A Business Trust is a legal entity created by a trust agreement to conduct business for the benefit of its beneficiaries.

Is New Trust

Select 'Yes' if this is for a new trust. Select 'No' if amending an existing trust.

Table of Contents

What is a Business Trust?

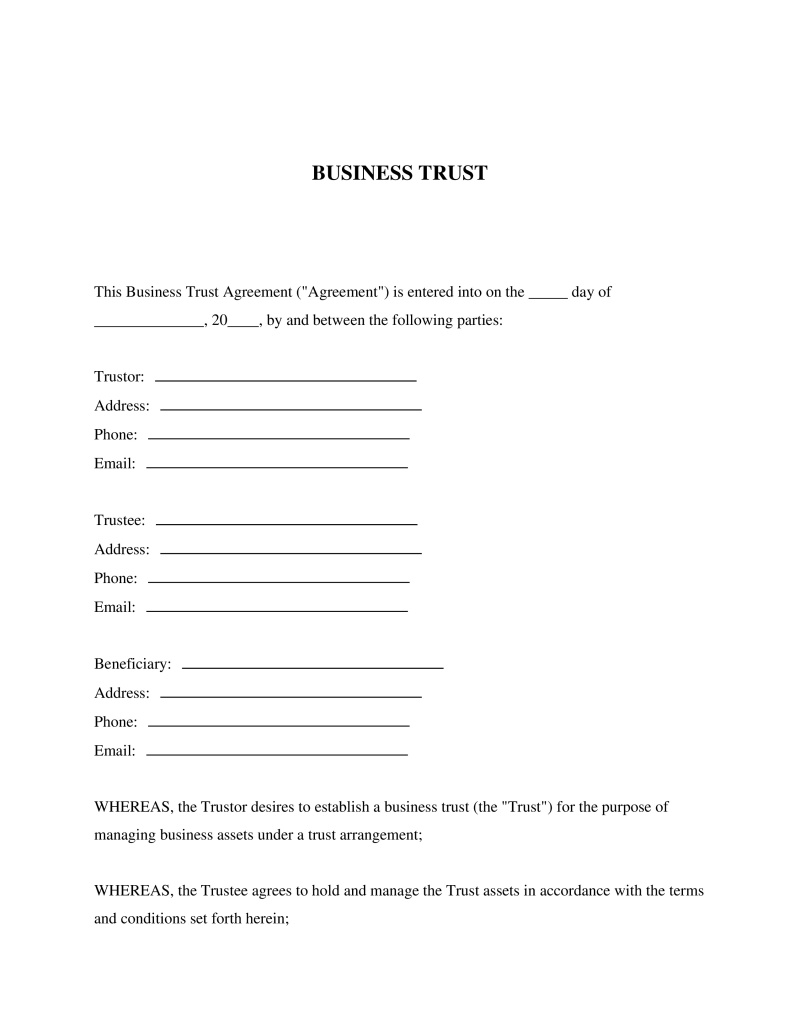

A Business Trust is a legal entity wherein the business is managed by trustees for the benefit of its beneficiaries, who may also be the owners or investors. This structure provides a unique mix of control and flexibility, allowing for efficient management and asset protection. Typically, individuals or entities looking to manage assets in a way that separates them from personal liability, while still maintaining operational control, will find a Business Trust especially beneficial. Compared to traditional corporate structures or partnerships, it offers distinct advantages in terms of taxation, confidentiality, and estate planning.

Key Features

Important Provisions

- Definition of terms section that clarifies key terminology used throughout the document.

- Appointment, powers, and obligations of trustees detailing how they are chosen, their authority, and their duties towards the trust.

- Beneficiary rights section explaining how benefits are distributed among beneficiaries including any restrictions or conditions.

- Indemnification clauses that protect trustees against liabilities arising from their actions within their role, provided they act in good faith.

Pros and Cons

Pros

- +Offers a high degree of asset protection from creditors as assets are held in the trust's name, not the individual beneficiaries'.

- +Potentially favorable tax treatment depending on jurisdiction and specific setup.

- +Enhanced privacy since trust documents generally do not need to be publicly registered unlike corporate documents.

- +Flexibility in management and control can be tailored to suit the specific needs of the business or family.

- +Can be an effective tool for estate planning, allowing for a smoother transition of assets.

Cons

- -Setting up a Business Trust can be more complex and potentially costly compared to simpler structures like sole proprietorships.

- -The need for meticulous record-keeping and administration to maintain the trust's status and comply with legal requirements.

- -Potential for conflicts among trustees or between trustees and beneficiaries if not properly managed.

Common Uses

- Real estate investment where properties are held within the trust for profit generation.

- Family businesses looking to separate personal assets from business liabilities while planning for succession.

- Investment ventures where multiple parties contribute capital but wish to limit personal liability and maintain anonymity.

- Holding intellectual property or patents in a secure entity separate from operational business risks.

- Managing charitable activities alongside for-profit ventures under one umbrella without compromising either's objectives.

- Asset protection strategies aiming to safeguard wealth against lawsuits or creditors.

Frequently Asked Questions

Do you have a question about a Business Trust?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!