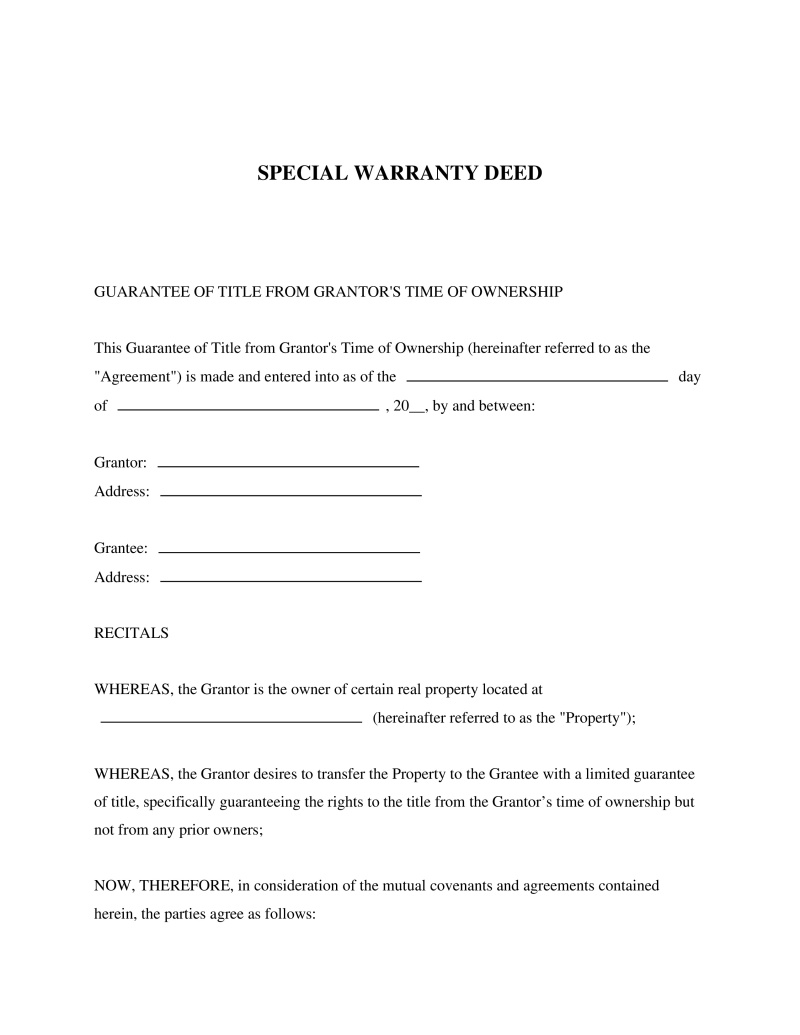

A Special Warranty Deed conveys property with limited warranties, protecting the buyer only against claims during the seller's ownership period.

Grantor Name

In this field, write the full legal name of the Grantor, who is the person or entity giving the property or rights. Use the format: First Name, Middle Initial (if any), Last Name. Accurate information is important because it helps ensure the legal transfer is valid and recognized.

Table of Contents

What is a Special Warranty Deed?

A Special Warranty Deed is a legal document that plays a critical role in real estate transactions, providing a middle ground between the buyer's need for protection and the seller's desire to limit future liability. Unlike a General Warranty Deed, which guarantees clear title from all previous owners, this deed only covers the period during which the current seller held the property. It assures the buyer that the seller has not encumbered the property during their ownership but does not guarantee against claims or liens from before that time. This specificity makes it particularly useful for sellers who acquired the property through foreclosure, as it allows them to transfer ownership without assuming responsibility for past discrepancies.

Key Features

Important Provisions

- Grantor and Grantee information: Identifies who is transferring and receiving property rights.

- Description of Property: Precisely delineates what is being transferred, including legal descriptions and parcel numbers where applicable.

- Warranty Clause: Specifically outlines the extent of warranty being provided by the grantor regarding previous encumbrances or liens.

- Signatures and Notarization: Ensures legality and enforceability through formal execution and authentication processes.

Pros and Cons

Pros

- +Protects buyers against any title defects or liens created during the seller's tenure.

- +Limits sellers' exposure to future legal action related to property title issues predating their ownership.

- +Facilitates smoother transactions for properties with complex historical titles or foreclosure backgrounds.

- +Offers more security than a Quitclaim Deed by including at least some warranty coverage.

- +Can be more quickly executed than a General Warranty Deed, as it requires less comprehensive research into the property's history.

Cons

- -Does not provide complete protection against all possible title issues, only those arising during specific ownership periods.

- -May necessitate additional title insurance for buyers seeking full coverage against potential historical claims.

- -Could potentially limit the pool of interested buyers who prefer the broader assurances of a General Warranty Deed.

Common Uses

- Transferring ownership of commercial real estate where a full history warranty is not necessary or possible.

- Selling residential properties that have been previously foreclosed on.

- Conveying property in states or regions where this type of deed is standard practice.

- Real estate transactions involving investment properties or entities as sellers.

- Refinancing scenarios where an existing owner wants to add or remove someone from the deed.

Frequently Asked Questions

Do you have a question about a Special Warranty Deed?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!