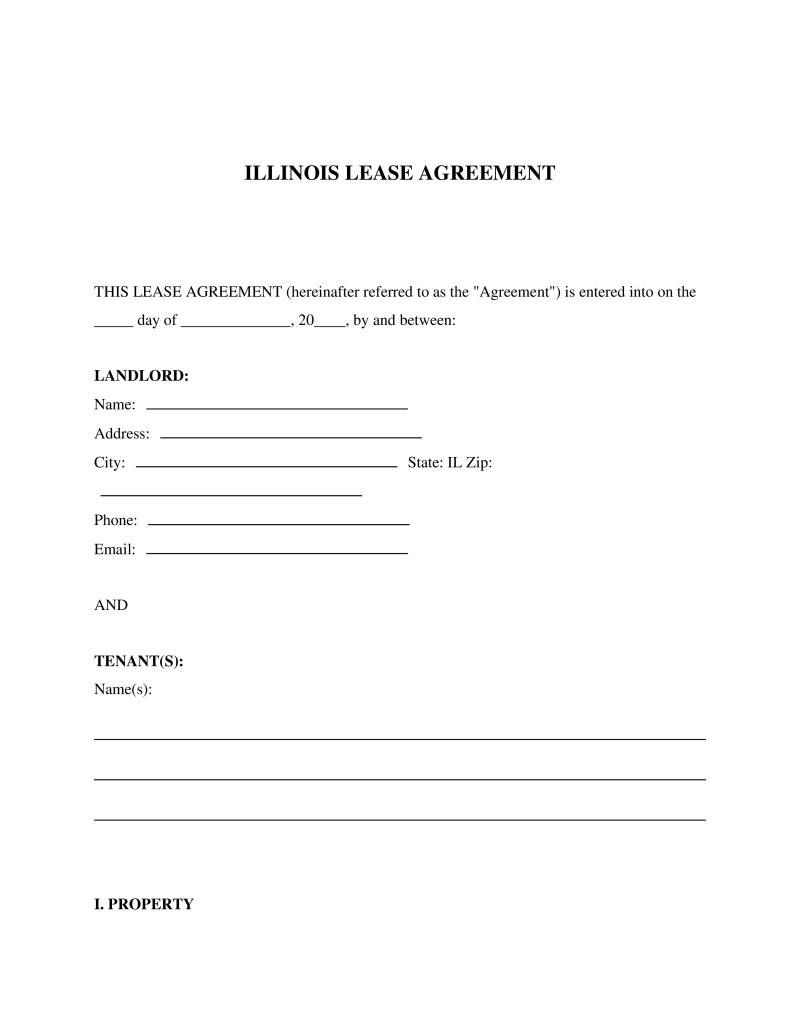

An Illinois Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for a rental of property in Illinois.

Lease Type

Select the lease structure that best fits your rental arrangement. 'Fixed Term' leases have a set end date, while 'Month-to-Month' leases renew automatically each month.

Table of Contents

What is an Illinois Lease Agreement?

An Illinois lease agreement is a legally binding contract between a landlord and a tenant that outlines the specific terms and conditions for renting a property within the state. This document establishes the rights and obligations of both parties regarding the use of residential or commercial real estate in exchange for regular rental payments. It serves as the primary governing instrument for the tenancy, detailing critical aspects such as the rent amount, lease duration, security deposits, maintenance responsibilities, and rules regarding property use. The agreement ensures that the arrangement complies with the Illinois Compiled Statutes and local ordinances, providing a clear framework for dispute resolution should issues arise.

Legal Framework and Statutory Requirements

The landlord-tenant relationship in Illinois is primarily governed by Chapter 765 of the Illinois Compiled Statutes (ILCS). Specifically, the Landlord and Tenant Act provides the statutory foundation for rental agreements. Additionally, the Security Deposit Return Act (765 ILCS 710) mandates strict guidelines regarding the handling and return of funds held as security. It is important to note that while state laws provide a baseline, local municipalities often have their own ordinances that supersede or add to state regulations. The most notable of these is the Chicago Residential Landlord and Tenant Ordinance (RLTO), which offers extensive protections to tenants in the city of Chicago and imposes strict liability on landlords for non-compliance.

Required Disclosures in Illinois

To execute a valid Illinois lease agreement, landlords must provide specific disclosures to the tenant before or at the time of signing. Federal law mandates that for any property constructed prior to 1978, a lead-based paint disclosure must be attached to the contract. At the state level, the Radon Awareness Act requires landlords to disclose any knowledge of radon hazards in the unit; if a radon test has indicated a hazard, the landlord must provide the tenant with a specific warning statement. Furthermore, if the rental unit shares a utility meter with other units or common areas, the landlord is legally obligated to disclose the formula used to calculate the tenant's portion of the utility bill under the Rental Property Utility Service Act.

Security Deposit Regulations

Illinois law does not impose a statutory cap on the maximum amount a landlord may charge for a security deposit. However, the state enforces strict rules regarding the return and management of these funds. For properties containing five or more units, the landlord must provide an itemized statement of damages within 30 days if deductions are made. If no deductions are claimed, the full deposit must be returned within 45 days of the tenant vacating the premises. Additionally, under the Security Deposit Interest Act, landlords managing complexes with 25 or more units are required to pay interest on deposits held for more than six months, calculated at a rate determined by the Illinois Department of Financial and Professional Regulation.

Essential Components of a Valid Illinois Lease

- Party Identification: Full legal names of the landlord and all adult tenants responsible for the lease.

- Property Description: The specific physical address of the rental unit, including unit numbers.

- Lease Term: The start and end dates of the tenancy, or specifications for a month-to-month arrangement.

- Financial Terms: The amount of rent, due date, acceptable payment methods, and any late fees.

- Security Deposit: The amount held, the financial institution where it is stored, and terms for its return.

- Rights of Entry: Conditions under which the landlord may enter the property (typically requiring notice).

- Maintenance Duties: Clarification of who is responsible for repairs, lawn care, and utilities.

Termination and Eviction Procedures

The process for terminating a tenancy is strictly defined by the Illinois Forcible Entry and Detainer Act. For standard lease violations involving non-payment of rent, a landlord must serve a 5-day notice to quit. If the tenant fails to pay within that window, the landlord may file for eviction. For other breaches of the lease agreement, such as unauthorized pets or noise violations, a 10-day notice is typically required. In the case of month-to-month tenancies without a specific cause for termination, either party must provide a 30-day written notice. Illinois law expressly prohibits "self-help" evictions, meaning a landlord cannot change locks, remove doors, or shut off utilities to force a tenant out without a court order.

Rent Control and Late Fees

The State of Illinois currently enforces the Rent Control Preemption Act, which prohibits local governments from enacting rent control measures. This means landlords generally have the discretion to set rent prices at market rates and increase them upon lease renewal, provided proper notice is given. Regarding late fees, while state law allows them, they must be reasonable and clearly stated in the written agreement. For Chicago specifically, the RLTO limits late fees to $10 for the first $500 of rent plus 5% of any amount exceeding $500, preventing excessive penalties.

FAQs

Do you have a question about an Illinois Lease Agreement?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!