An Alabama bill of sale is a legal document that serves as written evidence of the transfer of ownership of personal property from a seller to a buyer in the state of AL.

Interactive form preview

Table of Contents

What is an Alabama Bill of Sale?

An Alabama bill of sale is a legal document that serves as written evidence of the transfer of ownership of personal property from a seller to a buyer. This instrument records the specifics of a transaction, acting as a receipt that outlines the purchase price, the date of transfer, and the identities of the parties involved. While it is most frequently utilized in the sale of motor vehicles and watercraft to satisfy state registration and tax requirements, it is also applicable to the transfer of other personal assets, such as livestock, firearms, or heavy machinery. By executing this document, the seller formally releases their interest in the property, and the buyer establishes proof of ownership.

Legal Requirements and Validity

For an Alabama bill of sale to be legally valid, it must adhere to general contract laws found within the state statutes. The document represents a binding contract where valuable consideration—usually money—is exchanged for goods. While the state does not mandate a universal government-issued form for all private sales, the document must contain accurate and legible information regarding the asset and the transaction terms. In the context of vehicle registration, county licensing officials often require this document to calculate the appropriate sales tax, known as ad valorem tax. It is crucial that the details on the bill of sale match the information on the certificate of title to avoid administrative delays.

Required Elements of a Valid Alabama Bill of Sale

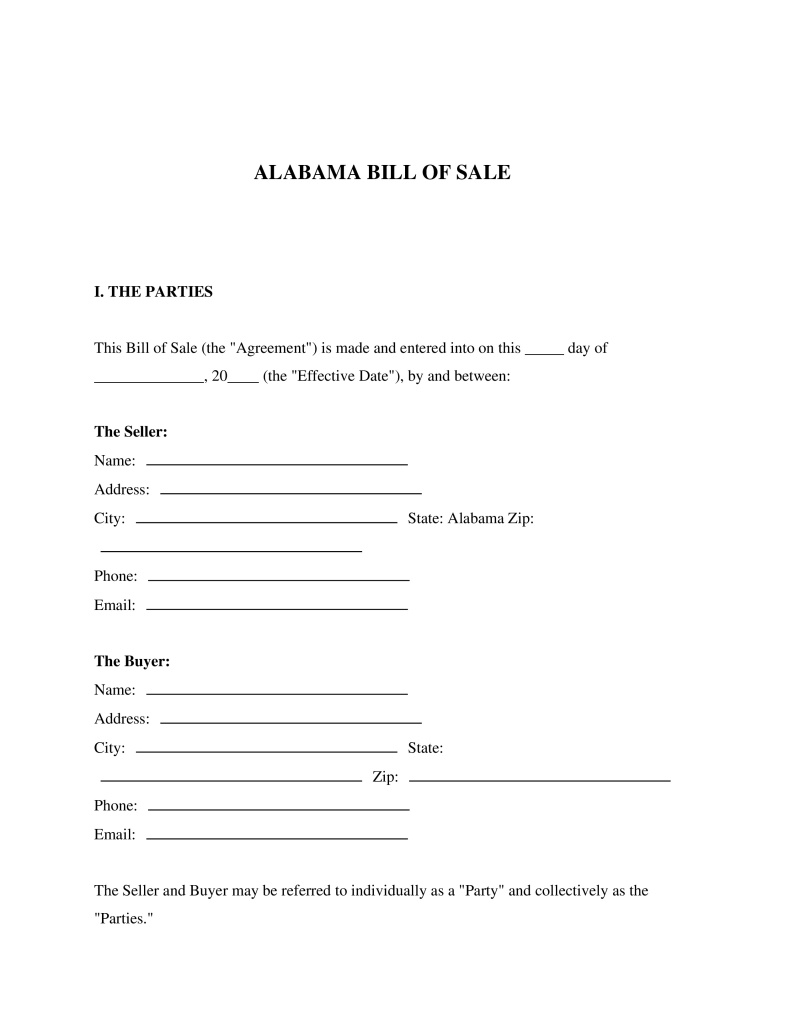

To ensure the document is accepted by the Alabama Department of Revenue (DOR) or other governing bodies, it should contain specific data points. A comprehensive bill of sale generally includes the following:

- Seller Information: The full legal name, physical address, and contact details of the party selling the item.

- Buyer Information: The full legal name and address of the party purchasing the item.

- Property Description: A detailed description including make, model, year, color, and serial number (VIN for vehicles, HIN for boats).

- Transaction Details: The date of the sale and the final purchase price.

- Signatures: The handwritten signatures of both the buyer and the seller.

Specifics for Motor Vehicle Transactions

When dealing with motor vehicles, the Alabama bill of sale carries additional weight due to titling laws. Alabama law requires that a bill of sale accompany the application for a certificate of title if the vehicle is being registered by a new owner. If the vehicle is less than 10 years old (or 20 years for certain weight classes under federal rules), the seller must also provide an odometer disclosure statement. This can be included within the bill of sale or attached as a separate document. The bill of sale acts as a safeguard for the seller, proving that the vehicle was sold on a specific date, which is vital if the vehicle is subsequently involved in an accident or used in a crime before the new owner updates the registration.

"As Is" Clauses vs. Warranties

In the majority of private transactions, property is sold "as is." This legal concept means the buyer accepts the item in its current condition, assuming responsibility for all existing faults and necessary repairs immediately upon purchase. An Alabama bill of sale typically includes an "as is" clause to protect the seller from future liability or warranty claims. Conversely, if a seller provides a warranty—guaranteeing the condition of the engine or other components for a set period—this must be explicitly written into the document. Without such written stipulations, the default presumption under state law for private party sales is that no implied warranty exists regarding the item's fitness for a particular purpose.

Applicable Laws and Statutes

The governance of sales and transfers in the state falls under various sections of the Code of Alabama. Title 7 (Commercial Code) outlines the general principles of sales and the transfer of goods. Specifically regarding motor vehicles, Title 32, Chapter 8 (Uniform Certificate of Title and Antitheft Act) mandates the procedures for transferring ownership and titling. Section 40-12-260 addresses the licensing and registration of vehicles, where the bill of sale is utilized to verify the purchase price for tax assessment purposes. Additionally, federal regulations, specifically the Truth in Mileage Act (49 U.S.C. Chapter 327), dictate the requirements for odometer disclosure during the transfer of vehicle ownership.

Notarization Requirements

Unlike real estate deeds, an Alabama bill of sale for general personal property does not strictly require notarization to be valid between the two parties. However, having the document notarized adds a layer of legal authenticity and makes the document self-authenticating in court. There are specific exceptions where notarization is necessary. For example, if a buyer is applying for a surety bond to obtain a title for a vehicle with missing paperwork, the state often requires the bill of sale to be notarized. Furthermore, some counties may prefer notarized documents to prevent fraud during the registration process.

Frequently Asked Questions

Do you have a question about an Alabama Bill of Sale?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!