An Irrevocable Trust form is used to establish a legal entity in which the grantor transfers assets into a trust, relinquishing control and ownership, to achieve tax benefits, asset protection, or estate planning objectives.

Purpose

Select whether the trust is for personal estate planning or business asset protection.

Table of Contents

What is an Irrevocable Trust?

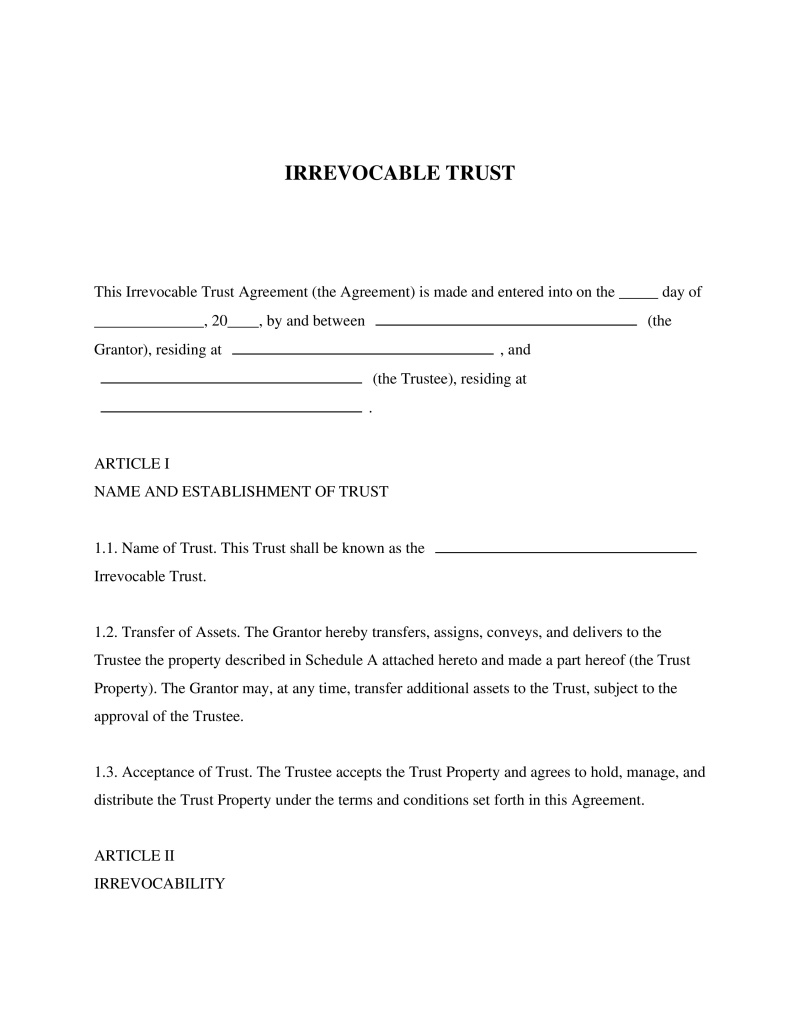

An Irrevocable Trust is a type of trust agreement that, once executed, cannot be altered, amended, or revoked by the grantor. This legal instrument effectively transfers ownership of assets from the grantor to the trust, providing a mechanism for property management and asset protection that is separated from the grantor's personal estate. Typically utilized for estate planning purposes, it can significantly reduce or eliminate estate taxes and offer protection against creditors and legal judgments. Individuals with substantial assets who wish to safeguard their estate for future generations while potentially benefiting from tax advantages often need this robust tool. Given its permanence, careful consideration is advised before establishment.

Key Features

Important Provisions

- Grantor's statement establishing the trust and transferring assets into it.

- Designation of a trustee(s) along with their powers and duties.

- Detailed description of how assets should be managed and distributed among beneficiaries.

- Provisions for amending or terminating the trust under specific circumstances, if allowed by law.

- Clauses addressing tax reporting and payment responsibilities.

Pros and Cons

Pros

- +Provides a strong layer of protection against creditors and legal judgments.

- +May significantly reduce or eliminate estate taxes, allowing more assets to pass to beneficiaries.

- +Ensures privacy as assets and distributions are not made public through probate.

- +Facilitates long-term financial planning and wealth preservation across generations.

- +Can be structured to support charitable giving objectives efficiently.

Cons

- -Lacks flexibility as changes cannot be made once it is established.

- -Setting up an irrevocable trust can be complex and may incur higher initial costs.

- -Could potentially create tension among beneficiaries if they disagree with the terms.

Common Uses

- To remove valuable assets from one's estate to minimize exposure to estate taxes.

- Protecting assets from potential future creditors or legal judgments.

- Providing for a disabled family member without affecting their eligibility for public assistance programs.

- Establishing a philanthropic legacy by allocating funds to charitable causes.

- Preserving wealth across generations with specific conditions attached to distributions.

- Funding life insurance policies outside of the taxable estate.

Frequently Asked Questions

Do you have a question about an Irrevocable Trust?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!