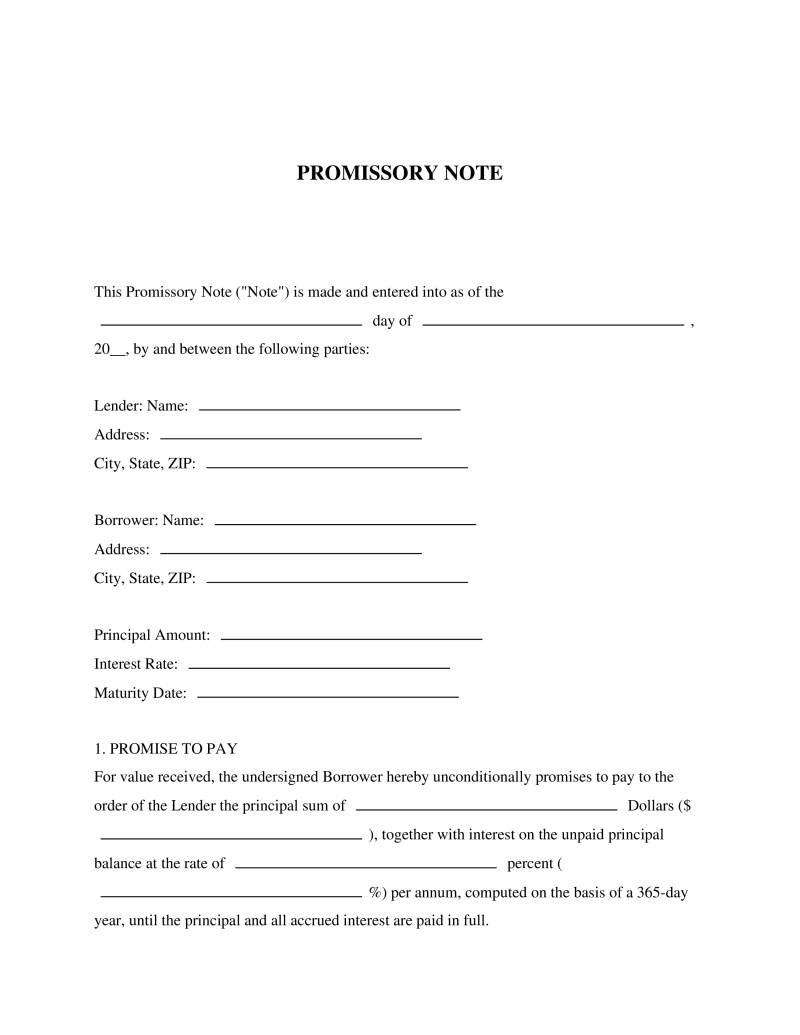

A Promissory Note is a legal document that formalizes a loan agreement by outlining the amount borrowed, repayment terms, interest rate, and default consequences, providing clarity and protection for both borrower and lender.

Identification

Select the option that best describes your role in this agreement. If you are lending money, choose "Lender"; if you are borrowing, select "Borrower." If your role is not listed, select "Other" and briefly describe your role in the space provided. Your role is important for determining legal responsibilities in this document.

Table of Contents

What is a Promissory Note?

A Promissory Note is a financial instrument that contains a written promise by one party (the issuer or maker) to pay another party (the payee) a definite sum of money, either on demand or at a specified future date. It outlines the terms under which the borrower agrees to repay the lender, including the loan amount, interest rate, repayment schedule, and what happens in case of default. This document is crucial for both individuals and entities that engage in loan transactions as it legally enforces the obligations of the borrower and provides a clear record of the loan details. It serves as an essential tool in financial and business transactions where lending and borrowing are involved, ensuring clarity and legal recourse for both parties involved.

Key Features

Important Provisions

- Principal Amount: The total amount of money being borrowed through this note.

- Interest Rate: The percentage at which interest on the borrowed money will accrue over time.

- Repayment Schedule: Detailed information on how and when the borrower is expected to repay the principal and interest.

- Default Provisions: Specific actions or remedies available if the borrower fails to make timely payments according to agreed terms.

Pros and Cons

Pros

- +Provides a legally binding agreement that clearly lays out the terms of the loan, reducing misunderstandings between parties.

- +Offers flexibility in structuring terms such as repayment schedules, interest rates, and security requirements.

- +Simplifies legal processes in case of disputes or defaults by serving as definitive proof of the agreement.

- +Enhances trust between parties by documenting their commitments in writing.

- +Can be used for a wide range of lending situations, from personal loans to business financing.

Cons

- -Requires careful drafting to ensure that all legal requirements are met and that the document is enforceable.

- -May require legal consultation to customize or understand complex provisions, potentially increasing costs.

- -The enforceability can vary by jurisdiction if not properly structured according to local laws.

Common Uses

- Loan transactions between individuals, such as personal loans or family loans.

- Business financing arrangements, including startup funding from investors or loans between companies.

- Real estate transactions that involve private lending for property purchases.

- Educational loans provided by individuals or institutions outside of traditional financial aid systems.

- Purchase financing where buyers agree to pay sellers over time for goods or services received.

Frequently Asked Questions

Do you have a question about a Promissory Note?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!