A rental application is a form used by landlords to gather information about potential tenants for lease agreements and background checks.

Full Name

Enter the requested information accurately and completely. This will become part of your legal document.

Table of Contents

What is a Rental Application?

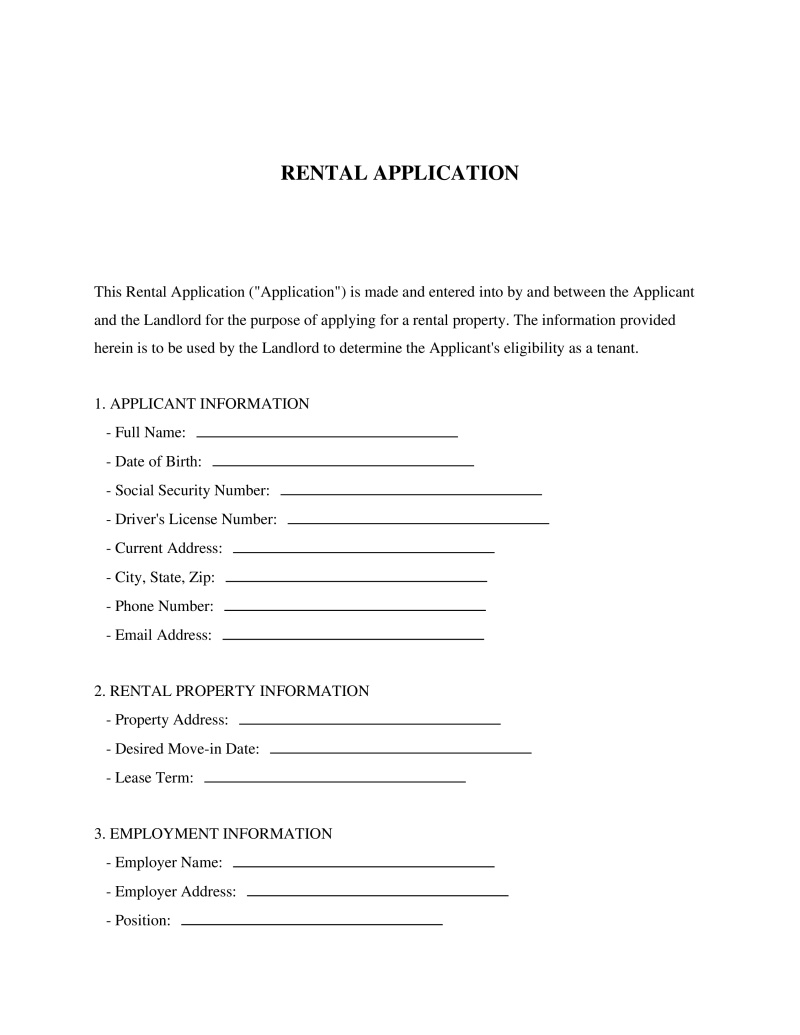

A Rental Application is a crucial document utilized by landlords and property managers to assess potential tenants before leasing residential property. It collects essential information about the applicant, including employment history, creditworthiness, rental history, and personal references, which aids in making an informed decision. This document serves both parties; it allows the landlord to screen applicants to ensure they are suitable for the property while giving the applicant the opportunity to present themselves as a reliable tenant. Anyone looking to rent a property should complete this form as part of the application process. Understanding its components can significantly increase one's chances of being approved for their desired residence.

Key Features

Important Provisions

- Applicant Information: Full legal name, contact information, social security number (where permissible), and date of birth.

- Employment History: Details about current and past employment to verify income stability.

- Rental History: Information on previous rentals including addresses, length of stay, and reason for leaving, which helps in assessing reliability as a tenant.

- Credit Check Authorization: Consent from the applicant allowing the landlord to perform a credit check as part of the vetting process.

Pros and Cons

Pros

- +Facilitates a faster decision-making process by providing all necessary information in a structured format.

- +Reduces the risk of renting to unreliable tenants through thorough vetting.

- +Enhances transparency between prospective tenants and landlords, building trust from the outset.

- +Saves time and resources by filtering out unqualified applicants early in the process.

- +Can be reused for multiple properties or rental applications, offering convenience and consistency.

Cons

- -May require detailed personal information that applicants could be hesitant to provide.

- -The comprehensiveness of the form might extend the time it takes to fill out, potentially delaying application submissions.

- -Relying solely on this document without further interaction may overlook qualities not captured on paper.

Common Uses

- Screening potential tenants for residential apartments or houses.

- Collecting background information for use in credit and reference checks.

- Establishing a formal record of interest in a property, which can be useful in highly competitive rental markets.

- Updating tenant records when renewing or modifying existing leases.

- Facilitating roommate or subletting arrangements within larger lease agreements.

Frequently Asked Questions

Do you have a question about a Rental Application?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!