A Beneficiary Designation Form is a legal instrument specifying the recipients of assets from financial accounts or insurance policies upon the holder's death.

Designation Type

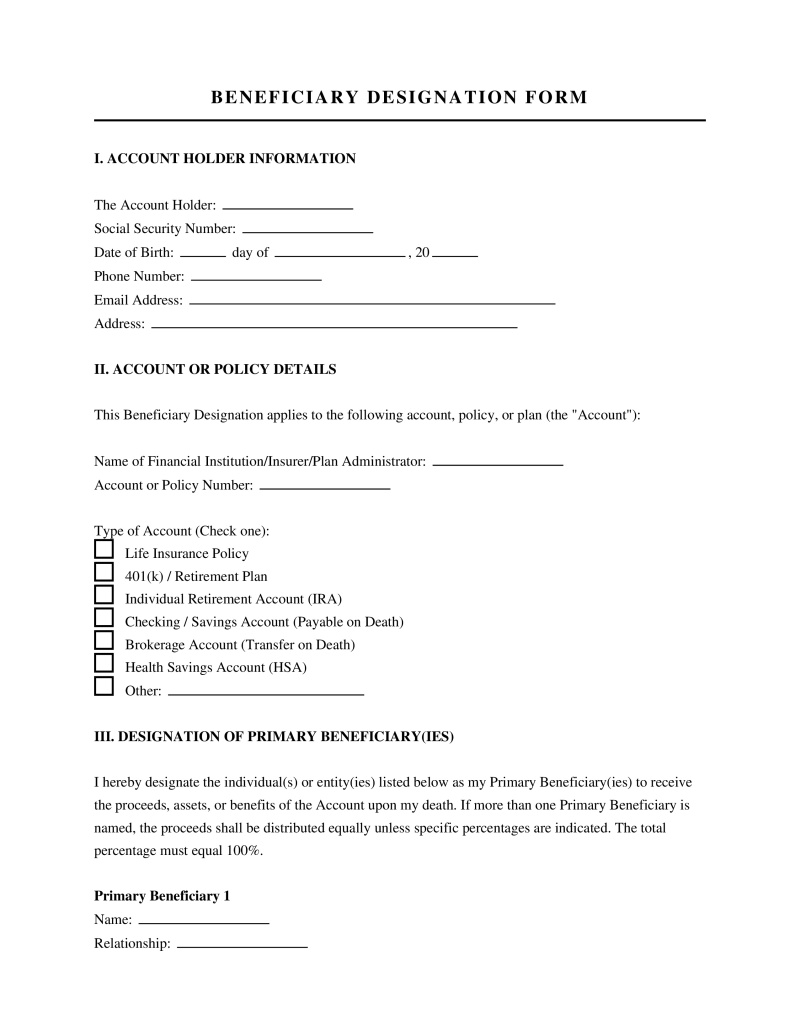

Select the type of account, policy, or plan for which you are designating beneficiaries. This helps determine any additional requirements.

Table of Contents

What is a Beneficiary Designation Form?

A Beneficiary Designation Form is a legal document that permits an account holder to specify individuals or entities entitled to receive assets from a financial account, insurance policy, or retirement plan upon the holder's death. This instrument creates a direct contractual agreement between the owner and the plan administrator or financial institution, instructing them to transfer funds immediately to the named recipients. These documents typically govern assets such as 401(k)s, IRAs, life insurance proceeds, and payable-on-death (POD) bank accounts. The designation generally allows the specified assets to bypass the probate process, ensuring a faster distribution of wealth to heirs compared to assets distributed through a will.

Legal Authority and Validity

The legal power of a beneficiary designation stems from contract law rather than probate law. The document serves as a standing instruction to the custodian of the asset. A valid designation overrides instructions found in a Last Will and Testament regarding that specific asset. Courts consistently uphold that the most recent validly executed form on file with the plan administrator controls the distribution, regardless of conflicting provisions in a will or trust. Account holders must ensure the document meets all internal requirements of the financial institution, including proper signatures and witness attestations, to maintain its validity.

