A Transfer on Death Deed allows property owners to designate beneficiaries, enabling direct transfer of real estate upon their death.

Property State

Select the state where the property is located. State law governs the validity of the Transfer on Death Deed.

Table of Contents

What is a Transfer on Death (Beneficiary) Deed Form?

A Transfer on Death Deed is a legal instrument used by real estate owners to designate a specific beneficiary who will inherit their property automatically upon their death. This document functions similarly to a beneficiary designation on a bank account or life insurance policy, allowing the asset to bypass the lengthy and costly probate process. The grantor retains full ownership, control, and use of the property during their lifetime, including the ability to sell or mortgage the real estate without the beneficiary's consent. This form is currently authorized in over half of the United States and the District of Columbia as a flexible estate planning tool.

Legal Validity and Essential Requirements

To establish a valid non-probate transfer, the document must adhere to strict execution standards defined by state statutes. A failure to follow these protocols often results in the deed being declared void, forcing the property into probate. Common requirements for validity include:

- Testamentary Capacity - The grantor must possess the same mental capacity required to draft a will at the time of signing.

- Legal Description - The document must contain the exact legal description of the real property as found on the current deed.

- Notarization - The grantor must sign the document in the presence of a notary public to verify identity and voluntary intent.

- Recordation Deadline - The deed must be recorded with the county clerk or land records office prior to the grantor's death (statutes strictly enforce this timing).

- Beneficiary Designation - The form must clearly identify the primary and contingent beneficiaries by legal name.

Rights and Obligations of Parties

The legal structure of a Transfer on Death Deed creates a unique division of rights between the current owner (grantor) and the future recipient (beneficiary). Unlike a joint tenancy, the beneficiary receives no immediate interest in the property.

- Grantor Rights - The owner maintains the absolute right to sell, gift, encumber, or mortgage the property without notifying the beneficiary.

- Beneficiary Interest - The designated individual holds only a contingent interest that vests solely upon the grantor's death.

- Creditor Claims - The property remains subject to any liens, mortgages, or judgments attached to the title at the time of the grantor's death.

- Revocability - The grantor may revoke the deed at any time before death by recording a revocation or a new deed.

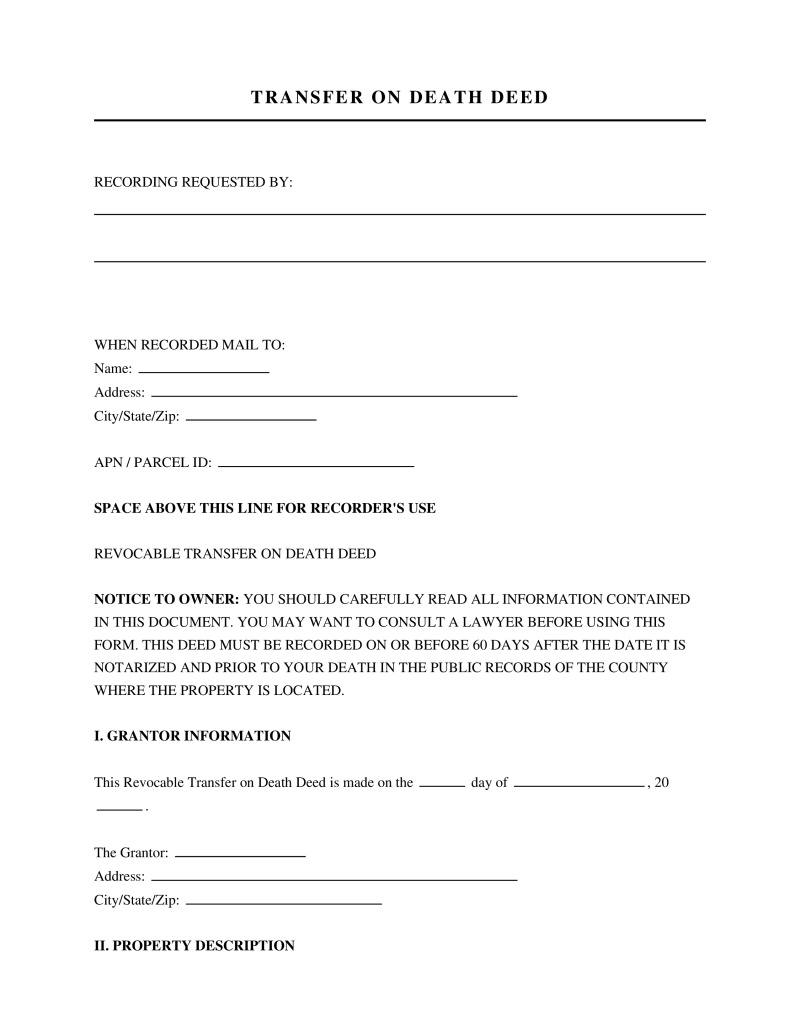

How to Execute a Transfer on Death Deed

The process for creating and finalizing this document generally follows a specific chronological order to ensure legal standing. Missing the recording step is the most common error associated with this estate planning tool.

Step 1: Obtain Property Details - Locate the current deed to copy the exact legal description and Assessor's Parcel Number (APN).

Step 2: Draft the Instrument - Complete the state-specific form, naming the primary beneficiary and any alternate beneficiaries.

Step 3: Execute Before a Notary - Sign the document in the presence of a notary public; some states also require disinterested witnesses.

Step 4: Record the Document - File the signed deed with the County Recorder or Register of Deeds in the county where the property is located before the grantor dies.

Applicable Laws and Statutes

The governance of Transfer on Death Deeds relies heavily on state adoption of model laws and federal regulations regarding estate recovery. These statutes define the mechanics of the transfer and the liability of the estate.

- Uniform Real Property Transfer on Death Act - Provides the model legislation adopted by many states to standardize the creation and execution of these deeds (URPTODA).

- Medicaid Estate Recovery Mandates - Requires states to seek adjustment or recovery for medical assistance from the individual's estate, which may include non-probate assets depending on state definition (42 U.S.C. § 1396p).

- Federal Gift Tax Regulations - Clarifies that revocable transfers of future interests are generally not completed gifts and do not trigger immediate gift taxes (26 CFR § 25.2511-2).

- Due-on-Sale Clause Exemptions - Prohibits lenders from enforcing due-on-sale clauses upon transfer to relatives resulting from the borrower's death (12 U.S.C. § 1701j–3).

Frequently Asked Questions

Do you have a question about a Transfer on Death (Beneficiary) Deed Form?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!