings within 31 days after the tenancy terminates and the tenant delivers possession.

Frequently Asked Questions

Do you have a question about an Oregon Lease Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!