Types of Beneficiary Designations

Designations fall into specific categories based on the priority of the claim and the rights retained by the account holder. Common classifications include:

- Primary Beneficiary Designation - Identifies the first individual or entity in line to receive the assets upon the account holder's death.

- Contingent Beneficiary Designation - Names a secondary recipient who receives the assets only if the primary beneficiary predeceases the account holder.

- Revocable Beneficiary Designation - Grants the account holder the right to change or cancel the beneficiary choice at any time without the consent of the named individual.

- Irrevocable Beneficiary Designation - Prevents the account holder from changing the beneficiary or borrowing against the policy without the written consent of the named beneficiary.

- Per Stirpes Designation - Directs that if a beneficiary dies before the account holder, their share passes to their lineal descendants rather than the other named beneficiaries.

Vehicle and Property Transfer Forms

Beneficiary designations extend beyond financial accounts to physical property in certain jurisdictions. State departments of motor vehicles often provide specific forms for vehicle transfers. Arizona residents, for instance, utilize the adot beneficiary designation form to establish a Transfer on Death (TOD) status for motor vehicles. This document allows the vehicle title to transfer to a named individual immediately upon the owner's death, avoiding probate court for that specific asset. Similar Transfer on Death deeds exist for real estate in many states, functioning on the same legal principle.

How to Complete a Beneficiary Designation Form

Proper completion of this document ensures the asset reaches the intended recipient without legal challenges. The process typically involves specific steps:

- Step 1: Gather Recipient Information - Collect the full legal name, Social Security number, date of birth, and contact information for each proposed beneficiary.

- Step 2: Determine Allocation Percentages - Decide how to divide the assets among primary beneficiaries, ensuring the total equals exactly 100 percent to avoid administrative delays.

- Step 3: Review Beneficiary Designation Form Examples - Examine sample forms provided by the institution to understand how to properly articulate complex distribution requests, such as trusts or charities.

- Step 4: Obtain Spousal Consent - Secure a spouse's notarized signature if the account is a retirement plan governed by federal law or if the account holder resides in a community property state.

- Step 5: Submit and Confirm - File the document with the plan administrator and request written confirmation that the new designation has been accepted and recorded.

Federal and State Laws

Various statutes govern the validity, implementation, and restrictions of beneficiary designations across different jurisdictions and asset types:

- Employee Retirement Income Security Act - Sets federal standards for private industry pension and health plans, requiring spousal consent for beneficiary changes on certain retirement accounts (29 U.S.C. § 1001 et seq.).

- Uniform Probate Code - Establishes rules regarding the effect of divorce on beneficiary designations, often automatically revoking designations of a former spouse upon divorce entry (UPC § 2-804).

- Uniform Transfers to Minors Act - Provides a mechanism for transferring property to a minor without a formal trust, often required when a minor is named as a beneficiary (varies by state adoption).

- Community Property Laws - Mandates that a spouse has a legal interest in assets acquired during marriage, restricting the ability to name a non-spouse beneficiary without consent (State Statutes in AZ, CA, ID, LA, NV, NM, TX, WA, WI).

- Simultaneous Death Act - Determines distribution when the insured and beneficiary die within a very short period of each other, typically treating the beneficiary as having predeceased the insured (Uniform Simultaneous Death Act).

Common Mistakes and Risks

Errors in drafting or maintaining these forms can lead to unintended consequences or litigation. Account holders often neglect to update forms after major life events such as marriage, divorce, or the birth of a child. Naming a minor child directly as a beneficiary often triggers court intervention to appoint a guardian for the funds, as minors cannot legally own substantial assets. Naming a deceased individual without a contingent beneficiary or a per stirpes designation causes the asset to revert to the estate, subjecting it to probate and creditor claims. Ambiguous descriptions, such as "my children," can cause confusion regarding stepchildren or adopted children if not explicitly defined.

FAQs

Do you have a question about a Beneficiary Designation Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!